When you're a sole trader in the UK, "accounting" really just boils down to keeping a clear record of your business income and expenses. This all feeds into your annual Self Assessment tax return, which is how you report everything to HMRC and make sure you pay the right amount of Income Tax and National Insurance.

Taking the leap into self-employment is brilliant, but let's be honest, the financial side of things can feel a bit daunting at first. Think of this guide as your roadmap. We’re going to break down all the essential tasks, from setting up a simple record-keeping system to getting your tax return filed correctly, leaving you free to focus on what you do best: growing your business.

Try not to see your accounts as a chore. Instead, picture them as the control panel for your business. Good records tell you what’s working, where the money is actually going, and how you can plan for what's next. We'll walk you through understanding your tax duties and, just as importantly, claiming every single expense you're entitled to.

If you've chosen this path, you're in good company. As of early 2025, being a sole trader is still far and away the most popular business structure in the UK. We're talking about 3.2 million businesses, which makes up a whopping 57% of the total private sector. It's a structure that massively outnumbers limited companies and partnerships, showing just how many entrepreneurs value its simplicity.

The real goal here is to swap that feeling of financial confusion for confident control. Once you get to grips with the core principles of sole trader accounting, you’ll be able to make smarter business decisions and keep HMRC happy.

While this guide gives you a solid foundation, sometimes you just need tailored support. If that's the case, it might be worth seeing how our dedicated accountants for sole traders can step in and help you directly.

Getting a firm handle on your finances isn't just about ticking boxes; it brings some serious benefits:

Getting your business's finances in order right from the start isn't about wrestling with complicated spreadsheets or accounting theory. It’s about nailing a few simple, practical steps.

Think of it like building a house. You’d never dream of putting up walls on soft, unprepared ground, would you? Your business is no different. It needs a solid foundation to grow without wobbling, and that foundation is built on good financial habits.

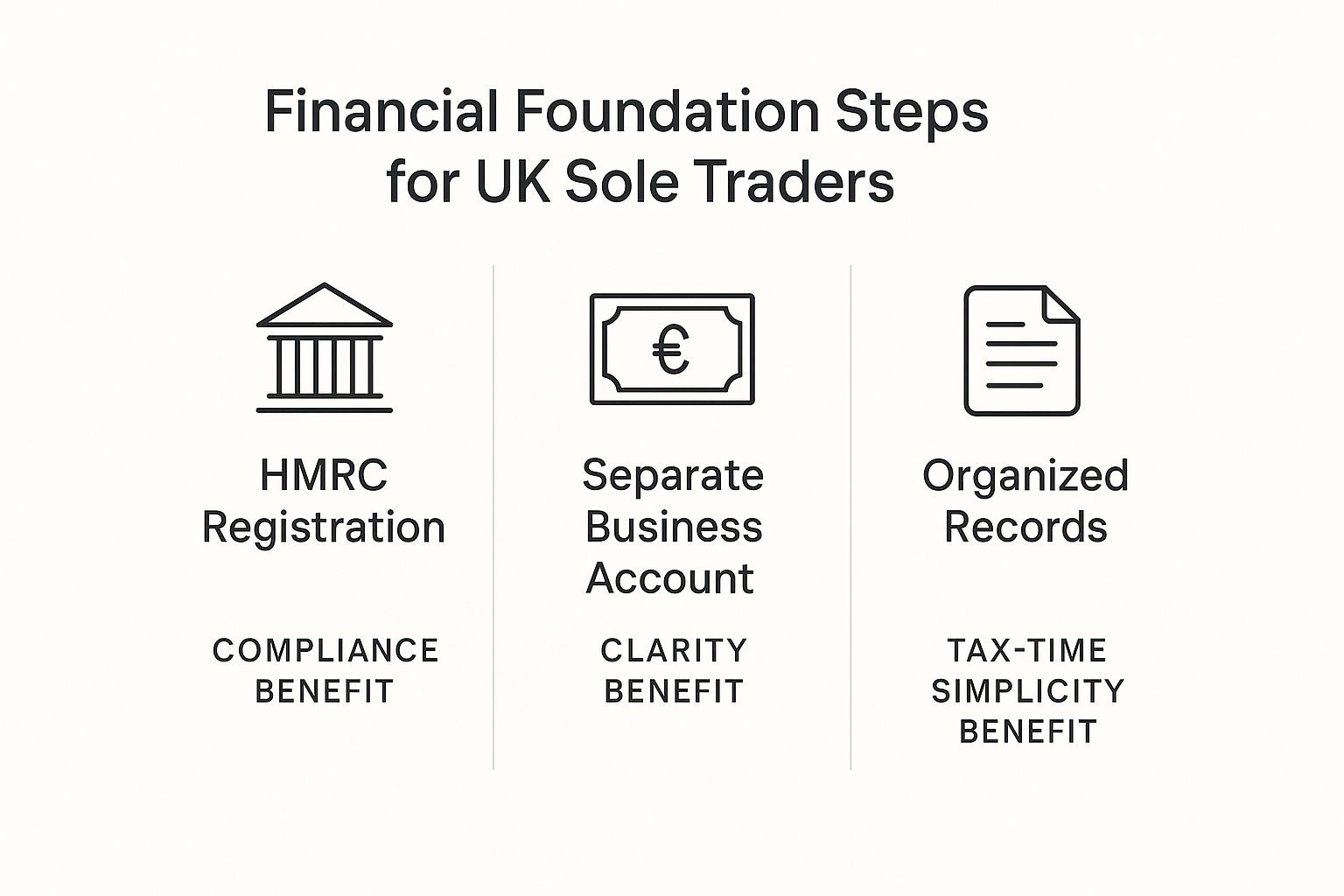

This means tackling three key jobs: registering as self-employed with HMRC, keeping your business and personal money separate, and keeping organised records from day one. Skipping these is like building on sand – things will get messy and unstable, fast.

Getting these basics right from the outset saves a world of headaches later. It keeps you on the right side of the law with HMRC, makes it easy to see how your business is actually doing, and turns your annual tax return from a frantic nightmare into a straightforward task.

So, let's break down these essential first steps. Each one plays a vital role in creating a strong financial structure for your sole trader business. Think of it this way: registration is your legal footing, separate accounts create a clear boundary, and organised records are the framework that holds everything up.

This infographic shows you exactly how these three pillars work together to support your business.

As you can see, each piece of the puzzle gives you a clear benefit – from staying compliant with HMRC, to getting a crystal-clear view of your finances, and finally, making tax time a breeze.

First up, you have to let HMRC know you're in business. It's a legal requirement to register as a sole trader if you've earned more than £1,000 from self-employment during a tax year (which runs from 6th April to 5th April). This £1,000 figure is your 'trading allowance'.

The deadline to register is the 5th of October in your business's second tax year. For example, if you start trading in June 2024 (the 2024-25 tax year), you have until 5th October 2025 to register. Don't miss it, as penalties can apply. It’s always best to get it done as soon as you start.

Registering gets you set up to pay tax through Self Assessment and sort out your Class 2 National Insurance contributions, which is what builds up your entitlement to the State Pension.

Now, this one isn't technically a legal must-have for sole traders, but trust me, it's one of the smartest moves you'll ever make. Trying to unpick your business income from your weekly shop and personal bills is a recipe for chaos.

A separate account brings instant clarity.

Getting an account set up is usually quick and painless. If you need a bit more guidance, have a look at our detailed advice on how to set up a business bank account. Seriously, this one step will save you a huge amount of time and stress down the line.

Finally, get into the habit of good record-keeping from the moment you make your first sale. This just means holding onto all your sales invoices, receipts for things you buy, and bank statements. Whether you use a simple spreadsheet or jump straight into accounting software, consistency is what matters.

And remember, good records aren't just for keeping HMRC happy – they're for you. They’re the only way to properly monitor your cash flow, understand what’s actually profitable, and make smart decisions about your business’s future. It’s the difference between guessing how you’re doing and knowing for sure.

Once you've got the basics sorted, you’re faced with a big decision: how are you going to track your money? This isn't just a tick-box exercise; it's about picking a system that truly reflects the way your business operates. For sole traders, it boils down to two main approaches: cash basis accounting and traditional (or accrual) accounting.

Think of it like this. Cash basis is like only logging a gym session on the day you actually go – it’s simple, immediate, and shows what you’ve done right now. Traditional accounting is more like logging the workout in your calendar the day you book it, giving you a better long-term view of your planned activity. Both get the job done, but one will almost certainly be a better fit for you.

Cash basis is the simpler of the two and, honestly, it's where most new sole traders start. The rule is beautifully straightforward: you record income when money hits your bank account, and you record expenses when money leaves it. Simple as that.

An invoice you’ve sent to a client doesn't count as income until they've actually paid you. By the same token, a bill from a supplier isn’t an expense until you physically transfer the cash to settle it. What you get is a real-time, no-nonsense picture of the cash you have on hand.

For freelancers, consultants, and small businesses with fairly straightforward transactions, this is often the most practical choice. It makes managing your cash flow feel intuitive because what you see in your books is exactly what's in your bank.

The greatest strength of cash basis is its simplicity. It’s a breeze to manage, cuts down on complex paperwork, and is fully approved by HMRC for any sole trader with an annual turnover below £150,000.

But that simplicity can also be its weakness. It doesn't give you a clear view of money you're owed or bills you have yet to pay, which can sometimes make long-term financial planning a bit tricky.

Traditional accounting, which you’ll often hear called accrual accounting, provides a much more complete financial picture. Under this method, you record income on the date you send the invoice, not when the payment arrives. Likewise, you log an expense on the date you receive the bill, not when you actually pay it.

This approach matches your income and expenses to the specific period they relate to. The result is a far truer picture of your business's actual profitability over, say, a month or a quarter, even if cash hasn't moved yet. If you manage large projects, hold stock, or deal with long payment terms, this method isn’t just helpful—it’s often essential.

So, which one is for you? The right answer depends entirely on the size and nature of your business. To make the decision a bit easier, let's put them side-by-side.

The table below breaks down the key differences to help you decide which accounting method aligns best with your business model.

Ultimately, choosing your accounting method is a foundational part of good financial management. If you’re just starting out, cash basis is probably the perfect, stress-free option. As your business grows, however, you might find the deeper insights from traditional accounting become too valuable to ignore.

If you're feeling stuck or just want to make sure you're starting on the right foot, exploring professional bookkeeping services for sole traders can give you the clarity and confidence you need.

This is where the magic really happens in sole trader accounting. If you want to know the single most effective way to shrink your tax bill, it's this: get to grips with your allowable expenses. Think of it less like a chore and more like a strategy for keeping more of your hard-earned cash.

So, what exactly is an allowable expense? It’s simply a cost you’ve paid out "wholly and exclusively" for your business. For every pound you claim as an expense, your taxable profit drops by a pound. That directly cuts the amount of Income Tax and National Insurance you'll owe.

Let's break this down. Instead of a long, boring list, we’ll group the most common expenses into logical categories and use real-world examples to show you how it works.

These are your bread-and-butter costs, the things you pay for just to keep the lights on and the business moving. It doesn't matter if you have a shiny office, a workshop, or just a corner of the kitchen table – plenty of these costs are tax-deductible.

For many sole traders, claiming for working from home is a big one. You can’t claim a slice of your mortgage payments, but you can claim a proportion of your household running costs, like council tax, heating, and electricity. You just need to calculate it fairly based on how much of your home you use for work, and for how long.

To save everyone a headache, HMRC created "simplified expenses." It's a flat-rate system that lets you sidestep all the fiddly calculations for things like home office and vehicle costs.

Instead of working out percentages of every utility bill, you can claim a flat monthly rate based on the hours you work from home. For instance, if you work between 51 and 100 hours a month from home, you can claim a flat £18 per month.

It’s quick and easy, no doubt. But be warned, it isn't always the most tax-efficient route. If your actual costs are higher than the flat rate, it's almost always worth doing the proper calculations to maximise what you claim back.

If you travel for work, you'll know these costs stack up fast. The good news is that most of them are allowable. This doesn’t cover your regular commute to a permanent workplace, but it absolutely covers trips to see clients, visit suppliers, or attend a conference.

Common travel expenses include:

Once again, simplified expenses can come to the rescue here. HMRC has a flat rate per business mile (45p for the first 10,000 miles in a car or van) that covers all your vehicle's running costs. Just keep a log of your business mileage, and you’re sorted.

The money you spend to find new customers and sharpen your skills is a legitimate business expense. After all, these are essential investments in your future growth.

You can claim for things like:

To really get your tax bill down, it pays to look beyond the obvious. Digging into the specifics of key freelancer tax deductions can uncover claims you might have missed. The golden rule through all of this? Keep meticulous records. Hold onto every receipt and invoice for every business purchase, no matter how small. It’s your proof if HMRC ever has questions, and your ticket to confidently claiming every penny you're entitled to.

For many sole traders, the annual Self Assessment tax return can feel like the final boss battle of the financial year. It’s the culmination of all your hard work and diligent record-keeping, but it honestly doesn't have to be that scary. Once you have a clear process, it becomes a simple case of reporting your finances to HMRC.

Think of it this way: you're just telling the story of your business's year in numbers. You've already done the tough bit by earning the income and tracking your expenses. Now, it's just a matter of putting those numbers into the right boxes so you can calculate and pay your Income Tax and National Insurance.

And you're in good company. The UK's self-employed workforce is massive and continues to grow, with projections hitting around 4.4 million people by mid-2025. That's a huge leap from just 3.2 million at the turn of the century, which shows just how many people successfully get this done every single year.

Before you dive into the HMRC portal, it’s really helpful to understand what you’re actually paying. Your final tax bill as a sole trader is mostly made up of two things, both calculated based on your business profits.

The good news is that these are calculated automatically when you fill out your return online. Your main job is to provide the accurate totals for your income and all your allowable expenses. The difference between those two figures is your taxable profit.

One of the biggest tripwires for new sole traders is Payments on Account. It’s a system HMRC uses to get you to pay next year's tax bill in advance, spreading the cost over two instalments.

Here’s how it works: If your tax bill for the year is over £1,000, HMRC basically assumes you'll earn a similar amount next year. They then ask you to pay half of this estimated future bill by 31st January and the other half by 31st July.

Important Takeaway: Your first big tax payment can be a real shock. You're paying the tax for the year that just ended plus the first payment for the upcoming year, all at once. Budgeting for this from day one is absolutely crucial to avoid a cash flow nightmare.

While the system is designed to stop you from facing one huge bill each year, it does require some careful financial planning right from the start.

Feeling ready to tackle it? Let's break the whole process down into a few manageable steps.

To stay on top of things and avoid any late penalties, get familiar with the key dates outlined in this guide to the UK Self-Employed Tax Return Deadline. It's also smart to look ahead; the tax system is changing. Get ahead of the curve by reading our guide on Making Tax Digital for Self Assessment to see what's coming.

Ditching the chaotic spreadsheets and the shoebox full of crumpled receipts is genuinely one of the best moves you can make for your business. Good accounting software isn't just a digital filing cabinet; it’s a tool that completely changes how you manage your finances, making the whole process of accounting for sole traders uk simpler and far more accurate.

Think of it like this: a spreadsheet is a push-bike. It’ll get you there eventually, but it’s slow, takes a lot of puff, and it's incredibly easy to take a wrong turn. Accounting software, on the other hand, is the car. It automates all the heavy lifting, saving you hours of tedious admin and giving you a clear view of the road ahead. This is even more critical with HMRC’s Making Tax Digital initiative looming.

The market is absolutely flooded with options, all promising to be the next best thing for your business. To cut through the noise, let’s focus on the features that offer real, tangible benefits for a sole trader.

The goal is to find a system that feels less like a chore and more like a helpful business partner—one that handles the boring stuff so you can get back to doing the work you love.

Not all sole traders are built the same. The right software for a freelance writer might be total overkill for a part-time dog walker. Let's look at a couple of common scenarios to see how different their needs can be.

Persona 1: The Part-Time Consultant

Imagine Sarah, a marketing consultant who works around 15 hours a week. Her business is straightforward: she has a few regular clients, sends a handful of invoices each month, and her expenses are mostly software subscriptions and home office costs.

For Sarah, a simple, low-cost solution is perfect. She just needs basic invoicing, a way to track her expenses, and a clean dashboard to see what's coming in and going out. She doesn't need fancy features like stock management or multi-currency support, so an entry-level plan from one of the main providers would be spot on.

Persona 2: The Skilled Tradesperson

Now think about David, a self-employed electrician. He’s out on jobs all day, buying materials from multiple suppliers and juggling several projects at once. He needs to track his mileage, snap photos of receipts from trade counters, and create detailed quotes and invoices right there on his phone.

David needs something more robust with a brilliant mobile app. On-the-go invoicing, instant receipt capture, and tools to track costs per project are essential for him. His software has to keep up with the fast, mobile nature of his work.

Making the right choice early on sets your business up for smooth, pain-free growth. For a deeper look at the top contenders, check out our guide on the best cloud accounting software for startups, which breaks them down to help you pick the perfect fit.

When you're diving into the world of accounting for sole traders uk, a few common questions always seem to pop up. Let's tackle them head-on with some quick, clear answers.

While HMRC won't chase you down for not having one, opening a separate business bank account is probably the single best bit of financial housekeeping you can do. Honestly, it's a game-changer.

It draws a clean line in the sand between your personal and business spending. This simple move makes bookkeeping a thousand times easier, saves you a world of pain when it's time to do your tax return, and gives you a crystal-clear audit trail if HMRC ever comes knocking.

Absolutely! Plenty of sole traders, especially when they're starting out or have a simple setup, manage their own books just fine.

With a bit of straightforward bookkeeping software and a good grasp of the basics (like which expenses you can claim and when your tax deadlines are), you can absolutely stay on top of your finances yourself. It’s all about staying organised and in control from day one.

A Quick Word on Record-Keeping: Just remember, HMRC expects you to keep all your business records—that’s bank statements, receipts, and invoices—for at least 5 years after the 31st January submission deadline for that tax year.

Missing the online Self Assessment deadline (which is usually 31st January) is something you really want to avoid. HMRC hits you with an instant £100 penalty the moment you're late.

And that applies even if you don't actually owe any tax. The penalties get steeper the longer you leave it, with more fines piling on after three, six, and twelve months. On top of all that, they'll charge interest on any tax you haven't paid. Filing on time is just plain good business sense.

At GenTax Accountants, we make complex accounting simple and stress-free. If you feel you need some expert support with your sole trader accounts, our friendly team is here to help. Find out more at https://www.gentax.uk.