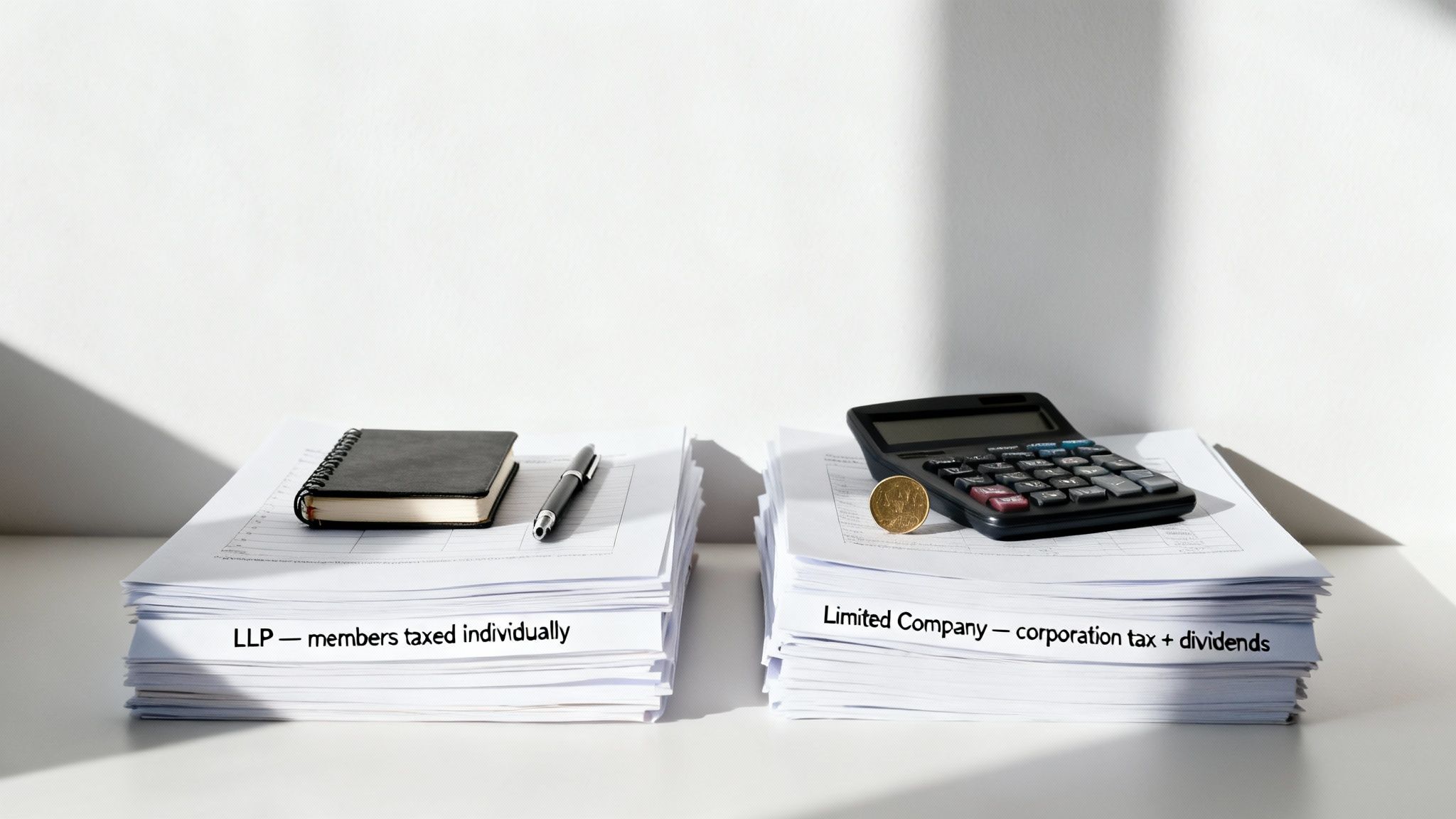

Deciding between an LLP and a limited company is one of those crucial early moments that genuinely shapes the future of your business. The core difference is pretty straightforward: an LLP gives you the flexibility of a partnership but with tax handled on a personal level, whereas a limited company is a more rigid corporate structure with its own Corporation Tax bill.

Ultimately, your choice boils down to what you value more: operational agility or a solid framework designed for investment and growth.

Getting this right from the start impacts everything, from how much tax you’ll pay to the protection of your personal assets. It’s a foundational decision, so you want to make sure your legal setup truly matches your long-term ambitions. Understanding the key distinctions is the first step to getting it right.

When you're looking at setting up a formal business, it helps to grasp how they are actually created. For anyone weighing up their options, learning about the overall process of company incorporation is a great place to start. Before we dive into the nitty-gritty, let's outline what we'll be comparing.

This guide will walk you through a side-by-side comparison of LLPs and limited companies, looking at the factors that really matter:

A bit of expert advice: Choosing the right structure from day one is far easier and cheaper than trying to change it later. Converting an LLP into a limited company, for instance, can be a minefield of legal and tax complications.

Every successful business starts with a solid plan. For a complete checklist on getting off the ground, our detailed guide on how to start a business in the UK is a must-read.

Now, let’s get a quick snapshot of the main differences.

Choosing between a Limited Liability Partnership (LLP) and a limited company is one of those foundational decisions that sets the entire tone for your business's legal and financial future. It’s not just a box-ticking exercise. At a high level, the distinction is clear: an LLP blends partnership flexibility with crucial liability protection, while a limited company offers a more formal, corporate framework that's ideal for growth and investment.

Think of an LLP as a hybrid. It gives its owners (known as members) the brilliant safety net of limited liability, meaning their personal assets are shielded from the business's debts. But for tax, it's completely transparent. The LLP itself doesn't pay any tax; profits simply pass through directly to the members, who then report them on their personal Self Assessment tax returns.

This image gives a quick visual summary of how the core ideas of flexibility and structure differ.

The handshake for the LLP perfectly captures its partnership-based, flexible nature. The solid building for the limited company signifies its more rigid, corporate structure and stronger liability shield.

A private limited company, on the other hand, is a completely separate legal entity from its owners (the shareholders). This distinction is fundamental. The company itself earns profits, pays Corporation Tax on those profits, and only then can it distribute what’s left to shareholders as dividends. Those dividends are then taxed again at a personal level.

This creates a two-layer tax system. While that might sound more complex, it also opens up significant opportunities for clever tax planning, especially as your profits start to climb. The management structure is also much more defined, with clear, distinct roles for directors (who run the company day-to-day) and shareholders (who own it).

To make these points crystal clear, let's lay out the main distinctions side-by-side. This table is a handy reference point as we dive deeper into each specific area of comparison.

This side-by-side view will act as a quick reference as we delve deeper into each specific area of the LLP vs limited company comparison.

This table neatly summarises the key structural points, but if there's one takeaway, it's this:

The most significant differentiator is tax. An LLP is a pass-through entity for tax, while a limited company is a separate taxable entity. This single difference has profound effects on profit extraction, administrative duties, and financial planning.

Ultimately, an LLP is often the structure of choice for professional services—think law firms, architects, or accountancy practices. It's perfect for situations where partners want flexibility and protection from each other's professional missteps. A limited company is the go-to for most commercial ventures, especially those aiming for serious growth, looking to attract investment, or wanting a clean separation between ownership and management.

One of the biggest drivers for setting up a formal business structure is protecting your personal assets. It’s a foundational concern. Both a Limited Liability Partnership (LLP) and a limited company deliver this crucial protection, but the way they do it differs in some important ways that really matter when choosing between llp vs limited company.

At the core of both structures is the idea of separate legal personality. This simply means that once your business is registered with Companies House, it becomes a legal 'person' in its own right. It can own property, sign contracts, and rack up debts, all completely separate from its owners.

This separation creates a vital firewall. If the business goes under, creditors can generally only go after the assets owned by the business itself. Your home, car, and personal savings are kept safely out of the line of fire.

In an LLP, the liability protection is built around the individual partners, or members. Each member gets the benefit of limited liability, which means they aren't personally on the hook for the LLP's overall debts. If the partnership can't pay its suppliers, their claim ends with the LLP's business assets.

But the real standout feature for an LLP is the protection members have from each other. Members are not usually held personally liable for another member's professional screw-up or negligence.

This ‘ring-fencing’ of individual negligence is the main reason LLPs are the go-to structure for professional services firms like solicitors, architects, and accountants. It stops one partner's costly mistake from threatening the personal finances of every other partner in the firm.

Imagine an architectural firm with five partners set up as an LLP. If one architect makes a critical design error that leads to a lawsuit, the personal assets of the other four partners are shielded from any claims related to that specific act of negligence.

A limited company offers what many see as the gold standard of liability protection, often called the 'corporate veil'. This creates a solid legal barrier that completely separates the company from its owners (the shareholders) and its managers (the directors).

A shareholder's liability is strictly limited to the value of the shares they own—for most small businesses, this might be a nominal amount like £1 or £100. It's a clear and powerful shield for your personal wealth.

Here’s a classic scenario of how that protection works:

This robust separation makes the limited company a hugely popular choice for all sorts of businesses that involve financial risk, from retail shops to tech start-ups.

It's important to remember that limited liability isn't an unbreakable shield. In rare and serious situations, a court can 'pierce the corporate veil' or set aside the LLP's separate status. This usually only happens in cases of:

While the UK centres on these two structures, other countries have similar models. For instance, the US Limited Liability Company (LLC) offers a different take on liability. While our focus is on UK structures, understanding the meaning of an LLC can offer a wider perspective on how businesses around the world handle asset protection. Ultimately, both the LLP and the limited company provide excellent—though subtly different—ways to protect you from business risks.

When it comes to the llp vs limited company debate, tax is often the deciding factor. It's not just a box-ticking exercise; how your profits are taxed and extracted directly shapes your take-home pay. The two structures couldn't be more different in their approach.

An LLP is known for being ‘tax-transparent’. In simple terms, this means the business itself doesn’t pay a penny in tax. Instead, the profits 'pass through' straight to the members. It's then up to each individual to pay Income Tax and National Insurance Contributions (NICs) on their share via their annual Self Assessment.

A limited company, on the other hand, operates a two-layer system. First, the company pays Corporation Tax on its profits. Only after HMRC has taken its slice can the remaining profits be distributed to shareholders, who then pay personal tax (usually Dividend Tax) on what they receive.

This fundamental difference creates distinct advantages depending on your profit levels and how you plan to manage your earnings.

For LLP members, the tax process is pretty straightforward, but it's directly tied to your personal income. Every pound of profit allocated to you is treated as personal earnings for that tax year, whether you’ve actually taken the money out of the business or not.

Think of it as being a sole trader, but with partners. For tax purposes, members are treated as self-employed. Since the LLP itself pays no Corporation Tax, all profits are allocated to the members and taxed as personal income. This means registering for Self Assessment and paying Income Tax at the prevailing rates – 20% on income up to £50,270, 40% between £50,271 and £125,140, and 45% on anything over that.

Key tax points for an LLP include:

The simplicity of an LLP's tax structure is its biggest draw. You don't have to worry about a separate corporate tax return, but that comes at the cost of flexibility. As profits climb, members can find themselves pushed into higher personal tax bands very quickly.

A limited company introduces a more complex but potentially much more tax-efficient structure, especially as your business grows. The two-stage process gives you far more control and opens the door to strategic tax planning.

First, the company calculates its annual profits and pays Corporation Tax on them. This is a flat-rate business tax, currently much lower than the higher rates of personal Income Tax. For a full breakdown, check out our guide on what Corporation Tax is.

Once Corporation Tax is settled, the remaining profit belongs to the company. From there, the directors and shareholders decide how and when to take that money out. This is typically done through a mix of a small salary and dividends, and that’s where the real planning opportunities kick in.

Let's put some real numbers to this. Imagine a business makes £100,000 in annual profit, shared equally between two owners (£50,000 each). For simplicity, we'll use 2023/24 tax rates.

Scenario 1: The LLP

In the LLP model, the entire £50,000 profit share hits each member's personal tax bill immediately.

Scenario 2: The Limited Company

Here, the owners pay themselves a small, tax-efficient salary of £12,570 (the personal allowance) and take the rest as dividends.

In this specific case, the limited company route results in slightly more cash in each owner's pocket. But the real power lies in the flexibility. The ability to leave profits in the company and draw them down strategically in future years provides significant tax planning advantages that an LLP simply can't match. This makes the limited company a formidable tool for long-term growth and wealth management.

How your business is owned, who runs it, and how the profits get shared are fundamental questions. The answers reveal the core philosophy behind choosing an LLP or a limited company, dictating control, flexibility, and how everyone gets rewarded for their hard work.

Let's break down how these two popular structures handle these critical internal mechanics. They take distinctly different approaches, and understanding them is key to making the right choice.

In an LLP, the structure is refreshingly straightforward: ownership and management are typically one and the same. The owners are called ‘members’, and they're all expected to be actively involved in running the business.

You won't find separate roles like shareholders or directors here. The members wear both hats, making the big decisions and sharing in the profits directly.

This integrated model is governed by a private document called the LLP Agreement. Think of this as the rulebook for the business. It’s the powerhouse behind an LLP’s flexibility, setting out how the business is run, how decisions are made, and, crucially, how profits are divided among the members.

Here’s where the LLP really shines: its incredible flexibility in profit allocation. The LLP Agreement can be drafted to allow profit shares to change year on year, based on criteria that go far beyond just how much capital someone put in. For professional service firms, this is a game-changer.

Imagine a law firm where one partner lands a huge, company-defining client. The LLP can decide to give that partner a larger slice of the profits for that year to reward their contribution. This can be a one-off adjustment, without permanently changing their underlying ownership stake.

This dynamic approach to profit distribution is a powerful way to motivate people. It allows an LLP to be agile, rewarding performance and contribution in real-time in a way a more rigid corporate structure simply can't match.

A limited company, on the other hand, introduces a clear, legal distinction between who owns the business and who manages it. This creates a more formal, hierarchical structure that is well understood in the business world.

The key roles are legally separate:

Of course, in many small businesses, the same people are both shareholders and directors. But that legal distinction always remains, providing a clear framework for governance that investors and lenders find reassuring.

In a limited company, how profits are shared is tied directly to ownership. After the company has paid its Corporation Tax, the remaining profits can be paid out to shareholders as dividends.

Here’s the crucial point: dividends must be distributed in proportion to the number of shares each person owns.

If Shareholder A owns 70% of the shares and Shareholder B owns 30%, any dividend payment has to be split 70/30. You can't just decide to give Shareholder B a bigger dividend one year because they had a great run. Their reward is fixed by their percentage shareholding. For a deeper dive into the rules, our guide on the UK dividend allowance is a great resource.

To reward performance in a limited company, you’d typically use a salary bonus. This is treated as a business expense (reducing your Corporation Tax bill) rather than a distribution of post-tax profit. While it works, it doesn't have the seamless flexibility of an LLP's profit-sharing model and brings payroll taxes into the equation.

This structured, predictable approach, however, provides certainty. It’s a key reason why the limited company is the go-to model for any business looking to attract external investment through selling shares.

When you're weighing up an LLP vs a limited company, it's easy to get bogged down in tax rates and liability. But the day-to-day admin and the amount of financial laundry you have to air in public are just as important. Both structures register with Companies House and have ongoing duties, but they’re worlds apart on internal governance and privacy.

Getting started is pretty similar for both. You'll fill out an online application and pay a registration fee. If you want the nitty-gritty on those initial costs, our guide to current company registration fees in the UK has you covered. The real difference, however, lies in the foundational documents that dictate how each business is run.

A limited company operates under its Articles of Association, a public rulebook that anyone can look up. An LLP, on the other hand, is governed by a private LLP Agreement. This difference is key – it gives the LLP far more flexibility and, crucially, confidentiality.

Don't be fooled into thinking one is a complete breeze while the other is a nightmare. Both an LLP and a limited company have to keep proper financial records and file key documents with Companies House every year. These aren't just suggestions; they're legal obligations.

The core annual filings include:

On the surface, these duties look identical. But the complexity involved in preparing the accounts can vary wildly. Limited company accounts need to juggle Corporation Tax calculations, director salaries, and dividend paperwork, making the process significantly more involved than for a typical LLP.

A key takeaway here is that while the filing duties are similar, the internal financial mechanics of a limited company are often far more complex. This is a direct result of its two-tier tax system and rigid rules around profit distribution.

This is where the two structures really diverge, and it’s a massive deal for any owner who values their privacy. Both file accounts that become public record, but what those accounts reveal about personal earnings is completely different.

With a limited company, the accounts filed can expose director salaries and the total dividends paid out to shareholders. That means your competitors, your clients, or just a nosy neighbour can get a pretty good idea of how much money the owners are taking out of the business.

An LLP pulls a thick veil over personal finances. The accounts filed at Companies House will show the LLP’s overall profit, but they do not reveal how that profit was carved up between the individual members. How much each partner gets is detailed only in the private LLP Agreement, keeping individual earnings completely out of the public eye.

Given the admin headaches and lack of privacy, you might wonder why the private limited company is still the go-to structure in the UK. LLPs have been an option since 2001, but they're a rare sight. By March 2023, LLPs made up just 1.0% of all corporate bodies on the register, a drop from 1.8% a decade ago.

In stark contrast, private limited companies have consistently made up over 95% of all registered bodies since 2005. You can dig into the official numbers in the government's Companies Register activities report. This overwhelming dominance comes down to the limited company's scalability, its universally understood framework for investment, and its powerful tax planning potential. For most businesses, these advantages simply outweigh the trade-offs in compliance and disclosure.

When you get down to the brass tacks, the final call between an LLP and a limited company often hinges on a few practical questions about the future. Tackling these common queries head-on can clear up any lingering doubts and help you see which path truly fits your long-term vision.

If you have ambitions to raise external investment from venture capitalists or angel investors, a limited company is almost always the way to go. It’s simply the structure investors understand and are set up to deal with. They invest cash in return for equity—a percentage of ownership in the form of shares—which is a straightforward and universally accepted model.

LLPs, on the other hand, don't have share capital. This makes structuring an investment deal far more complicated and unconventional. Most professional investors are used to the clear-cut equity framework a limited company provides and will likely be deterred by the complexity of an LLP.

Yes, you can convert an LLP into a limited company, but be warned: it’s a complex legal and tax minefield. The process, often called 'incorporation', involves creating a new limited company and transferring all the LLP's assets over to it. This single move can trigger major tax liabilities, like Capital Gains Tax, for the members.

Because of the legal hoops and potential tax bills, it’s vital to get professional advice from an accountant and a solicitor before even considering it. Honestly, choosing the right structure from day one is nearly always the simpler and more cost-effective route.

This really depends on your specific situation. The initial formation costs for both are broadly similar. At first glance, an LLP might seem cheaper because you dodge corporation tax returns. However, every single member must file a personal Self Assessment tax return, which brings its own costs and complexities.

A limited company has to file corporation tax returns and might need a payroll system for directors, which can push up accountancy fees. But the real cost comes down to your profits and how you take money out. A limited company offers far more tax planning opportunities, like balancing salary and dividends, which often makes it the more financially efficient choice once profits start to climb.

After forming your company, one of the first jobs is to open a business bank account to keep your finances separate and professional. For a clear walkthrough on this essential step, you can read our guide on how to set up a business bank account.

Choosing the right structure is the foundation of your business's financial health. At GenTax Accountants, we specialise in helping startups and established businesses make these critical decisions with confidence. Get in touch today to make sure your company is set up for success right from the start.