Right, let's talk about the money side of being an influencer. It's easy to get caught up in creating amazing content, but if you're earning from it, you're running a business. Simple as that.

Influencer accounting isn't some scary, complex beast. It’s just the specific way creators like you need to handle their income, track their spending, and sort out their taxes with HMRC. Getting this right from the start is the difference between a fun hobby and a proper, sustainable career.

The moment you earn your first quid from a sponsored post or get a "free" product in exchange for a review, you've officially stepped over the line. You're no longer just a hobbyist; you're a business owner. And just like any business owner, your financial health is as vital as your content strategy.

Think of it this way: your creativity gets you noticed, but solid financial management keeps you in the game. The opportunity out there is massive. The UK influencer market hit a staggering £1.86 billion this year, and it’s forecast to rocket to £19.05 billion by 2033, according to a report from imarcgroup.com. That's serious economic power, and with that power comes the responsibility to manage your finances properly.

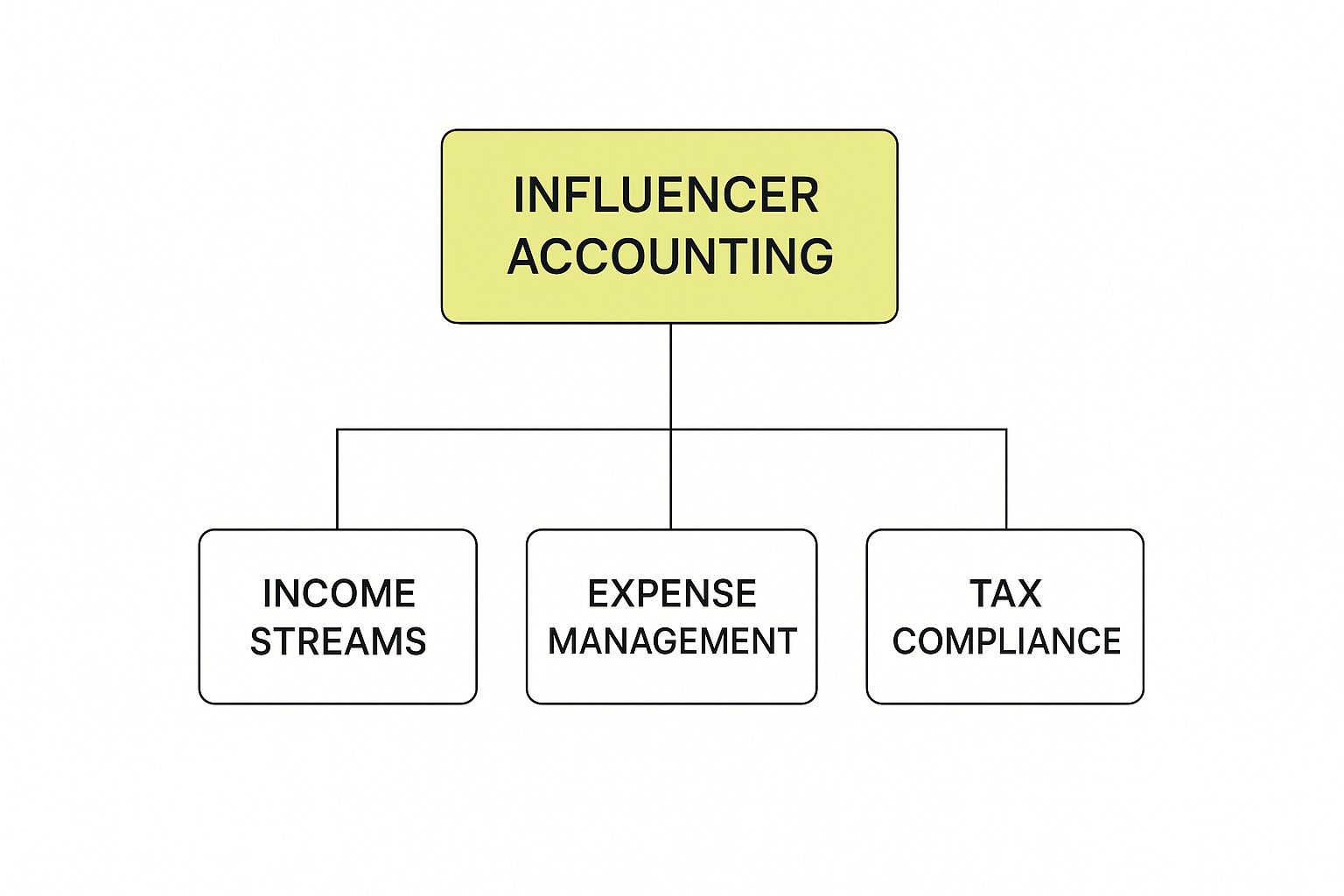

So, what does good financial management actually look like for a creator? It really boils down to a few core pillars. Get these right, and you'll not only keep your finances organised and sail through tax season, but you'll also be able to make much smarter decisions for your brand's future.

This isn't just about ticking boxes; it's about building a foundation that can support your growth.

As you can see, it’s a balancing act. You need to keep a close eye on your income, meticulously track your expenses, and stay on top of your tax obligations. If one of these pillars wobbles, the whole structure can get pretty unstable, fast.

Building a business requires more than just great content; it demands a solid financial structure. From tracking income streams to managing expenses and understanding tax duties, these pillars are non-negotiable for any creator aiming for professional success and peace of mind.

To make it crystal clear, here are the four non-negotiable pillars every influencer needs to build.

Mastering these four areas is your ticket to financial clarity and long-term success in the creator economy.

One of the first big decisions you'll face is how to set up your business legally. For most UK creators, it comes down to two main options: operating as a sole trader or setting up a limited company. Each has its own pros and cons when it comes to your personal liability, the tax you'll pay, and the amount of admin you'll have to deal with.

The best choice for you really depends on your current income, how much risk you're comfortable with, and where you see your brand going in the future. To get into the nitty-gritty, have a read of our guide on how to start a business in the UK. Getting this decision right is crucial, as it sets the scene for how you'll manage your money for years to come.

As a creator, your income rarely arrives in one neat monthly payslip. It flows in from all sorts of places, like rivers feeding into a lake. To get a real sense of your business's health and stay on the right side of the tax man, you need to measure every single one of these streams, from cash in the bank to the "free" products that land on your doorstep.

The world of influencer accounting demands you be meticulous. If you fail to track everything, you're not just getting an inaccurate picture of your earnings; you could be heading for serious trouble with HM Revenue and Customs (HMRC).

One of the first, and biggest, financial hurdles for new influencers is figuring out what to do with gifted products. When a brand sends you a camera, a new skincare range, or a designer jacket to feature in your content, it’s not just a friendly present. In the eyes of HMRC, this is a payment in kind.

Think of it like a good old-fashioned barter deal. The brand gives you something of value (the product), and in return, you provide a service of value (promotion to your audience). Because a service was exchanged for an item with a clear value, that item is considered taxable income. This is a common tripwire for creators who assume "free" also means "tax-free." It almost never does.

Under UK tax law, any product or service you get as part of a promotional arrangement is treated as income. Its fair market value needs to be recorded and declared on your tax return, just like cash.

Ignoring this is one of the quickest ways to find yourself in a sticky situation with compliance. That's why having a solid system for tracking both cash and non-cash income is absolutely vital from day one.

So, how on earth do you put a price on a gifted item for your books? The rule is to use its fair market value (FMV). This is simply the price a regular customer would pay for that item on the open market when you received it. A quick search on the brand’s website or a major retailer like John Lewis or Amazon will usually give you the figure you need.

Let’s walk through a quick example:

This applies even if you don't have a formal contract. If there's an unspoken understanding that you'll promote the product, it’s a payment in kind.

Beyond gifted items, your income will likely come from a variety of other sources. Each one needs to be tracked just as carefully.

To handle all this, your bookkeeping system—whether it's a simple spreadsheet or dedicated software—needs separate categories for each type of income. This doesn't just make your tax return easier; it gives you powerful insights into which revenue streams are working best for your business. And that's the key to smart influencer accounting.

As your creator business picks up steam, so will your costs. From that new vlogging camera to your monthly software subscriptions, these outgoings aren't just part of the job—they are legitimate business expenses that can seriously lower your tax bill. Getting your head around what you can claim is a massive part of smart influencer accounting.

The golden rule from HMRC is that any expense must be “wholly and exclusively” for your business. This simply means the cost was only for your trade. It sounds straightforward, but it’s where a lot of confusion crops up, especially when your work and life are so closely linked.

Think of it like this: a new ring light you only ever switch on for filming YouTube videos is a clear-cut, 100% business expense. But what about a new laptop? If you use it for editing videos 70% of the time but for personal Netflix binges the other 30%, it has a dual purpose. In that scenario, you can only claim the business portion, so 70% of the cost.

The most obvious expenses you can claim are the tools of your trade. These are the workhorses of your influencer business, and you can usually deduct their full cost.

In this digital-first world, your software subscriptions are just as vital as your physical kit. These recurring payments can really add up, so it's crucial to track them as expenses.

A few common examples include:

These are all ongoing operational costs directly linked to creating and sharing your content, which makes them perfectly valid expenses in HMRC’s eyes.

It's so easy to overlook the small, monthly subscriptions. That £15 a month for a bit of software might not seem like much, but it comes to £180 over a year. Tracking every single one is the secret to maximising your deductions.

What about when you're on the move? This is where that "wholly and exclusively" rule really gets put to the test. You can claim travel costs, but only if the trip’s sole purpose is business.

For instance, if you travel from London to Manchester specifically to film a collab video, your train ticket and hotel are allowable expenses. But if you decide to tack on a few extra days to visit friends, you can only claim the costs for the business part of the trip. The personal sightseeing bit is on you.

Likewise, you can claim for food and drink (subsistence) but only when you're travelling for business away from your usual workplace. Sorry, but you can't claim your daily coffee or lunch when you're working from your home office!

As an influencer, buying products to feature in your content is often part of the gig. If you're a beauty blogger purchasing the latest foundation to review, the cost of that foundation is a legitimate business expense. Simple.

This also applies to props. If you're a food blogger buying specific ingredients for a recipe video or a home decor influencer picking up cushions for a room makeover post, those costs are allowable. The key is that they were bought for the purpose of creating content.

Since most creators work from home, you can claim a portion of your household bills as a business expense. There are a couple of ways to tackle this:

For all these expenses, keeping meticulous records isn't just good practice; it's essential. It ensures you claim everything you're entitled to and gives you the proof you need if HMRC ever comes knocking. Getting these claims right is a cornerstone of preparing accurate and optimised tax returns, helping you keep more of the money you've worked so hard to earn.

Let's be honest, disorganised finances are a huge source of stress for any business owner, and your life as a creator is no different. A solid, simple bookkeeping system is the engine room of your influencer business. Once it’s set up, it works quietly in the background, giving you the clarity and confidence to make your next move.

This isn't about becoming a master accountant overnight. The goal is to create a sustainable workflow that you can actually stick with. Get this right, and you'll transform that messy pile of receipts and invoices into a powerful tool for making smarter business decisions.

The very first, non-negotiable step is to open a bank account dedicated solely to your influencer business. Mixing your personal and business spending is a recipe for chaos, making it nearly impossible to get an accurate picture of your income and expenses.

Think of it as creating a clear boundary. All your earnings—brand deals, affiliate links, ad revenue—go into this account. All your business spending—camera gear, software subscriptions, travel costs—comes out of it. This simple act creates immediate clarity and makes your accounting infinitely easier down the line.

A dedicated business account is the bedrock of professional bookkeeping. It cuts out the financial "noise" of personal spending, giving you a clean, accurate view of your business's true financial health at a glance.

This separation isn't just for your own sanity, either. It creates a clean, clear audit trail that HMRC will appreciate if they ever need to review your records.

With a dedicated account in place, you need a central hub to record and categorise every single transaction. You've got a few great options here, and the best one for you depends on where you are in your creator journey.

This is the key to professionalising your finances. Proper accounting software saves countless hours, slashes the risk of human error, and gives you real-time reports on your profitability and cash flow. It’s an investment that pays for itself in time saved and tax bills minimised.

The creator space is becoming more professional, and the accountancy world is taking notice. In fact, the Institute of Chartered Accountants in England and Wales (ICAEW) even launched a ranking system to spotlight the top accountancy influencers, showing just how much value there is in clear, ethical financial guidance.

A system is only as good as the habit you build around it. You don't need to chain yourself to your books for hours every day. A simple, consistent routine is far more effective.

This simple routine gives you the financial clarity to know when to invest in new kit, when to push for higher rates, or when it's time to bring in professional help. If the idea of setting all this up feels daunting, exploring dedicated bookkeeping services can give you the support and structure you need to get it right from day one.

The word "tax" can make anyone's shoulders tense up. But for UK creators, it's just another part of the business puzzle. Getting to grips with your duties to HM Revenue and Customs (HMRC) isn't about memorising the tax code; it's about having a clear process so you pay the right amount and avoid any nasty surprises down the line.

Think of it as the final, crucial step in your financial workflow. You’ve diligently tracked your income and logged every allowable expense—now it's time to report those figures correctly. Let's break down exactly what you need to do, step by step.

If you're earning money as a self-employed creator in the UK, you’ll almost certainly need to file a tax return through the Self Assessment system. This is simply how HMRC collects Income Tax from people who aren't on a traditional company payroll where tax is deducted automatically.

You have to register for Self Assessment if you earned more than £1,000 from your creator activities in a tax year (which runs from 6th April to 5th April). This is your 'trading allowance'. As soon as your gross income—including the value of gifted products—creeps over this line, signing up becomes a legal requirement.

The most important date for your diary? 31st January. That's the final deadline to get your online tax return filed and pay whatever tax you owe for the previous tax year. Missing it means automatic penalties, so it really pays to be prepared.

As a self-employed person, it’s not just Income Tax you need to think about. You also have to pay National Insurance. These contributions are what build up your entitlement to state benefits later in life, like the State Pension.

For most influencers working as sole traders, there are two types you'll encounter:

The good news is that your Self Assessment tax return calculates all of this for you based on the profit you report. It's not a separate bill; it's all handled in one go.

Properly managing your tax obligations is a hallmark of a professional creator. It signals the shift from a hobbyist to a compliant business owner, safeguarding not just your finances today but also your future access to state benefits.

These principles aren't unique to influencers; they apply to most small businesses. For a broader look, our guide with tax advice for small businesses is a great place to deepen your understanding.

Value Added Tax, or VAT, is another tax that might eventually appear on your radar. It’s a tax on most goods and services, and it becomes mandatory for your business once your turnover reaches a certain level.

The magic number to watch is the VAT registration threshold, which is £90,000 (as of 2024). This isn't based on your profit; it’s calculated on your total VAT-taxable turnover in any rolling 12-month period. That figure includes all your cash earnings and, crucially, the market value of any 'payment in kind' items you’ve received, like gifted tech or holidays.

Let's say your turnover for the last 12 months breaks down like this:

In this scenario, because your total turnover has tipped over the £90,000 threshold, you are now legally required to register for VAT with HMRC.

Once you’re VAT-registered, a few things change:

Becoming VAT-registered definitely adds an extra layer of admin to your bookkeeping, but it’s a non-negotiable step once you hit that turnover figure. Keeping a close eye on your rolling 12-month turnover is the best way to make sure you register on time and steer clear of hefty penalties.

As your creator business starts to really take off, you'll hit a fork in the road that’s about much more than just day-to-day bookkeeping. You’ll need to decide on the legal structure for your brand. For most influencers in the UK, this choice really boils down to two main paths: operating as a sole trader or setting up a limited company.

This isn't just a bit of admin to tick off a list. The structure you pick will have huge, long-term effects on your tax bill, your personal liability, and just how much paperwork you'll be drowning in. It's a strategic move that will genuinely shape the future of your business.

Kicking things off as a sole trader is the go-to route for new creators, and for very good reason. It’s hands down the simplest and fastest way to get your business up and running. In the eyes of the law, you and your business are treated as one and the same.

The main perks are pretty straightforward:

But, and it’s a big but, this simplicity comes with a major catch: unlimited liability. Because there's no legal distinction between you and your business, your personal assets—think your house or your savings—could be on the line if the business runs into debt or gets sued. You can learn more in our detailed guide on financial management for sole traders.

Forming a limited company means you're creating a completely separate legal entity. Think of it like building a solid wall between your business finances and your personal bank account.

A limited company provides limited liability, which is the single biggest reason successful creators choose to incorporate as their income and risks grow. It means your personal assets are shielded from business debts.

While it offers fantastic protection, it does come with a bit more responsibility.

So, when’s the right time to make the switch? Many influencers start thinking about incorporating when their profits begin to nudge them into the higher-rate tax bracket. At that stage, the tax efficiencies of a limited company—like paying yourself with a mix of a small salary and dividends—can often start to look a lot more appealing than the extra admin. Getting this right is a crucial part of strategic influencer accounting.

When you're navigating the world of influencer finances, a few common questions always seem to pop up. Let's tackle some of the most practical queries we hear from UK creators.

Yes, you absolutely do. It’s one of the first things new creators get caught out on. In the eyes of HMRC, products or services you receive for a promotion are considered 'payment in kind'. This means they're treated just like taxable income.

Your job is to work out the item's fair market value – basically, what it would cost someone to buy it off the shelf – and declare that figure on your Self Assessment tax return. Ignoring this is a one-way ticket to trouble.

This is a big one, and it can creep up on you fast. You are legally required to register for VAT once your total VAT-taxable turnover in the last 12 months goes over the government threshold. As of early 2024, that magic number is £90,000.

Remember, "turnover" isn't just the cash that hits your bank account; it also includes the value of any gifted items. It's crucial to keep a running total of your 12-month income so you can register on time and sidestep any nasty penalties from HMRC.

Definitely, but only the business part. It’s rare for a phone to be used 100% for your influencer work, so you can only claim a portion of the bill.

You'll need to work out a reasonable percentage for business use – think about the time you spend creating content, replying to brand emails, and managing your social channels. For instance, if you figure that 60% of your phone usage is for business, you can claim 60% of your bill as a legitimate expense.

A common question we get is whether to start as a sole trader or a limited company. When you're just starting out, being a sole trader is much simpler. But once your profits start climbing, usually around the time you'd hit the higher-rate tax bracket, forming a limited company often makes more sense for tax efficiency and gives you crucial liability protection.

Stop wasting hours buried in confusing spreadsheets and stressing about HMRC. GenTax Accountants blends expert advice with smart tech to manage all your influencer accounting, from day-to-day bookkeeping to your final tax return. Get a dedicated accountant and the clarity you need to focus on growing your brand. Start your journey to financial peace of mind with GenTax today.