If you run a limited company in the UK, Corporation Tax is one of those non-negotiable facts of life. Getting your head around it isn't just good practice; it's a core part of your legal and financial duties.

Think of it as the business version of Income Tax. While individuals pay tax on their personal earnings, your company pays tax on its financial success. It’s managed and collected by HM Revenue & Customs (HMRC), and understanding the rules is crucial.

Let's use a simple analogy. Imagine you run a small coffee shop. All the money you take from customers for flat whites and pastries is your revenue. But to make those sales, you had to buy coffee beans, milk, cups, and pay for rent and staff. These are your business costs.

Your profit is what’s left after you subtract all those costs from your revenue. This is the figure that matters. Corporation Tax is calculated on this final profit, not the total cash that came through the till.

This distinction between revenue and profit is the most important concept to grasp. A company could have millions in turnover but, due to high operating costs, very little profit, and therefore a surprisingly small Corporation Tax bill. HMRC is only interested in taxing the actual financial gain your business has made during its accounting period.

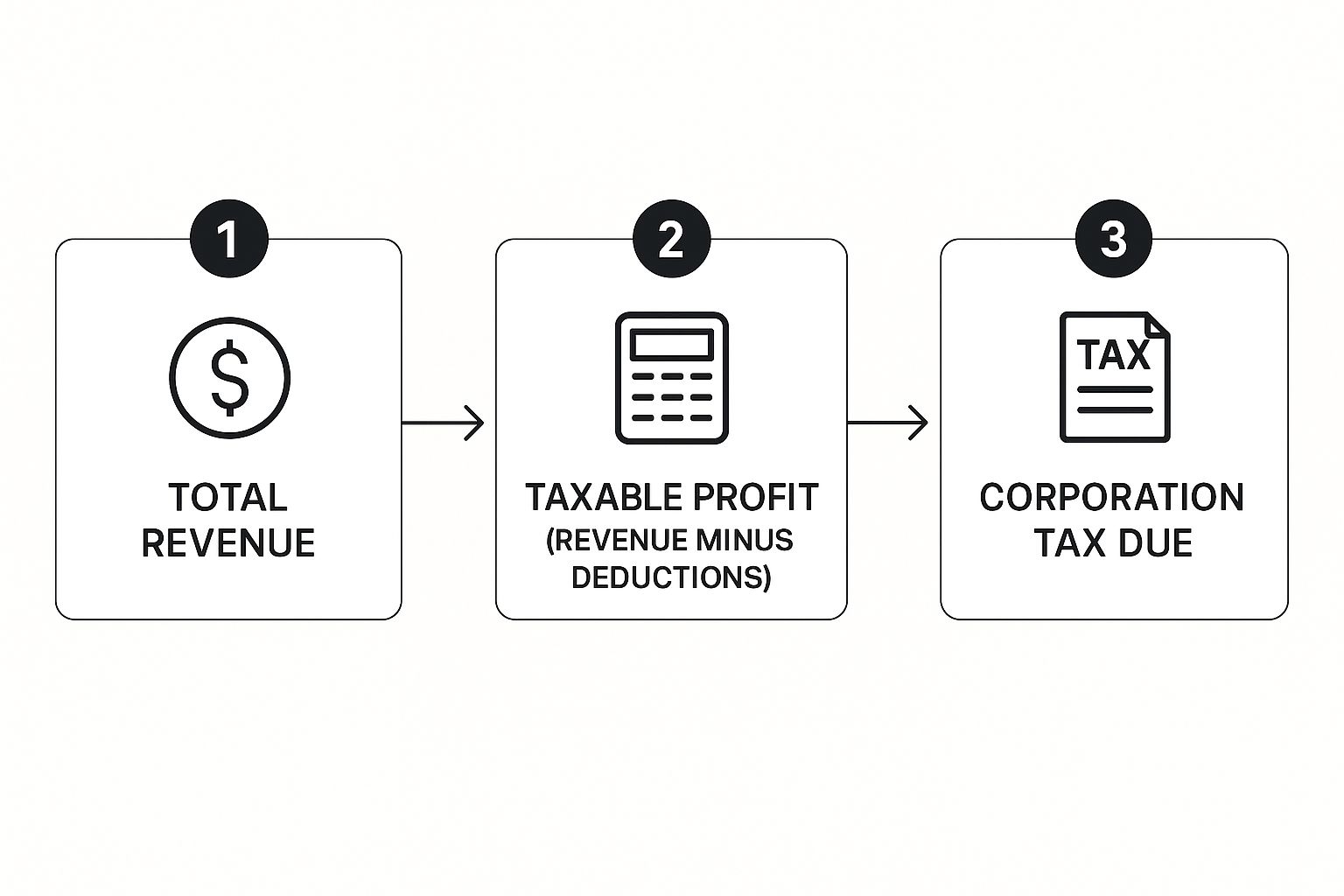

So, let's break down the fundamentals:

Key Takeaway: At its heart, Corporation Tax is a tax on success. Your company only pays it when it's profitable, making it a direct reflection of your business's financial health.

The rate you pay isn't a one-size-fits-all figure. For the financial year starting 1 April 2025, the main rate is set at 25% for companies with profits over £250,000.

However, there’s good news for smaller businesses. A 'small profits rate' of 19% applies if your profits are below £50,000. For companies earning between these two thresholds, a tapering system smooths the transition. You can find all the official details on the government's Corporation Tax rates and thresholds page.

To quickly recap, here's a simple look at the key elements.

The table below summarises the absolute basics of what you need to know about UK Corporation Tax.

Element

Description

The Tax Base

Based on the company's taxable profits, not its total revenue or turnover.

The Payer

Primarily UK limited companies and some other qualifying organisations.

The Authority

Administered and collected by HM Revenue & Customs (HMRC).

Understanding these core ideas is the first step towards managing your company's tax obligations effectively and legally.

The Corporation Tax rates you pay today aren’t just random numbers. They’re the product of years of economic policy, political shifts, and a constant balancing act between making the UK attractive for business and funding essential public services like the NHS. Knowing this recent history gives you crucial context for your own tax planning.

For a long time, the story of UK Corporation Tax was one of steady decline. The government's thinking was simple: lower taxes would encourage companies to invest, expand, and set up shop here, which would, in turn, boost the wider economy. This strategy saw the main rate drop significantly over a decade.

This journey hit its lowest point between 2017 and 2020, when the main rate was just 19%. This move positioned the UK as having one of the most competitive tax regimes among major global economies.

But then, the economic landscape shifted dramatically. The pressures of a post-pandemic economy, coupled with the need for massive government spending, led to a complete reversal of this long-standing trend. It was a pivotal moment that kicked off a new chapter for UK business taxation.

The change was stark. Until 2010, the main rate had been 28%. Successive governments chipped away at it until it hit that all-time low of 19%. There were even plans to cut it further to 17%, but that idea was scrapped. Instead, the 2021 Budget brought a bombshell announcement: the rate would increase to 25% from April 2023. It was the first time the main rate had been hiked since 1974.

You can dive into a full breakdown of these historical tax rate changes on the OBR's website.

Key Insight: The jump from a low-tax strategy to a 25% rate signals a fundamental change in economic policy. It throws a spotlight on the tension between creating a pro-business environment and the undeniable need to fund public services.

The good news is that the new 25% main rate doesn't hit every company. The government recognised this would be a heavy burden for smaller businesses, so they introduced a tiered system.

Here's a simple breakdown of how it works now:

This structure is designed to give smaller and growing businesses some breathing room while ensuring larger, more profitable corporations contribute more. For any business owner, understanding what corporation tax is today means getting to grips with this recent history and the political forces that continue to shape it.

Figuring out if Corporation Tax applies to your business is the first and most critical hurdle in staying compliant. Get this part right, and you're already on the path to stress-free tax management. The rules are actually quite clear; it all comes down to how your business is legally structured.

The main group that must register for and pay Corporation Tax is the UK limited company. The moment you incorporate your business with Companies House, you create a distinct legal entity. This new entity is completely separate from you, the owner. It’s this entity’s profits that HMRC taxes, not yours personally.

This rule applies to all types of limited companies, whether they're limited by shares (the most common setup) or by guarantee. If you're a director, getting your head around your company's tax duties isn't just good practice; it's a fundamental part of your role.

It’s not just the classic limited company that gets caught in the Corporation Tax net. The rules are designed to cover other types of organisations that operate in a similar way, holding and managing funds as a distinct body.

You’ll find these other organisations are also liable:

The core principle is simple: if an organisation acts as a separate legal body and makes a profit, it almost certainly has to pay Corporation Tax.

A company's location, or its tax residency, is a massive factor. A company is considered a UK resident for tax purposes if it's either incorporated in the UK or if its central management and control happen here. This means a business registered overseas could still be on the hook for UK Corporation Tax if its key decisions are made on UK soil.

On top of that, a non-UK company that operates through a UK-based branch or office has to pay Corporation Tax on all profits generated from its UK activities. There's a big difference between doing business with the UK and doing business in the UK.

Key Distinction: It's the physical presence or "permanent establishment" in the UK that usually triggers the tax liability for a foreign company. This is all about creating a level playing field, ensuring any business profiting from the UK market contributes fairly.

Knowing who is exempt is just as important. This is a common point of confusion for new entrepreneurs, so let's be clear: if you are a sole trader or in a partnership, you do not pay Corporation Tax.

Instead, sole traders and partners pay Income Tax on their business profits through the Self Assessment system. The profits are treated as your personal income, which you declare on your annual tax return. It’s a completely different way of handling your tax obligations.

Getting your business structure and its tax implications right from day one is the best way to prevent major headaches later. If you've gone the limited company route, our team provides the specialised accounting services you need to navigate these rules with confidence.

Working out your company’s Corporation Tax bill can feel like a maze, but it’s actually a pretty logical sequence. It’s not as simple as applying a tax rate to your total sales. The real job is to figure out your genuine taxable profit, making sure you only pay tax on what your business has actually earned.

The whole process kicks off with the 'profit before tax' figure you see in your company’s annual accounts. Think of this as your starting line. But hold on, HMRC doesn’t just take this number and run with it. You first need to make a few important tweaks to land on your final 'profits chargeable to Corporation Tax'.

First, grab that pre-tax profit from your financial statements. From there, it's a two-step dance of adding and subtracting. You’ll add back any costs that aren't allowed for tax purposes and then subtract any special tax allowances you're entitled to.

A big adjustment is adding back disallowable expenses. These are genuine business costs you’ve already deducted to find your accounting profit, but which HMRC rules say you can’t claim for Corporation Tax. The classic example? Client entertainment. While taking a client out for lunch is a perfectly valid business activity, the cost is a no-go for tax deduction.

Other common disallowable expenses include:

Next up, you get to subtract capital allowances. This is HMRC's replacement for depreciation. It allows you to deduct a chunk of the cost of major assets like machinery, computers, or company vans. The system is designed to encourage businesses to invest by letting you write off these big-ticket items against your profit, which in turn lowers your tax bill.

Key Takeaway: The formula isn't just Revenue - Costs = Taxable Profit. The real calculation is: Accounting Profit + Disallowable Expenses - Capital Allowances = Profit Chargeable to Corporation Tax. It's this final number that your tax rate is applied to.

Once you’ve got that final taxable profit figure, it’s time to apply the right tax rate. Which rate you pay depends entirely on how profitable your company is. Since April 2023, the UK has used a tiered system, which means not everyone pays the same percentage.

To give you a clear picture of how this works, here's a breakdown of the current rates and thresholds.

UK Corporation Tax Rates and Thresholds

Profit Level

Applicable Corporation Tax Rate

Notes

Profits up to £50,000

19% (Small Profits Rate)

This lower rate is designed to support smaller businesses.

Profits over £250,000

25% (Main Rate)

This is the standard rate for larger, more profitable companies.

Profits between £50,001 and £250,000

Between 19% and 25%

This is where Marginal Relief comes into play to smooth the increase.

This table shows exactly where your business fits in. As you can see, a company's profitability directly determines its tax obligations.

This handy visual simplifies the journey from your total revenue right down to your final tax payment.

As the diagram shows, the tax you owe is a percentage of your taxable profit, not your total income. That’s precisely why getting the profit calculation right is so important.

So, what happens if your profits land somewhere in that middle zone? If your company makes between £50,001 and £250,000, you don’t just jump to the higher rate. You enter a territory governed by Marginal Relief.

Think of Marginal Relief as a buffer. It’s designed to prevent a sudden, painful jump from 19% to 25% the second your profits tip over the £50,000 mark. The calculation itself can look a bit complicated, but its purpose is simple: to create a gradual, smooth increase in the tax rate.

In practice, you calculate your tax at the 25% main rate but then claim a specific relief amount. This effectively brings your overall rate down to a figure somewhere between 19% and 25%. The closer your profits are to the £50,000 lower limit, the more relief you get. As your profits climb towards £250,000, that relief slowly fades away until it disappears completely. It’s a fair system that scales with your company’s growth.

Knowing what corporation tax is and how to calculate it is only half the battle. The other, far more empowering half, is learning how to legally reduce the amount you owe. HMRC offers a range of valuable tax reliefs designed to reward specific business activities, turning what feels like a burden into a genuine opportunity for smart financial planning.

These reliefs are powerful tools that lower your taxable profit, and in turn, your final tax bill. For many UK companies, these aren't just minor discounts; they can free up significant cash. That's money you can plough back into the business to fuel growth, innovation, and hiring. Think of it less as avoiding tax and more as being rewarded for investing in your company and the UK economy.

This is a big deal, especially as corporation tax is a massive contributor to the UK's public finances. In the 2024/25 financial year, for example, HMRC receipts from corporation tax were around £91.6 billion. You can dig deeper into these UK tax revenue trends on Statista.

One of the most common and vital forms of relief is Capital Allowances. As we touched on earlier, you can't just deduct the 'depreciation' of your assets from your profits like you might in your internal accounts. Instead, Capital Allowances serve a very similar purpose, letting you 'write off' the cost of certain assets over time.

This means you can deduct a portion of the value of business-critical items from your profits before tax is calculated. Key assets that usually qualify include:

Claiming these allowances is a fundamental part of preparing your Company Tax Return. It’s a non-negotiable step to reduce your taxable profit and ensure you only pay tax on your true operational earnings.

Key Insight: Capital Allowances are HMRC’s way of acknowledging that the tools you buy to run your business wear out and lose value. By letting you deduct this cost, the government actively encourages you to invest in the equipment you need to grow.

For companies that are pushing boundaries and innovating in their field, Research and Development (R&D) tax reliefs are a complete game-changer. These are some of the most generous incentives on offer, designed to reward businesses for investing in true innovation.

If your company is working to overcome a genuine scientific or technological uncertainty, you could be eligible. This might mean creating a totally new product or process, or making a significant improvement to an existing one. The scheme is especially valuable for Small and Medium-sized Enterprises (SMEs), allowing them to deduct an extra chunk of their qualifying R&D costs from their annual profit.

Better yet, even if your company is loss-making, you can still benefit. You might be able to claim a tax credit, which HMRC pays to you in cash, a vital lifeline for start-ups and innovators in those crucial early years.

Beyond general business investment and R&D, HMRC also has targeted reliefs for specific creative and intellectual sectors. These schemes recognise the unique value that comes from brilliant ideas and creative works.

Two of the most well-known are:

Effectively using these reliefs is what separates basic tax compliance from smart tax management. By understanding which schemes your business qualifies for, you can significantly lower your liability and keep more money where it belongs: in your company. Properly filing your tax returns is the final, crucial step to unlocking these powerful savings.

Knowing what corporation tax is and how to work it out is one thing. Actually meeting the deadlines is where the rubber meets the road. When it comes to HMRC, timing isn't just important; it's everything. Miss a deadline, and you're looking at automatic penalties and interest charges that can sting.

One of the most common traps for new company directors is confusing the deadline for paying your tax with the deadline for filing your return. They are two completely separate dates, and getting them mixed up is a costly mistake.

Let’s break them down so you can stay compliant and avoid any unnecessary financial pain.

First up, let's talk about paying what you owe. This is the date by which the money must land in HMRC's bank account. For most companies, the rule is thankfully quite straightforward.

Key Deadline: Your Corporation Tax payment is due 9 months and 1 day after the end of your company's accounting period.

So, if your company’s year-end is 31 December, your payment is due by 1 October of the following year. This deadline often creeps up much faster than people expect, long before the final accounts are polished. It means you need a solid estimate of your profits well in advance.

The goalposts move if your company is considered 'large' by HMRC. Generally, this means your annual profits are north of £1.5 million. If that's you, you can't just make a single payment.

Instead, you’ll be paying your Corporation Tax in quarterly instalments. This system, known as Quarterly Instalment Payments (QIPs), is designed to give the government a more regular flow of tax revenue from the UK's biggest earners. These payments are spread throughout your accounting year and beyond, demanding much more proactive cash flow management.

After you've sorted the payment, you still have the admin task of filing your Company Tax Return (the CT600 form). This is the official document where you lay out all the details of your income, costs, and the final tax calculation for HMRC.

Fortunately, you get a bit more breathing room here.

Using our previous example, a 31 December year-end, your payment was due on 1 October, but your CT600 form isn't due until 31 December of the next year. This extra time is there for a reason: it allows you and your accountant to finalise everything properly. As digital tax becomes the norm, this process is getting smoother; our guide on Making Tax Digital for Self Assessment touches on similar changes happening elsewhere in the tax world.

The golden rule is simple: pay first, file later. Always hit that payment deadline to swerve interest charges, then use the following months to make sure your filed return is perfect.

Even with a decent grasp of the basics, business owners always have specific questions that pop up when dealing with Corporation Tax. Getting straight answers can give you the confidence you need to manage your company’s finances without the guesswork.

Let’s tackle some of the most common ones we hear.

No, Corporation Tax is only charged on profits. If your allowable expenses are higher than your income, you’ve made a trading loss, and you won’t have a tax bill for that accounting period. Simple as that.

Better yet, those losses are valuable. You can carry them forward to slash your taxable profits in future years, which means a smaller tax bill down the line. In some cases, you can even carry a loss back to a previous, profitable year and get a refund on tax you’ve already paid. Just remember, you still have to file a Company Tax Return to officially report the loss to HMRC.

This is a big one, and it's vital to understand they are two completely different taxes.

A company can be profitable but not VAT-registered, and it can be VAT-registered without making a single penny of profit.

Key Distinction: Think of it like this: Corporation Tax is based on what your business keeps. VAT is a tax your business collects from customers on behalf of the government.

Technically, yes, you can. But you absolutely shouldn't. A limited company is a separate legal entity from its owners, and keeping that financial separation clean is crucial.

Paying a company bill from a personal account blurs that line, creating a bookkeeping nightmare. It can be treated as a Director's Loan, which has its own complex tax rules and reporting headaches. Always, always pay company bills from the dedicated business bank account. It keeps things clean and compliant.

HMRC doesn't mess around with late payments. Interest starts racking up the very next day after the deadline and won't stop until the bill is paid in full.

If you continue to pay late, HMRC will hit you with penalties, and they get bigger the longer the debt goes unpaid. If you know you're going to struggle to pay on time, the worst thing you can do is ignore it. Contact HMRC as soon as you can. You might be able to set up a 'Time to Pay' arrangement, which is far better than letting the problem (and the cost) spiral.

Navigating the complexities of Corporation Tax is a core responsibility for any limited company director. At GenTax Accountants, we combine expert knowledge with smart technology to ensure you meet your obligations efficiently and optimise your tax position. Find out how we can help your business stay compliant and grow by visiting us at https://www.gentax.uk.