Here's a breakdown of the core differences between an LLP and a Limited Company. Think of it this way: a Limited Company (Ltd) is its own legal person, owned by shareholders and perfectly set up for businesses that want to bring in outside investment. On the other hand, a Limited Liability Partnership (LLP) is a more flexible setup where the profits are taxed on the individual members, making it a popular choice for professional service firms.

The right choice for you boils down to whether you need a formal corporate structure ready for investment, or the tax transparency and flexibility of a partnership.

Picking your UK business structure is one of those foundational decisions you have to get right. When it comes to LLP vs Ltd, you need to look past the names. This choice dictates everything from your tax bill and personal liability to your admin workload and even your ability to grow.

Choosing the right structure needs to align with where you see your business going in the future. It’s a key part of good strategic planning for small businesses and ensures your legal setup doesn't hold you back. Let's dig into what really sets them apart.

The easiest way to see the key distinctions is to put them side-by-side. This table gives you a quick snapshot of how they stack up on the most important points.

As you can see, while both offer limited liability, the way they handle ownership, management, and especially tax is fundamentally different.

Introduced back in 2001, LLPs were created to offer a sort of 'best of both worlds' model. By March 2023, there were 52,627 LLPs on the register in the UK, making up about 1.0% of all corporate bodies. While that number is down from its peak, the LLP is still the go-to structure for many professional service firms.

Ultimately, this isn't about which one is "better" – it's about which one is the right fit for your business. Both require you to register with Companies House to get started, and if you're curious about the costs, you can read more about the company registration fees in our UK guide.

When you get right down to it, the single biggest factor in the LLP vs Ltd debate is usually tax. The way profits are taxed in each structure couldn't be more different, and that directly hits the net income of the owners. This isn’t just a minor detail; it’s a core strategic decision that can save—or cost—you thousands each year.

A Limited Liability Partnership works on a principle of tax transparency. All this really means is that the LLP itself doesn't pay any tax on its profits. Instead, all the profits "pass through" directly to the individual members, who are then responsible for paying their own way with HMRC.

This creates a refreshingly straightforward, single layer of taxation. Each member's slice of the profit pie is treated as their personal income, which they must declare on their annual Self Assessment tax return.

For members of an LLP, it’s all about personal tax. Their obligations are calculated based on their individual profit share and break down into two main parts:

It’s easy to see why this structure is a firm favourite for professional services firms, where profits are simply divvied up between the partners each year. You get to skip the complexities of corporate tax filings and shareholder dividends, which makes financial planning a whole lot simpler for everyone involved.

The core takeaway for an LLP is that tax liability is personal and direct. The business itself has no tax burden; the responsibility falls entirely on the individual members to handle their Self Assessment obligations based on the profits they are allocated.

A Private Limited Company, on the other hand, is a completely separate legal and tax entity from its owners. This separation creates a multi-layered tax system. While it's more complex, it also offers far more flexibility in how and when you take money out of the business.

First off, the company pays tax on its own profits. Only after that are the owners (the shareholders and directors) taxed again on any money they take out. This process involves two key taxes at different stages.

LLPs are tax-transparent, meaning profits pass straight to the members who then pay Income Tax and National Insurance. In complete contrast, a private limited company first pays Corporation Tax on its profits—at rates from 19% to 25% depending on profit levels—before its directors and shareholders face any further tax on salaries and dividends.

The first layer is Corporation Tax. The limited company pays this on all its taxable profits before a single penny is distributed to shareholders. For a proper deep dive on this, check out our detailed guide on what Corporation Tax is and how it works.

After the company has settled its Corporation Tax bill, the remaining profits can be distributed to the owners. This is where the second layer of personal tax comes in:

Whether you choose a Limited Company (Ltd) or a Limited Liability Partnership (LLP), you gain one massive advantage over being a sole trader: you’re limiting your personal financial risk. But that's where the similarities end. The legal mechanics behind this protection are fundamentally different, and getting your head around this is the first crucial step in the LLP vs Ltd decision.

A limited company is recognised in UK law as a separate legal entity. This isn’t just jargon; it’s a game-changer. It means the company is treated as its own ‘person’, entirely distinct from its owners (shareholders) and the people running it (directors). This creates what’s known as the 'corporate veil'.

Think of this veil as a legal shield. It protects your personal assets—your house, your savings, your car—from business debts or legal claims. If the business gets into hot water financially, creditors can generally only go after the company’s assets, not yours. Your liability is capped at whatever you agreed to invest in your shares, which is often just a nominal £1.

Because it's a distinct legal person, a limited company can do a lot of things in its own name. This has some very practical implications for how you run and grow the business. For instance, a company can:

This solid legal structure provides real certainty and protection. It's why it's the go-to choice for businesses planning to take on hefty contracts, hire staff, or look for outside investment.

An LLP also operates as a separate legal entity, so it can own property and sign contracts just like a limited company. The key difference lies in how liability is structured, which is rooted in the traditional partnership model it evolved from. Liability is indeed limited, but the focus is more on protecting individual members from the fallout of another member's negligence.

Here's the core difference: Both structures shield your personal wealth if the business fails. But the limited company's 'corporate veil' is a comprehensive barrier separating the entire business from its owners. An LLP's protection is more about isolating each partner from the misconduct of their fellow partners.

In an LLP, each member’s liability is typically limited to what they've put into the partnership, as set out in the LLP agreement. The whole point is to avoid a scenario where one partner's bad advice could make every other partner personally bankrupt—a massive risk in an old-school partnership. You can get a deeper sense of this by reading up on the fundamental characteristics of a Limited Liability Partnership, as the principles are widely shared.

This unique setup makes LLPs a perfect fit for professional services—think law firms, accountancy practices, or architects. It’s ideal for groups of equal partners who want to work together without taking on unlimited personal liability for each other's professional work.

When you look beyond the tax and liability figures, the day-to-day experience of running your business will be worlds apart depending on whether you’ve set up an LLP or a limited company. It really boils down to one simple trade-off: formality versus flexibility. A limited company is built on a rigid, legally-defined hierarchy, while an LLP is governed almost entirely by an internal agreement you create yourselves.

A private limited company has a very clear chain of command set out in UK law. This formal structure is built around two distinct roles:

This entire setup is cemented in the Companies Act 2006, which loads directors up with specific statutory duties. These aren't just friendly suggestions; they are serious legal obligations. Directors must act in the company's best interests, sidestep conflicts of interest, and apply reasonable care, skill, and diligence. Getting this wrong can lead to some painful personal consequences.

The legal framework of a limited company demands a certain amount of administrative discipline. It’s not enough to just have directors and shareholders; you have to document how they operate and make decisions. This creates a very predictable, if sometimes a bit cumbersome, way of working.

You'll find yourself needing to keep on top of:

This regulated environment brings a lot of clarity and provides a solid audit trail for every major decision. That’s invaluable if you have external investors or a complicated ownership structure. If this sounds like the right path for you, it’s crucial to get your head around the full scope of your responsibilities. You can find out more about how we support limited companies on our dedicated page.

An LLP, on the other hand, is almost the complete opposite, offering near-total freedom internally. There are no legally required directors or shareholders. Instead, the business is simply owned and managed by its "members," who are all on a relatively equal footing from a legal standpoint.

The entire rulebook for how an LLP operates is found in one vital document: the LLP Agreement. This is a private contract, agreed upon by all members, that dictates absolutely everything about how the business is run.

The LLP Agreement is the constitutional heart of the partnership. It defines profit distribution, voting rights, decision-making processes, and procedures for members joining or leaving. Without a robust agreement, an LLP is operating on a dangerously informal basis.

This flexibility is the LLP's biggest advantage – and also its greatest risk. A well-written agreement lets the members design a bespoke governance structure that’s a perfect fit for them. They can decide exactly how profits are carved up, who gets the final say on certain issues, and what happens if a member wants to retire.

But this freedom can be a double-edged sword. If an LLP doesn’t put a comprehensive agreement in place, any disputes will fall back on the default (and often unsuitable) provisions of the LLP Act. This can easily lead to long, expensive arguments over profits or control, which is exactly why getting the internal constitution of an LLP right is so critical for its long-term health.

Getting past the technical details, the real heart of the LLP vs Ltd debate is figuring out which structure actually fits your business model and where you want to take it. The theory is one thing, but how it works in practice is everything. You’ll find that certain industries and ambitions naturally lean towards one structure over the other, and for good reason.

Picking the right framework isn't just about ticking a box on a form; it’s a crucial decision that can either set you up for smooth growth or create headaches down the road. Let's look at which types of businesses are a natural fit for each.

The LLP is the undisputed champion for professional service firms. Its entire design is geared towards businesses built on the collective expertise of its founding members, where the profits are a direct result of their work together.

It’s particularly popular in professions where the partnership model has been the traditional way of doing things for centuries. These businesses get the best of both worlds: the liability protection of a company and the tax transparency of a partnership.

In every one of these cases, the business is the people. The LLP structure respects this by treating the members as self-employed for tax, letting the profits flow straight through to them.

An LLP shines when the business is essentially its partners. Its flexibility in profit-sharing and internal governance makes it the go-to for professional collaborations where the owners and managers are the same people.

On the flip side, the limited company is the default choice for any business with ambitions that go beyond the founding team. Its more rigid, hierarchical structure isn't a downside; it’s a feature that provides the stability and scalability needed for growth.

An Ltd is built for ventures that plan to bring in outside investment or expand significantly, where ownership and management might become separate functions. Its key advantage is the ability to issue shares, creating a clear and universally understood way to handle investment.

At the end of the day, if your business plan involves external investors, a growing team of employees, or separating ownership from the day-to-day running of the company, the Ltd provides the legal and financial architecture you need. When growth and investment are on the horizon, the choice becomes very clear: the limited company is purpose-built for that journey.

Choosing between a Limited Liability Partnership (LLP) and a Private Limited Company (Ltd) is a big decision, but it doesn't have to be a headache. Often, the best way forward becomes much clearer once you ask yourself a few direct questions about your business and your goals.

Think of this checklist as the final filter. By running your plans through these questions, you'll see which structure naturally fits your vision, how you want to operate, and where you see the business going.

Answering these honestly will give you the strongest possible steer. Don't just skim them; really consider what each one means for your business.

Let’s boil the llp vs ltd debate right down to the essentials to help you make that final call.

An LLP offers fantastic internal flexibility and tax simplicity for partnerships. A Ltd company provides the robust, scalable framework needed for businesses that want to chase investment and serious growth. Ultimately, your long-term vision is the tiebreaker.

A Limited Liability Partnership (LLP) is your best bet for:

A Private Limited Company (Ltd) is the clear winner for:

Once you’ve registered your new business with Companies House, one of your very first jobs is to get your finances separate. Our guide on how to set up a business bank account takes you through every step. This simple move reinforces the legal wall between you and the business—a fundamental benefit of both the LLP and Ltd structures.

Choosing between an LLP and a limited company throws up a lot of practical questions. Getting straight answers to these common queries is the best way to move forward with confidence, making sure you’ve covered all the angles before you commit.

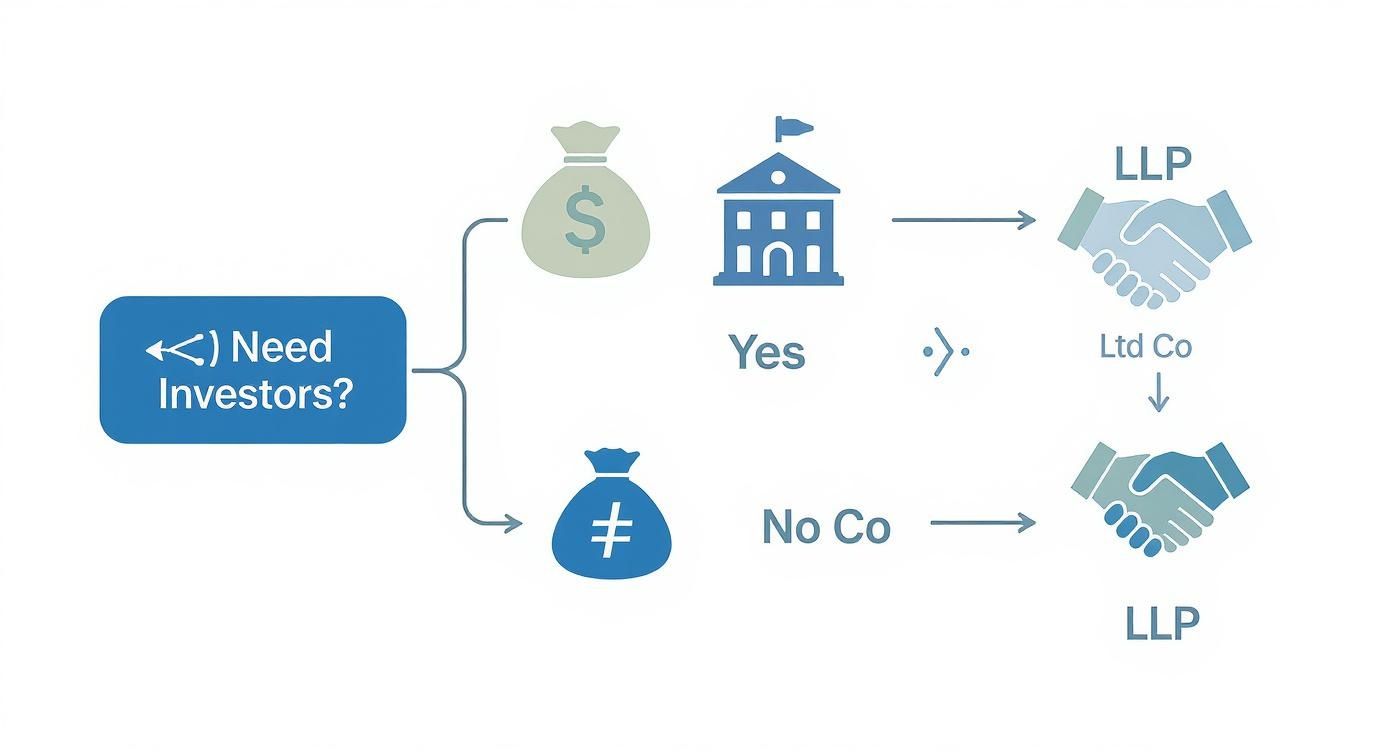

One of the most fundamental questions in the whole LLP vs Ltd debate boils down to one thing: are you looking for external investment? This simple flowchart helps visualise that decision.

As you can see, if raising capital from investors is on your roadmap, a limited company isn't just an option—it's the only viable path.

Yes, you can convert an LLP into a limited company, but it's definitely not a simple flick of a switch. The process involves setting up a brand new Ltd company and then formally transferring the assets and business activities over from the LLP.

Be warned, this transfer can trigger some hefty tax bills. You could be looking at Capital Gains Tax on the assets being moved and even potential Stamp Duty. Because of these complexities, it's absolutely crucial to get professional tax and legal advice before you even think about starting the process. You need to know the full financial impact.

For a single founder, an LLP isn't an option at all. The law is clear: an LLP requires a minimum of two members to be formed and to continue operating. So, if you're going it alone, your choice is between being a sole trader or setting up a limited company.

For most solo entrepreneurs, forming a limited company is the way to go. It offers the massive advantage of limited liability, which creates a legal firewall between your business debts and your personal assets. That's a vital safeguard a sole trader structure just doesn't provide.

While both LLPs and Ltd companies file information with Companies House, a limited company has to disclose more detailed financial data. The profit shares for LLP members stay private on their personal tax returns, whereas a company's financial health is much more public.

Neither structure offers complete privacy, as both have to make public filings at Companies House. However, a limited company generally has to file more detailed financial accounts, including a full balance sheet that can reveal a lot about the company’s financial position.

An LLP has slightly different filing rules. The key difference is that the individual profit shares paid out to members are not publicly disclosed. This information is declared privately on each member's Self Assessment tax return. This gives LLP members a much greater degree of privacy over their personal earnings compared to the more transparent reporting required of a limited company.

Making the right structural decision is a cornerstone of your business's future success. At GenTax Accountants, our experts provide clear, actionable advice tailored to your specific goals, ensuring you start on the strongest possible financial footing. Learn how we can help you today at https://www.gentax.uk.