Working from home comes with plenty of perks, but it also means your household bills can start to creep up. If you've been required to work from home by your employer, there's a UK government scheme designed to give you a bit of a break on those extra costs. It's a way to claim back some tax to offset the rise in your heating, electricity, and other related expenses.

This isn't just for standard employees; the relief can also apply to company directors and even the self-employed, who often have a formal home-working arrangement in place.

Let's cut through the jargon. Think of this tax break as HMRC's way of acknowledging that your home is now doubling as your office, and that comes with extra running costs. The most important word to remember here is "required". This relief isn’t for people who just fancy working from the kitchen table; it's specifically for those whose job demands it.

So, if your boss told you to work from home and you've seen your utility bills jump, you're probably in the right place. This scheme gives you a formal way to get some of that money back from the taxman.

You generally have two ways to go about making a claim. The one you choose really depends on your specific costs and how much time you want to spend on the paperwork.

The Simplified Flat Rate: This is the straightforward, no-fuss option. You can claim a fixed amount of £6 per week (which adds up to £312 a year) without needing to dig out a single receipt or do complex sums. It's built for speed and simplicity.

The Actual Cost Method: This route takes a bit more legwork but could lead to a much bigger claim if your work-related costs are higher than the flat rate. You'll need to meticulously calculate the exact portion of your household bills that can be attributed to your work.

This tax relief scheme has been around since 2003, but it really shot to fame during the COVID-19 pandemic when the rules were temporarily relaxed. In the 2020/21 tax year alone, a staggering 2.68 million people made a claim, totalling around £310 million in payments from HMRC.

To help you get a quick idea of whether you're likely to be eligible, have a look at this checklist.

This table is just a starting point, but if you're ticking these boxes, it’s a good sign you should look into claiming.

Eligibility isn't just for the 9-to-5 employee. It's a common point of confusion, but the rules are designed to cover various working arrangements. This includes:

If you want to see the bigger picture of how remote work affects your finances beyond just tax, a remote work savings calculator can be a really useful tool. It helps put things into perspective.

This guide will walk you through the specifics so you can figure out if you qualify and, most importantly, which method will put the most money back in your pocket.

Knowing what HMRC considers a legitimate work-from-home expense is the secret to getting your claim right. This isn’t about trying to get tax relief on your weekly shop or a new sofa; the rules are surprisingly specific.

A good way to think about it is to picture your total household costs as a pizza. You can't claim for the whole thing, only for the extra slice you're using because your home has become your office.

Getting this bit right saves you from guesswork and keeps you off HMRC’s radar. Let's break down exactly what you can and can't include, focusing only on costs that are a direct result of being told to work from home.

The most common and clear-cut claims are for your essential utilities. These are the extra, or ‘incremental’, costs that come from running your home office space during work hours.

When you’re at home all day, the heating is on for longer, the lights are on more, and you're using more power. It’s these additional costs that tax relief is designed to cover.

Remember, these costs have to be apportioned fairly. You can only claim for the energy used over and above what you’d normally use if you weren’t working from home.

These days, a solid internet connection isn’t a nice-to-have, it’s essential. You might also find yourself using your personal phone for work calls. HMRC gets this, but they have very strict rules about how much you can claim.

You can claim the business-use percentage of your home phone and broadband bills. For instance, if you can reasonably show that 25% of your internet usage is purely for work, you can claim relief on that chunk of the bill. The key here is having a sensible way to work out that percentage.

Crucially, if you already had a broadband or phone contract for personal use, you can only claim for the business portion of your calls. You can't claim for the line rental itself, because you would have been paying for that anyway.

This category is for the day-to-day stuff you use up while doing your job—the tangible things that are essential for your tasks but that your employer doesn't provide.

Think about the small but necessary bits and pieces you buy to keep your home office running. This could include:

These smaller costs can really add up over a tax year, so keeping receipts is a smart move, especially if you plan to claim the actual costs instead of using the flat rate. The world of claims can get tricky, and for those in creative or digital fields, knowing what's deductible is a must. For example, our guide on influencers' accounting dives into the unique expenses that apply to many modern professions.

Just as vital as knowing what you can claim is knowing what you can't. Trying to claim for things that aren’t allowed is one of the quickest ways to attract unwanted attention from HMRC. They're particularly strict about costs that have a "duality of purpose"—meaning they benefit you personally as well as professionally.

Here’s a simple list of expenses that are not eligible for work-from-home tax relief:

Steering clear of these common mistakes will keep your claim compliant and reduce the risk of any awkward questions. Always focus on costs that are additional and necessary purely because of your work.

When it's time to claim your work-from-home tax relief, you have two ways to go about it. Choosing the right path is key, as it affects both how much you can claim and how much paperwork you'll need to do.

Think of it like this: you can either accept an estimated grade for an exam or tally up your exact marks. One is quick and easy, while the other takes more effort but could give you a much better result. Let's break down both the simplified flat rate and the actual cost method so you can figure out which one makes the most sense for you.

First up is HMRC’s simplified flat rate, which most people know as the £6 per week method. This is by far the most straightforward way to claim, designed for anyone who wants to avoid wading through bills and complex calculations.

As the name implies, you can claim a flat rate of £6 every week you work from home, which adds up to £312 for a full tax year. The real beauty of this method is its simplicity. You don't need to dig out receipts or prove your costs have gone up. It’s a one-size-fits-all approach that assumes this amount is a fair reflection of your extra expenses.

Key Takeaway: The simplified method is perfect if your extra costs are fairly low or if you value your time more than squeezing every last penny out of your claim. It’s a quick, easy, and guaranteed way to get some money back.

For a basic rate taxpayer (paying 20% tax), a £312 claim means you get £62.40 back per year. If you're a higher rate taxpayer (40%), that relief doubles to £124.80. It might not be a life-changing sum, but it's a simple win for minimal effort.

If you're pretty sure your work-related household costs are much higher than £6 a week, then the actual cost method is your best bet. This route demands more of your time and attention, but it can lead to a significantly larger claim that truly reflects your expenses.

Going down this path means calculating the exact proportion of your household bills that can be pinned on your work activities. This includes things like electricity, heating, and business-only phone calls. But you can't just pluck a number out of thin air; you need a logical, defensible calculation to back it up.

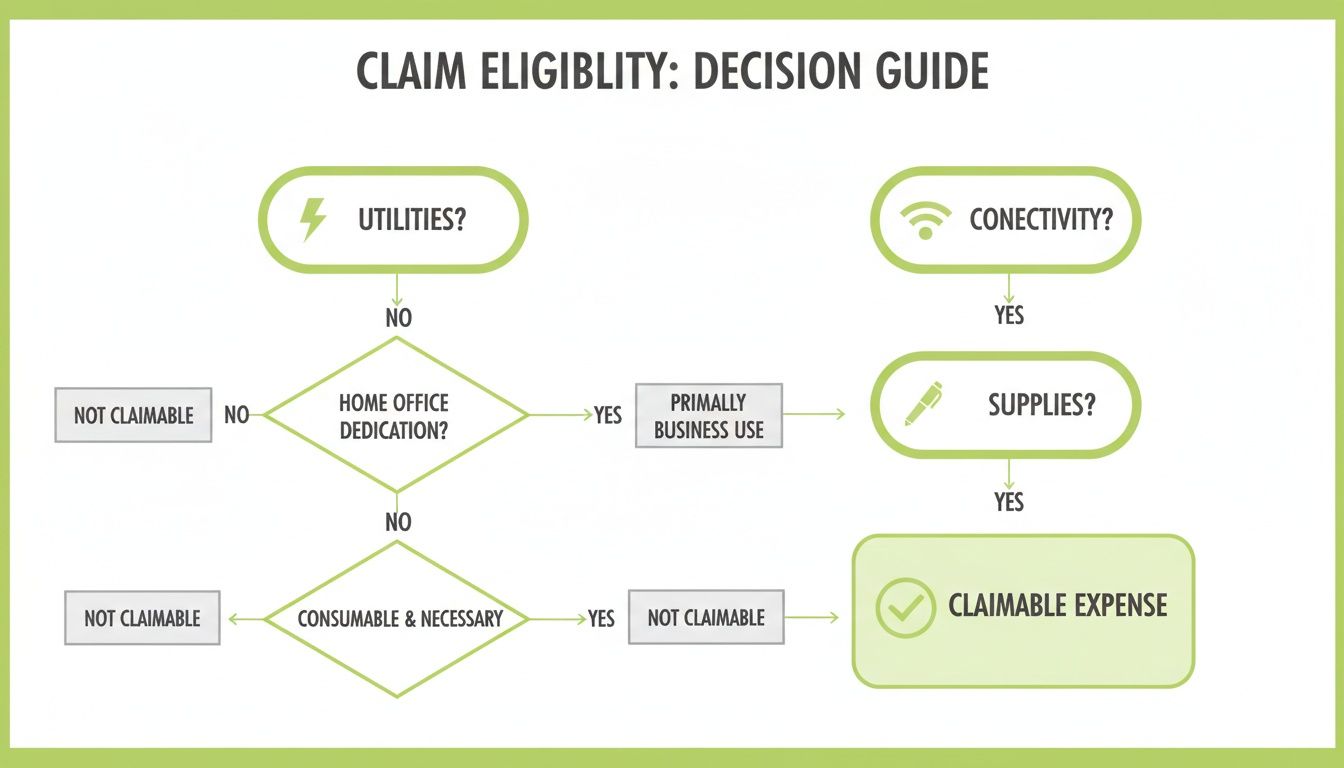

This flowchart gives you a clear decision-making process to help you sort out which expenses—from utilities and broadband to office supplies—are likely eligible.

Use it as a guide to trace your expenses from start to finish, making sure you don't miss any potential claims.

Working out your actual costs isn't as daunting as it sounds. It usually boils down to a two-step process based on apportionment—first by space, then by time.

Apportionment by Space: Start by figuring out what percentage of your home you use for work. A common and accepted way to do this is to divide the number of rooms you use for work by the total number of rooms in your house (you can leave out bathrooms and hallways). For instance, if you use one dedicated room as an office in a five-room house, your business-use space is 20%.

Apportionment by Time: Next, you need to work out how much of the time that space is actually used for work. If you work a standard 40-hour week, you'd calculate what percentage of the total hours in a week (168) that represents.

Let's walk through a real-world example to see how this comes together.

Example Calculation

Let's say Sarah works full-time from a home office. Her house has 4 main rooms (not counting the bathroom). She works 40 hours a week, and her combined gas and electricity bills come to £200 a month.

In this case, Sarah can claim £11.90 per week—almost double the £6 flat rate. Over a full year, her total claim would be £618.80, which makes the extra legwork of the actual cost method completely worth it. Just remember to hang on to all your bills and the notes on how you did your sums, as HMRC might want to see them.

To help you decide, here’s a quick head-to-head comparison of the two methods.

Ultimately, the choice is yours. If your costs are high and you don't mind a bit of admin, the actual cost method is the clear winner. But if you want a quick and easy claim with zero fuss, the simplified flat rate is a perfectly sensible option.

Alright, you've figured out you're eligible and have a number in mind for your claim. Now for the important part – actually getting the money back. Dealing with HMRC can feel a bit daunting, but claiming your work from home tax relief is often more straightforward than you’d expect. The path you take really just depends on your employment status and which claim method you've gone for.

Let's break the process down into simple, practical steps. Whether you're an employee using the flat rate or a sole trader detailing every last penny, we’ll walk you through exactly what to do. The goal here is to turn a potential headache into a simple checklist, so you can get your claim submitted correctly first time.

If you're an employee claiming the standard £6 per week, the good news is you generally don't need to file a full Self Assessment tax return just for this. HMRC has set up a special online service to make it as painless as possible.

Once you’ve submitted it, HMRC will usually adjust your tax code. This means you pay a little less tax each month for the rest of the year, rather than getting a lump sum refund. If you're back-claiming for previous years, they'll typically send you a cheque or a direct bank transfer.

Things are a little different if your real-world costs add up to more than the flat rate and you want to claim the exact amount. For this, you’ll need to fill out a P87 form.

If you're a sole trader or a limited company director, you'll claim your work-from-home expenses on your annual Self Assessment tax return. It's not a separate process; it's just one part of your overall tax submission.

When you're filling out your tax return, you’ll add your home working costs to the "business expenses" section. For sole traders, this is usually on the SA103 supplementary pages. For directors, it can get a bit more complex depending on whether the company is reimbursing you or if you're claiming the costs personally.

It’s absolutely vital to put the right numbers in the right boxes. The Self Assessment can be a minefield, especially if you're juggling different income streams and a long list of expenses. For anyone feeling out of their depth, getting professional help with filing your Self Assessment tax returns can be a game-changer. An expert will know exactly where these expenses should go, ensuring you claim everything you're entitled to while staying fully compliant.

Successfully claiming your relief is only half the battle. You also need to make sure your claim is compliant and audit-proof, which is where good record-keeping comes in. Think of your claim like a structure you're building – without the solid foundation of good records, it could easily crumble under scrutiny from HMRC.

This is especially true if you’ve gone down the actual cost route, where every single figure needs to be backed up by solid evidence. Your goal is to create a bulletproof file for your claim, so that if HMRC ever comes knocking, you can hand everything over with confidence. It turns a potentially stressful situation into a straightforward one.

To keep your claim secure, you need a clear, organised system. Shoving a year's worth of receipts into a drawer just won't cut it. You need a method that lets you easily pull up proof for every part of your claim, even years down the line.

Your record-keeping checklist should include:

Effective record-keeping is the cornerstone of sound financial management. For those running a business, our dedicated bookkeeping services can help establish robust systems to manage all your expenses.

So many well-intentioned claims get rejected because of simple, avoidable errors. Getting wise to these common mistakes can save you a lot of time and potential penalties, ensuring your claim for work from home tax relief is both maximised and secure.

Crucial Reminder: A claim is only valid if you were required to work from home by your employer. If you simply chose to work remotely for convenience on days you could have been in the office, you are not eligible to claim relief for those days.

Here are some of the most frequent mistakes to watch out for:

Even with the correct understanding, a shocking number of eligible workers are missing out. Following the pandemic, claims for this relief saw a staggering 90% drop, falling from 2.68 million in 2020/21 to just 300,000 by 2023/24. Don't be one of the people leaving money on the table.

The landscape for work from home tax relief is shifting, and it’s a big one. It's really important to get your head around these changes to keep your finances in order, as the government has made it clear it's moving away from the broad relief measures we've gotten used to over the past few years.

For employees, the writing is on the wall. The system that allowed you to claim tax relief for homeworking expenses your employer didn't cover is being wound down. This signals a return to how things were before the pandemic, putting the responsibility for costs back on employers through reimbursement schemes, rather than on individuals making direct tax claims.

The rules aren't just being tweaked; for many employees, they're being completely rewritten. A major policy change announced in early 2024 will see this type of tax relief scrapped entirely for employees starting from the 2025/26 tax year.

This isn't a minor adjustment. The move is expected to hit an estimated 300,000 people directly in the pocket. For a basic rate taxpayer, this means a tax increase of £62 a year. If you're a higher rate taxpayer, that figure doubles to £124. You can read the government's own breakdown on the official page detailing the removal of tax relief on non-reimbursed homeworking expenses. All this makes understanding your employer's reimbursement policy more crucial than ever.

While claiming the simple £6 weekly flat rate might feel like a walk in the park, things get complicated fast. Diving into the details of actual costs, structuring your business correctly, or getting ahead of these policy changes often needs a professional eye. Knowing when to call in an expert isn't giving up; it's a smart move that can save you money and a lot of headaches down the line.

Seeking professional advice isn't an admission of defeat; it's a strategic move to ensure you are operating in the most tax-efficient way possible, especially during times of regulatory change.

Think about getting help if you find yourself in these situations:

Making the right calls here is a key part of running a successful business. For more on this, have a look at our guide on tax advice for small businesses. A good accountant won't just help you with today's rules; they'll help you build a resilient strategy for whatever comes next.

Even the clearest guides can leave you with a few lingering questions. It’s completely normal – everyone’s situation is a little different. Here are some of the most common queries we get about work-from-home tax relief, answered in plain English.

Yes, but there’s a crucial catch: you can only claim for the days your employer requires you to work from home.

If your contract says the office is your main base and you just prefer working from your sofa a few days a week, that’s a choice, not a requirement. In that case, you can't claim. However, if your company has a formal hybrid policy that mandates home-working days, you’re in the clear to claim for those specific periods. It all comes down to what your employment agreement says.

This is a really common one. If your employer gives you a tax-free allowance of up to £6 a week (£26 a month), you can’t double-dip and claim again from HMRC. That allowance is designed to cover those exact costs.

But what if they pay you less than £6 a week? In that case, you can claim tax relief on the difference. And if your actual costs are genuinely higher than their allowance, you might be able to claim for the full amount, but you’ll need to go down the ‘actual cost’ route and have the paperwork to prove it.

Think of your employer's allowance as the first port of call. You only need to turn to HMRC if your employer doesn't pay you the full tax-free amount, or if they don't offer an allowance at all.

It depends on how you made your initial claim. If you used HMRC’s online portal to claim the flat rate, they often adjust your tax code for you. This means the relief should be applied automatically in the following years. But the ball is still in your court – you must tell HMRC if your circumstances change (like if you go back to the office full-time).

For anyone claiming via a Self Assessment tax return, it’s a different story. You’ll need to manually include your work-from-home expenses on your return for every single tax year you’re eligible. A quick annual review of your claim is always a smart move, just to make sure everything is still correct.

As a director, you've got a bit more flexibility, which is great. The simplest option is to pay yourself a tax-free allowance of £6 a week directly from the company. It’s a straightforward business expense, no fuss involved.

The other route is to calculate the actual extra household costs and have the company reimburse you for that precise amount. This can be much more tax-efficient, especially if your costs are high, but it involves more admin and might even need a formal rental agreement between you and your company. For this, I’d strongly recommend chatting with an accountant to figure out which strategy makes the most sense for your business.

Tax relief can feel like a minefield, especially when the rules keep shifting. At GenTax Accountants, we help business owners, freelancers, and directors get every penny they're entitled to. If you want expert advice that’s actually tailored to you, get in touch to learn more about our accounting services.