Deciding on the most tax-efficient director's salary isn't just a numbers game; it's a strategic choice. For the 2025/26 tax year, the figure of £12,570 per year often comes up as the go-to starting point for many UK company directors. Why this specific amount? It lines up perfectly with the Personal Allowance, letting you draw a salary without paying any income tax on it, all while banking those crucial National Insurance credits for your state pension.

This guide explains salary vs. dividend strategies, managing your director's loan account, and other key tax planning considerations for company owners.

Figuring out the most tax-efficient salary for yourself as a director is the bedrock of your company's pay strategy. It might seem like a simple decision, but it creates a ripple effect that touches your personal tax bill, your company's Corporation Tax, and even your future financial security. It's all about striking that perfect balance.

For many sole directors, the conversation often starts and ends with that one key figure: £12,570 per annum for the 2025/26 tax year. This aligns your salary with the Personal Allowance threshold, which is brilliant because it means you maximise your tax-free income. You also get the added bonus of qualifying for National Insurance credits towards your state pension without paying employee's NI.

Now, it's true that this salary level does trigger an Employer's National Insurance charge for the company. However—and this is the important part—the salary itself is a tax-deductible expense. This means it reduces your Corporation Tax bill by more than the NI cost, making it a net gain for the business.

To really see how this works in practice, let’s look at a couple of the most common salary levels that directors consider. Each has its own pros and cons, depending on what you're trying to achieve with your business and personal finances.

You'll notice we're comparing the current "sweet spot" with a lower amount that used to be popular but has become less efficient due to shifts in National Insurance thresholds.

This quick table breaks down how these choices stack up against each other, showing the direct impact on tax and your state pension qualification.

Salary LevelPersonal Income Tax DueCompany Employer NI DueQualifies for State Pension Credits?£9,100£0£0Yes£12,570£0£479Yes

As you can see, the higher salary of £12,570 does come with a small Employer's NI bill for the company.

Key Takeaway: Even with the small Employer NI contribution, the Corporation Tax saving from the higher salary almost always makes the £12,570 option the most efficient route for most sole directors. The tax relief you get is greater than the NI cost.

Getting these calculations and the subsequent payroll submissions right is absolutely vital. Our expert payroll services can take this off your plate, ensuring your director's salary is processed accurately and on time. This keeps you compliant while making sure you're as tax-efficient as possible, setting a solid foundation before we start looking at the interplay between salary and dividends.

Before you can work out the most tax-efficient director’s salary, you need to understand the numbers that shape the UK tax landscape. These thresholds aren’t set in stone; they change, sometimes year-on-year, and staying on top of these shifts is absolutely critical for making the right call for your company. This isn't just about crunching numbers—it’s about building a smart, sustainable strategy.

The cornerstone of your personal tax situation is the Personal Allowance. For the 2025/26 tax year, this figure is £12,570. It’s useful to think of this as your own tax-free bubble; any income you earn up to this amount is completely free of income tax. You can see why aligning your salary with this threshold is such a popular and effective strategy for many directors.

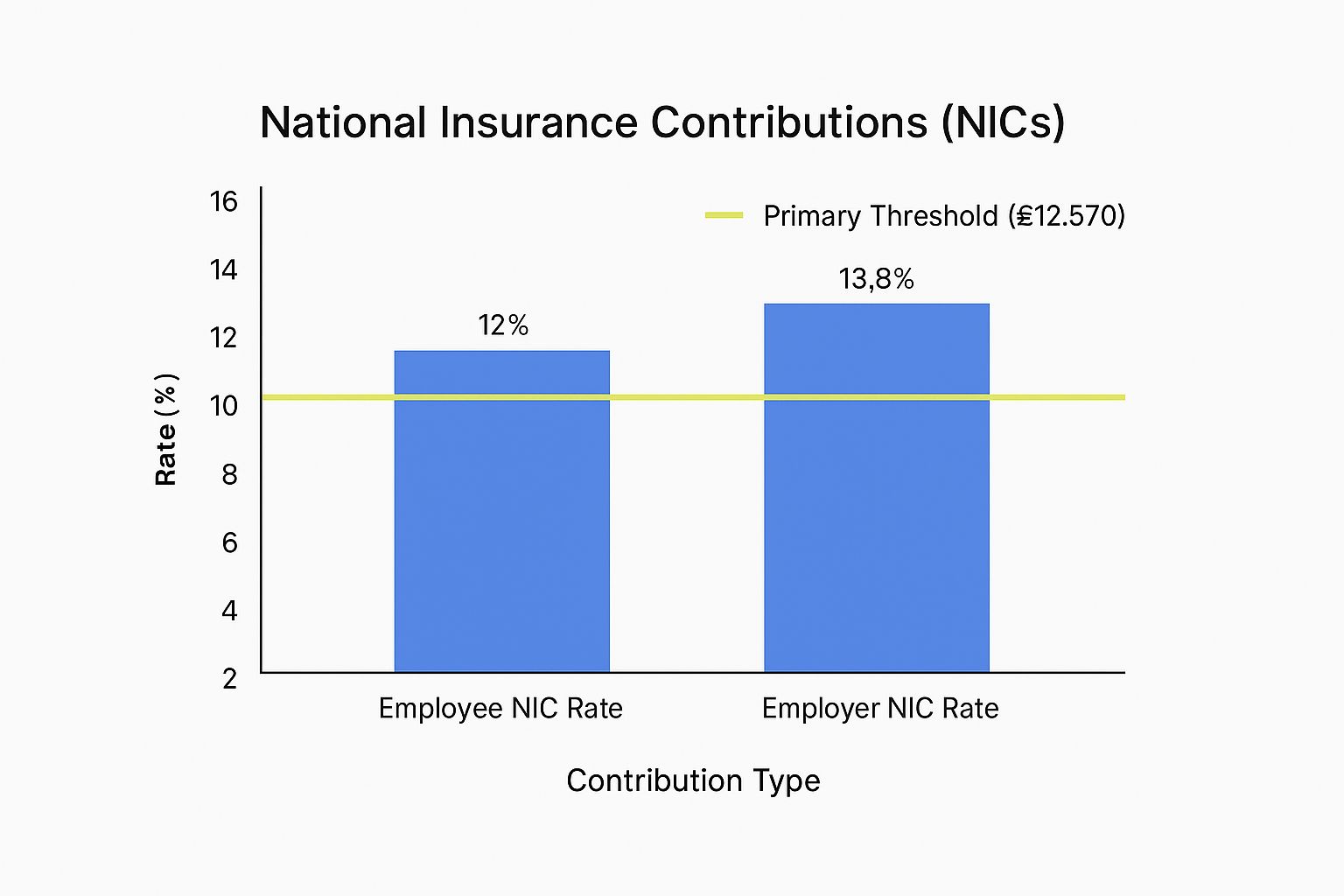

But income tax is only one side of the coin. You also have to factor in National Insurance Contributions (NICs), which come with their own set of thresholds for both you (as the employee) and your company (as the employer).

It’s crucial to get your head around the different NI thresholds because they all do different jobs. They directly impact how much salary you can draw before you or your business start getting hit with tax and NI costs.

Here’s a quick rundown for 2025/26:

A common mistake I see is directors focusing only on their personal tax position. A truly tax-efficient strategy has to look at the bigger picture, especially the company’s liabilities like employer's National Insurance. Without that, you're flying blind.

The tax system is always on the move, and some recent changes have really altered the playing field for director salaries. Not so long ago, taking a salary just below the Employer's NI threshold was the go-to strategy because it cleverly avoided all tax and NI.

However, aligning the Employee's Primary Threshold with the Personal Allowance at £12,570 has changed the calculation. Now, paying a salary up to this level, despite incurring some Employer's NI, often proves more tax-efficient overall. This is because the Corporation Tax relief on the higher salary outweighs the NI cost. While the Employment Allowance can sometimes wipe out Employer's NI, companies with a single director usually don't qualify. These changes have forced a complete rethink of what a tax-efficient director's salary actually looks like.

Navigating these moving parts is a core piece of your annual financial puzzle. Ensuring every detail is spot on for your personal tax returns is vital to staying compliant and avoiding any nasty surprises from HMRC.

The classic director's dilemma: what’s the perfect mix of salary and dividends? For years, the go-to strategy has been a low salary topped up with chunky dividends. While this approach is still fundamentally sound, recent tax changes mean the balancing act has shifted. You need to understand the new mechanics to figure out what works best for you right now.

It all boils down to one key difference:

This distinction is precisely why nailing your salary level is the first, most crucial step in creating a tax-efficient structure.

This infographic shows the different National Insurance (NI) rates that apply to you and your company, and more importantly, the thresholds where they kick in.

As you can see, paying a salary right up to the Personal Allowance (£12,570) can be a sweet spot, as it maximises tax relief for the company without triggering the higher employee NI rates.

Let's put this into practice with a real-world scenario. Imagine you're the sole director of your limited company, and you want to draw a total of £50,000 this year. We'll compare two popular strategies to see which one leaves more cash in your pocket.

For this example, we’ll assume your company has enough profit to cover these payments and will pay the 19% small profits rate of Corporation Tax.

This table breaks down how much you actually take home under two common approaches: one with a salary at the Employer's NI threshold, and one taking full advantage of the Personal Allowance.

MetricStrategy 1 (£9,100 Salary)Strategy 2 (£12,570 Salary)Salary£9,100£12,570Dividends Needed£40,900£37,430Total Take-Home£45,616£45,861Overall Tax Saved-£245

As the numbers show, even after accounting for the Employer's NI liability, the higher salary strategy comes out on top. It puts an extra £245 in your bank account. It might not sound like a life-changing sum, but this efficiency scales up with your income and clearly points towards the optimal structure.

Director remuneration for 2025/26 is all about smartly combining salary with dividends. While dividends aren't a deductible expense for Corporation Tax, salaries are. This makes a salary up to the £12,570 Personal Allowance a powerful tool for reducing your company's tax bill. You'll also secure NI credits towards your state pension and use your tax-free allowance without paying any income tax on it.

The catch? The dividend allowance has been slashed to just £500. This makes careful planning more important than ever. You can get the full picture by reading our guide on the UK dividend allowance changes and how they might affect your personal tax position.

Key Takeaway: The sweet spot is a salary that maximises your tax-free Personal Allowance. It reduces your company’s Corporation Tax bill by more than the Employer's NI it triggers, leaving more profit available to be paid out as dividends.

Beyond salary and dividends, the Director's Loan Account (DLA) is a really important tool in your financial kit. It's not as complicated as it sounds. Essentially, it's just a running tally within your company's books that tracks any money moving between you and the business that isn't a salary, dividend, or expense reimbursement.

Think of it as a simple IOU register. When you put your own money into the business, maybe to help with a temporary cash flow issue, your DLA is in credit. The other way around, when you take money out of the company that isn't a formal salary or dividend, your DLA becomes overdrawn. This is where you need to be careful.

It can be tempting to just dip into the company account to cover a personal bill, but doing this without following the proper process can have serious tax consequences. An overdrawn DLA is, in HMRC's eyes, a loan from your company to you. They have very strict rules in place to stop directors from taking tax-free loans instead of taxable income.

If your loan from the company goes over £10,000 at any point during the year, it's classed as a "benefit in kind," and you'll personally have to pay tax on it.

What’s even more alarming is the penalty if any part of that loan is still outstanding nine months and one day after your company’s year-end. If it's not paid back, your company gets stung with a painful tax charge.

This charge, known as Section 455 tax, is set at 33.75% of whatever loan balance is left. While it's technically a temporary tax that can be reclaimed once you repay the loan, it can create a massive, and often crippling, cash flow problem for your business.

Let’s look at a common situation. Imagine a director, Alex, needs £15,000 for a house deposit. He pulls the cash straight from the business bank account, which puts his DLA into a £15,000 overdrawn position.

Alex's company has a 31st March year-end. To dodge that nasty Section 455 charge, he absolutely must have that loan repaid by 1st January of the following year.

So, what are his options?

The crucial takeaway here is to act decisively and make sure the transaction is officially recorded. If Alex failed to clear the loan in time, his company would be hit with a £5,062.50 tax bill under Section 455 (£15,000 x 33.75%).

It’s a perfect example of why managing your DLA isn't just about good bookkeeping – it's absolutely essential for protecting your company's bottom line.

Once you’ve got your head around the optimal salary and dividend mix, don't stop there. The next layer of savvy financial planning is about looking beyond your immediate take-home pay. This is where advanced strategies come into play, helping you slash your tax bill while building serious, long-term wealth for your future.

Easily one of the most powerful tools in a director's arsenal is making company contributions to a personal pension. I often tell clients this is the single most efficient way to pull profit from your business. It’s hard to beat, offering a fantastic triple tax advantage.

First off, any pension contributions your company makes are usually treated as an allowable business expense. This immediately reduces your company's profit, which means a smaller Corporation Tax bill. Simple.

Better yet, unlike a salary or dividend, these pension contributions don't trigger personal tax or National Insurance for you. And for the company? No Employer’s NI to worry about either.

Pensions are the big one, but there are other benefits your company can pay for that also chip away at your taxable profit while giving you some valuable perks. Think of them as legitimate business expenses that add another dimension to how you’re rewarded.

A few common examples I see all the time include:

It's all about taking a holistic approach. This isn't just a simple case of salary versus dividends. When you start layering in company pension contributions and other legitimate benefits, you build a much more robust and tax-savvy structure. You're supporting both your life now and your security down the road.

Let's walk through a quick scenario. Imagine a director has already nailed their salary and dividend levels for the year. They decide to direct an additional £10,000 of company profit into their personal pension.

Straight away, this reduces the company's Corporation Tax liability by at least £1,900 (assuming the 19% rate).

That £10,000 lands directly in their pension pot, completely free of income tax and National Insurance. Had they taken that same amount as a dividend, a higher-rate taxpayer would have handed £3,375 of it straight to the taxman. It’s a stark example of how you can shift significant value from your company to your personal wealth with incredible efficiency.

Of course, the exact numbers can get a bit more involved. Our guide on how to calculate employer pension contributions breaks down the mechanics in more detail.

Ultimately, getting your remuneration right means looking at the full picture. By combining an optimal salary, strategic dividend payments, and powerful tools like pensions, you make sure that more of your hard-earned money stays where it belongs – with you.

Finalising your director's pay strategy involves a few moving parts. It’s only natural to have questions as you try to apply these ideas to your own company. We get asked a lot of the same things, so we've put together some direct answers to help you lock in your approach with confidence.

Even with a solid plan, your personal circumstances can add extra layers of complexity. Let's tackle some of the most frequent "what if" scenarios that directors face.

This is a big one. If you have other sources of income, like from a rental property or another job, your £12,570 Personal Allowance might already be used up. In this common scenario, taking a salary at that level from your company suddenly becomes much less efficient, as it would be taxed right away.

Often, a better approach is to pay yourself a much smaller salary—just enough to keep your National Insurance contributions ticking over for your state pension—and take the rest as dividends.

For higher-rate taxpayers, the game changes again. The dividend tax rate jumps to a steep 33.75%, which makes maximising your company pension contributions one of the most tax-savvy moves you can make. This strategy neatly sidesteps both the high rate of income tax and that hefty dividend tax.

The Employment Allowance is a fantastic tax break that can offset your company's Employer National Insurance bill. But, and it's a big but, there's a critical restriction: it cannot be claimed by companies where a single director is the only person on the payroll.

If your company employs at least one other person (who isn't also a director), then you may well be eligible to claim it. However, if you're a "one-person band," you have to factor in the full cost of Employer's NI when working out your most efficient salary.

Key Insight: The Employment Allowance is a powerful tool, but its ineligibility for most sole director companies is a crucial detail. Overlooking this can lead to unexpected tax bills and completely undo an otherwise efficient pay structure.

You absolutely must review your pay strategy at least once a year. The best time to do this is just before the start of the new tax year in April, as this is when all the new tax rates and thresholds kick in.

Other triggers for an immediate review include a major life event, a significant shift in your company's profits, or the decision to hire your first employee. Staying proactive is the only way to make sure your pay strategy stays optimised and, just as importantly, compliant.

For broader insights that go beyond your director's pay, our guide on tax advice for small businesses offers valuable tips for maintaining financial health across your entire operation.

At GenTax Accountants, we specialise in removing the guesswork from your financial planning. Our expert team combines advanced tools with personalised advice to build the most tax-efficient structure for you and your business. Get in touch today for a free consultation and see how we can help you keep more of your hard-earned money.