Working out your employer pension contributions is a crucial part of running payroll correctly. At its core, it's about figuring out an employee's qualifying earnings, applying the right minimum contribution rate, and making sure you account for the lower earnings threshold. Getting this right keeps you compliant with UK auto-enrolment laws and ensures your team gets what they're due.

Before you start crunching any numbers, it’s vital to get your head around the foundations of the UK's automatic enrolment system. This isn't just about memorising percentages; it's about understanding exactly what slice of an employee's pay those percentages apply to.

Nail this from the beginning, and you'll save yourself a world of compliance headaches down the line. The entire calculation rests on a key concept: qualifying earnings.

You might think you just apply the pension percentage to an employee's total gross salary, but that’s a common mistake. Instead, contributions are based on a specific band of earnings known as qualifying earnings.

For the 2024/2025 tax year, this band captures all earnings between £6,240 (the lower threshold) and £50,270 (the upper threshold).

What's really important to remember is that "earnings" is a broad term here. It doesn't just mean basic pay. You must include:

This wide definition means that even if an employee's basic salary falls below the £6,240 threshold, a chunky bonus or a month with lots of overtime could easily tip them into the bracket where contributions are required for that pay period.

Under the UK's auto-enrolment rules, a total minimum contribution must find its way into an employee's pension pot. Right now, that total is 8% of their qualifying earnings. But here's the good news: as the employer, you aren't on the hook for the full amount.

Your legal responsibility is to contribute a minimum of 3%. The employee then makes up the rest, with their 5% share getting a boost from government tax relief (which typically means they only see 4% leave their payslip).

Key Takeaway: The 3% employer minimum is just that—a minimum. It's a legal requirement you cannot go below. Many businesses choose to contribute more as part of a competitive benefits package, which can be a great way to attract and retain talent.

Let's put this into practice. Say you have an employee, Sarah, who earns an annual salary of £30,000. Her earnings fall comfortably within the qualifying band.

First, you need to work out the portion of her salary on which contributions are actually calculated. You do this by subtracting the lower earnings threshold:

£30,000 - £6,240 = £23,760

This is her total qualifying earnings for the year. Now, you can calculate your minimum employer contribution, which is 3% of this figure:

Broken down monthly, your contribution for Sarah would be £59.40.

Handling these calculations accurately and consistently every single pay run is a fundamental part of a well-managed payroll system.

When it comes to calculating employer pension contributions, there’s no single, catch-all method. The right approach depends entirely on the type of pension scheme you’ve chosen for your business. While most employers will use the default method based on qualifying earnings, it's vital to know if your scheme uses a different basis, often called pensionable pay.

This might sound like a minor detail, but getting it wrong can have a serious financial impact. A simple misunderstanding here could lead to incorrect payments, compliance headaches with The Pensions Regulator, and a lot of confusion for your employees. Nailing this from the start ensures every pay run is accurate and fair.

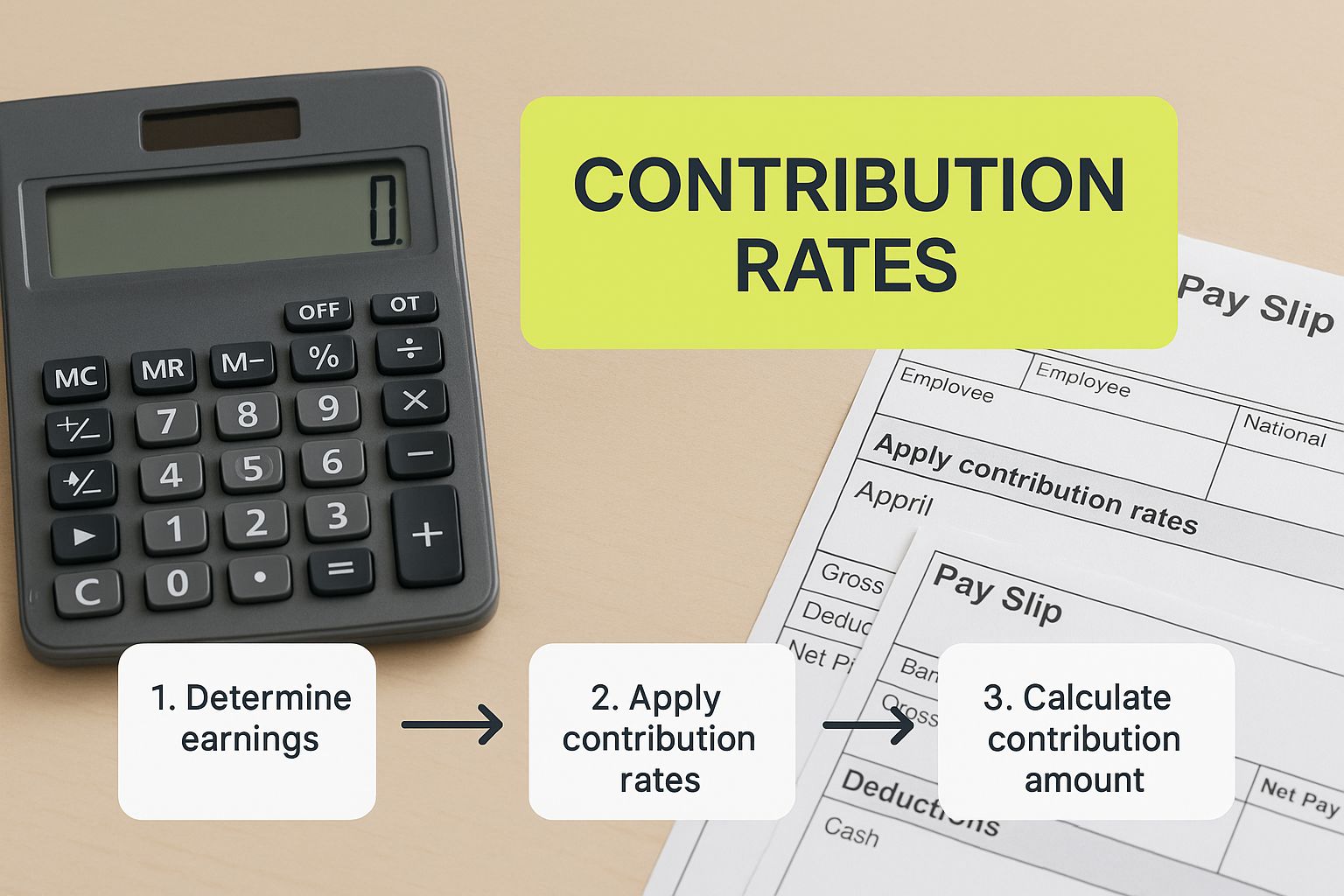

This infographic gives a great visual of the starting point for these crucial calculations.

As the image shows, the first step is always to identify the correct earnings base and apply the contribution rate set out in your scheme’s rules.

Most automatic enrolment schemes are set up using the qualifying earnings model. As we’ve already touched on, this means you only calculate contributions on an employee's earnings that fall between the lower and upper thresholds set by the government each year.

Some schemes, however, use a pensionable pay basis. This approach can simplify the maths but often leads to higher overall contributions. There are typically three main types, known as Tiers, that you might come across:

The biggest takeaway here is that pensionable pay schemes usually ignore the government's lower and upper earnings thresholds. This means the percentage is applied to a much wider chunk of salary.

Expert Tip: Always, always check your pension provider's documentation to confirm which basis your scheme uses. Assuming it's based on qualifying earnings when it's actually pensionable pay is a common and surprisingly costly mistake I see businesses make.

Let's walk through how this works with a real-world scenario. We'll use an employee, David, who earns a basic annual salary of £38,000. This year, he also received a £2,000 bonus, bringing his total earnings up to £40,000.

Scenario 1: A Qualifying Earnings Scheme

Scenario 2: A Pensionable Pay Scheme (Tier 3 - All Earnings)

As you can see, the pensionable pay scheme costs the business an extra £187.20 a year for David alone. The contribution percentage is identical, but the earnings base it's applied to makes all the difference. Making sure these calculations are spot-on is a fundamental part of good financial management, and keeping clear, accurate records is where professional bookkeeping services can be a lifesaver.

Let's be honest, real-world payroll is rarely a neat, monthly affair. People get bonuses, work fluctuating hours, or need to take statutory leave. These common variations can make calculating employer pension contributions feel like trying to hit a moving target.

For employees with variable pay – think weekly wages or commission-based roles – the trick is to assess their earnings in each specific pay period. Your auto-enrolment duties apply to that pay reference period, whether it’s weekly, fortnightly, or monthly.

This means you have to check if their earnings in that single period tip them over the relevant threshold. If someone is paid weekly, you assess that week's earnings against the weekly auto-enrolment trigger, not some annualised figure. It’s a granular approach, but it’s the only way to accurately capture contributions when pay can swing wildly from one payslip to the next.

Employees on maternity, paternity, or sick leave are another common scenario that can trip businesses up. When an employee receives payments like Statutory Maternity Pay (SMP) or Statutory Sick Pay (SSP), these count as qualifying earnings.

Here's the crucial part: your employer pension contributions must continue, calculated based on the employee's pre-leave salary, not the reduced statutory amount they're currently receiving.

The employee’s own contribution, however, is calculated based on the actual cash they get (e.g., their SMP). This often results in the employer paying a larger slice of the pension pie during these leave periods.

Let’s look at an example:

This rule is there for a very good reason: to protect an employee's pension pot during major life events.

A Crucial Point on Directors' Pay: Company directors often have unique pay structures, blending a small salary with larger dividend payments. You must remember that dividends are a return on investment, not salary. They are not considered qualifying earnings for pension calculations. Contributions are only ever based on their PAYE salary.

Beyond variable pay, a few other employee categories require a careful hand. Each situation has its own quirks that can throw your calculations off if you’re not prepared.

Getting these non-standard payroll situations right is about more than just ticking boxes. It protects you from penalties from The Pensions Regulator and, just as importantly, ensures every member of your team is treated fairly, no matter their working arrangements.

It’s all too easy to fixate on the 3% minimum employer contribution figure when thinking about workplace pensions. After all, that’s the legal floor for auto-enrolment in most private businesses. But if you think that number represents the whole story, you’re missing a huge piece of the puzzle. The gap between typical private sector contributions and those in the public sector isn't just a small step—it’s a chasm.

Getting your head around this contrast is essential, particularly if you’re a company bidding on public contracts or an employee thinking of switching between sectors. The financial realities and expectations are worlds apart.

The core of the difference lies in two fundamentally distinct types of pension schemes. Most private businesses offer defined contribution (DC) schemes. In a DC scheme, you and your employee both pay in, and the final retirement pot hinges on how those investments perform over time. The risk, for the most part, rests with the employee.

The public sector, however, largely runs on a defined benefit (DB) basis. You might know these as 'final salary' or 'career average' pensions. They promise a specific, guaranteed income for life in retirement, calculated based on the employee’s salary and how long they've worked there. With these schemes, the financial risk falls squarely on the employer (i.e., the government) to make sure there's enough money to pay out those promises, often for decades to come.

Key Insight: This fundamental structural difference is precisely why public sector contributions are so much higher. They aren't just building a pot of money; they are funding a guaranteed future liability that could last a lifetime.

The financial fallout from this difference is massive. While a private company might be paying the legal minimum of 3%, public sector bodies are contributing vastly more to underwrite their pension promises.

To put it into perspective, employer pension contributions for the Civil Service Pension Scheme can range anywhere from 26.6% to 30.3% of an employee's pensionable earnings. The NHS pension scheme isn't far behind, with similarly eye-watering rates. You can dig into the specifics by checking out the details on the Civil Service pension scheme website.

Let's break down just how different these worlds are.

This table clearly illustrates the gulf between the minimum legal requirement in the private sector and the typical rates needed to fund public sector schemes.

Pension Scheme TypeTypical Employer Contribution RateBasis of CalculationPrivate Sector (Auto-Enrolment)3% (Legal Minimum)Qualifying EarningsPublic Sector (e.g., NHS, Civil Service)20% - 30%+Pensionable Earnings

The numbers speak for themselves. The contributions aren't even in the same ballpark.

This enormous difference is exactly why you can't use 3% as a universal benchmark. The true cost of providing a pension depends heavily on the industry and the type of scheme you're running. For company directors mapping out their own remuneration strategy, it’s a crucial reminder that pension contributions are just one part of a much bigger financial plan. Balancing this with other forms of income, like dividends, is key to tax-efficient planning. You might find our guide on the UK dividend allowance helpful for seeing how it all fits together.

Getting your employer pension contributions right is a massive tick in the box, but it’s really only half the job. Now, you’ve got to stay on the right side of The Pensions Regulator (TPR) and build a strategy that won’t fall apart when rules inevitably change. Trust me, getting this wrong is not an option—you’re looking at hefty penalties and a hit to your reputation.

A huge part of this is simply keeping good records. It's not the most exciting task, but it’s a legal must. You need to keep a clear trail of how you’ve assessed your staff, the contributions you’ve paid, and every bit of communication you've sent about auto-enrolment. Hold onto these records for at least six years.

Timing is also everything. You must get your contributions over to the pension provider by the date laid out in your payment schedule. For most, that’s the 22nd day of the month after you made the deductions. Slipping up on payment dates is a massive red flag for the TPR and one of the most common triggers for enforcement action.

Beyond your day-to-day duties, a smart pension strategy means keeping one eye on the future. UK pension policy isn't set in stone; it’s constantly shifting to keep up with the economy and our changing population. If you ignore the writing on the wall, you could find your business blindsided by new costs down the line.

For example, there’s constant chatter about raising the minimum auto-enrolment contribution rates. Let's be honest, the current 8% total (split 3% from you, 5% from your employee) isn't seen by many as enough for a comfortable retirement.

The Pensions and Lifetime Savings Association (PLSA) has gone on record to recommend bumping up the total minimum contribution to 12% over the next decade. Their idea is to split the cost evenly between employers and employees. While it's just a proposal for now, it's a strong hint at where things are likely headed.

A change like that would have a direct impact on your payroll costs, so it’s only sensible to start thinking about it now.

So, how do you make sure your approach is built to last? It all starts by seeing the legal minimum for what it is: a starting line, not a finish line. When you proactively review your pension scheme, you can turn a tedious compliance task into a real strategic asset.

Here are a few things you can do right now:

It’s also vital to weave your pension management into your wider financial planning. For any small business, making sure all the financial gears—from payroll to pensions—are working together smoothly can be a game-changer. Good tax advice for small businesses will often highlight how these elements connect, affecting your cash flow and overall liabilities. By building a resilient strategy today, you’re setting yourself up to be compliant and competitive for years to come.

Even once you get the hang of calculating employer pension contributions, certain situations can pop up and leave you scratching your head. That's completely normal. Let's walk through some of the most common questions we get from business owners, so you can handle them with confidence.

An employee has the right to opt out of your pension scheme within one month of being enrolled. If they do, your immediate job is to stop their contributions and process a full refund of any money they’ve already paid in. This should be sorted out in your next payroll run.

It's critical to remember you must never encourage or pressure an employee to opt out. Doing so is a serious compliance breach with hefty penalties.

But your duties don't stop there. The law requires you to re-enrol any eligible staff who have previously opted out. This is known as cyclical re-enrolment, and you have to do it roughly every three years. It’s a way of giving employees who might have changed their minds a fresh chance to start saving. You must let them know you've re-enrolled them, and they'll get another one-month window to opt out again if they still want to.

A salary sacrifice scheme is an arrangement where an employee agrees to give up part of their salary. In return, you provide a non-cash benefit—in this case, a bigger employer pension contribution. It can be a real win-win.

For your calculations, the employee's contractual salary is now lower. This reduced salary becomes the new baseline for calculating National Insurance Contributions (NICs) for both of you, which often leads to some welcome savings. Your pension contribution is then paid from the company's funds, not as a deduction from their now-lower pay.

For example, say an employee earns £35,000 and agrees to sacrifice £1,000. Their new official salary becomes £34,000. You, as the employer, would then pay that sacrificed £1,000 directly into their pension. Your own 3% (or higher) contribution would then be calculated on the new £34,000 figure.

This isn't a casual agreement. It needs a formal change to the employee’s contract of employment and has to be managed carefully. You must ensure the new salary doesn't dip below the National Minimum Wage.

Absolutely! The 3% employer contribution required by auto-enrolment is just the legal floor, not a ceiling. You are completely free to contribute more, and many businesses do just that to attract and keep the best people.

Offering a more generous pension package—like 5%, 7%, or even a matched contribution scheme—can be a powerful tool in a competitive job market. It sends a strong signal that you're invested in your team's long-term financial security.

Before you commit, it’s wise to model the costs carefully. But don't forget to weigh them against the huge benefits a great pension scheme can bring to employee morale, loyalty, and your reputation as a first-class employer.

Navigating the maze of payroll, tax, and pensions can be a real headache for any business owner. At GenTax Accountants, we pair expert knowledge with smart technology to offer clear, fixed-price accounting that keeps your business compliant and financially sound. Discover how our dedicated accountants can simplify your finances today.