Payroll accounting is the engine room of your financial reporting. It’s the process of logging every single penny related to employee pay—from wages and salaries to deductions and employer taxes—into your company's general ledger. Think of it as the crucial bridge connecting the day-to-day task of paying your staff with the high-level financial health of your business.

Payroll isn't just about sending money to your team; for most UK businesses, it’s one of the biggest expenses on the books. Good payroll accounting takes those raw payment figures and turns them into meaningful financial data. It tells the story behind the numbers, revealing exactly how your labour costs are affecting profitability and cash flow.

Without a solid accounting system for your payroll, your financial reports would be dangerously incomplete. You’d be flying blind, with no real grasp of your operational costs, making it impossible to budget properly or make smart strategic moves.

At its heart, payroll accounting makes sure your key financial statements, like the profit and loss and the balance sheet, give a true picture of your obligations to both your employees and HMRC. It brings order to the chaos of different pay rates, tax codes, and deductions, creating a clear, auditable trail.

Getting this right is vital for a few key reasons:

The sheer scale of payroll's impact on the UK economy is massive. As of September 2025, there were 30.3 million payrolled employees in the UK. And while that number saw a slight dip year-on-year, the median monthly pay actually grew by 5.5% to £2,546. This highlights the huge flow of money being managed through the nation's payroll systems.

Payroll accounting isn’t just an admin chore; it’s a fundamental business control. Nail it, and you protect your company from compliance risks, gain critical financial insight, and build a foundation for sustainable growth.

Letting this process slide can lead to serious headaches, from unhappy staff dealing with pay errors to significant fines from HMRC for incorrect tax filings. For many businesses, investing in expert payroll guidance right from the start is one of the smartest moves they can make.

Think of your payroll system as a finely tuned machine. You feed in the raw materials at one end—employee details, tax codes, hours worked—and out the other comes perfectly calculated payslips and accurate reports for HMRC. To really get a handle on accounting for payroll, you need to understand every cog in that machine.

It all starts with getting your information right. This isn't just about the basics like an employee's name, address, and National Insurance number. It also includes the variable data for each pay run, like timesheets, overtime hours, commissions, or any bonuses. A single typo here can throw everything else out of whack, so accuracy from the get-go is non-negotiable.

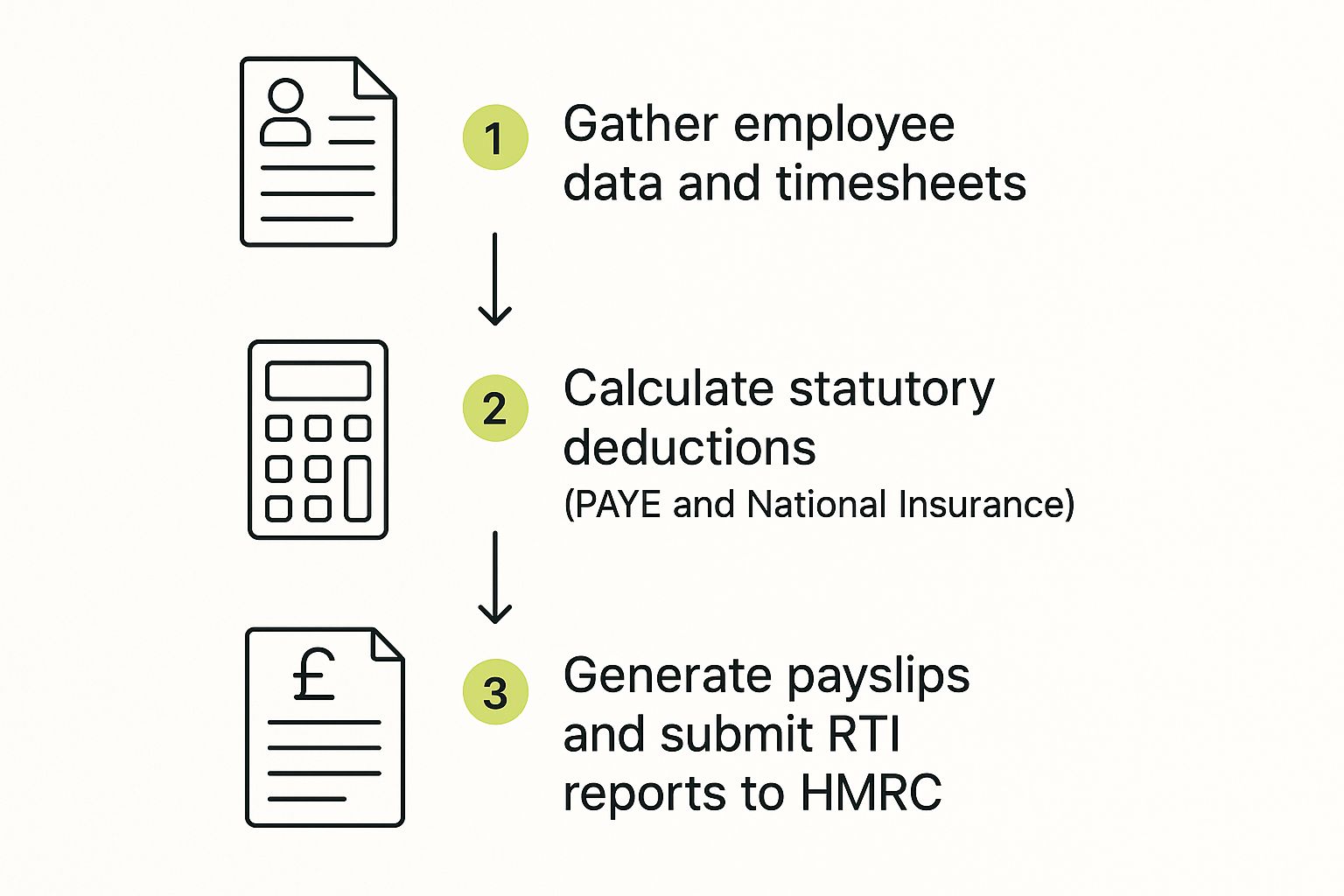

This quick infographic breaks down the basic flow of a typical UK payroll process.

As you can see, it's a logical cycle: collect the data, run the numbers, and then report. This cycle repeats itself every single time you pay your team.

Once you've worked out an employee's gross pay, the next big step is to calculate and withhold all the legally required deductions. These aren't optional—they're your core responsibilities as a UK employer.

To help you get your head around the common deductions and contributions, here’s a quick summary of what you'll be dealing with.

Each of these elements must be calculated with precision. Getting it wrong doesn't just create headaches; it can lead to serious compliance issues with HMRC.

While payroll rules are set at a national level, it's interesting to see how their effects differ across the UK. Real-time data from PAYE often tells a story about regional employment trends. For instance, between August 2024 and August 2025, Northern Ireland saw a 0.4% rise in payrolled employees, while London saw a 0.8% decrease.

These figures show just how much local economic conditions can vary, a crucial insight for any business with a presence in multiple UK locations. For a closer look, you can dig into the full government report on these trends.

Your payroll system isn't just a calculator; it's a compliance machine. Every calculation, from PAYE tax to student loan deductions, must be exact to fulfil your legal duties to both your employees and HMRC.

With all the calculations done, the final pieces of the puzzle are communication and reporting. By law, you must give every employee a detailed payslip on or before their payday. This document needs to clearly break down their gross pay, list every single deduction, and show the final net pay hitting their bank account.

At the same time, you have to send all this information to HMRC. This is done through their Real Time Information (RTI) system, usually via a Full Payment Submission (FPS). This keeps HMRC in the loop with your payroll activity for every pay period. Good software makes this part a breeze; for a deeper look at your options, you might find our guide to the best cloud accounting software for startups useful.

This is where the theory of payroll accounting gets real. When you run payroll, you need to translate every salary, tax, and deduction into the language of debits and credits. This happens in your company's general ledger, and while it might sound a bit daunting, it’s a perfectly logical process that keeps your financial records balanced.

Think of the general ledger as the official financial diary for your business. Every time money moves or you take on a financial obligation, it gets an entry. For payroll, we need to log two key things: the expense of paying your staff, and the liabilities you've just created to your employees and HMRC.

To make this crystal clear, let’s walk through a simple, real-world example. Imagine a small UK business, "Creative Widgets Ltd.," with one employee, Jane. Her gross pay for the month is £3,000.

The first entry is the big one. It captures the entire cost of payroll before any cash actually leaves your bank account. The goal here is to recognise the expense you've incurred and create the liabilities (i.e., the debts) you now owe.

Here are the key figures for Jane's £3,000 gross monthly pay:

So, the net pay Jane will actually receive is:

£3,000 (Gross) - £300 (PAYE) - £180 (NI) - £120 (Pension) = £2,400

Now, let's turn this into a journal entry. We debit the expense accounts (to increase them) and credit the liability accounts (to show we owe money).

This one entry tells the whole story. The business has a £3,000 wage expense, and it now owes £2,400 to Jane, a total of £480 to HMRC (for PAYE and NI), and £120 to the pension provider. See how it all balances?

But that's just the employee's side of things. As a UK employer, you have your own costs to account for—namely, the Employer's National Insurance contributions. This is a separate business expense and isn't deducted from Jane's pay.

Let's say Creative Widgets Ltd. owes £250 in Employer's NI for Jane's salary. That needs its own journal entry.

This entry adds £250 to the company's expenses and also increases what’s owed to HMRC in the "Payroll Liabilities: NI" account. The total NI liability now stands at £430 (£180 from Jane + £250 from the company).

A common mistake is to lump Employer's NI in with gross wages. By recording it as a separate expense, you get a much clearer picture of your true employment costs, which are always higher than just the salary you offer.

The final step is to clear these liabilities by making the actual payments. This means creating journal entries that show cash leaving your bank account. These entries zero out your liabilities and reduce your cash balance, keeping the books in perfect harmony.

First up, paying Jane her net salary.

Next, we pay HMRC. The total owed is £300 (PAYE) + £180 (Employee NI) + £250 (Employer NI) = £730.

And finally, we pay the pension scheme provider.

Once these three payments are recorded, all the liability accounts we created (Salaries Payable, Payroll Liabilities, and Pension Payable) go back to a zero balance, ready for the next pay run. Your cash account has dropped by the total outflow, and your expenses are correctly recorded on your profit and loss statement.

This step-by-step process is the backbone of accurate financial reporting. While modern software does most of the heavy lifting, understanding the flow of debits and credits is crucial for spotting problems and staying in control of your finances. If you need hands-on support with this, our professional bookkeeping services can bring the clarity and accuracy your business deserves.

Once you’ve calculated your payroll and posted the journal entries, you’ve hit the next major milestone: reporting everything to His Majesty's Revenue and Customs (HMRC). This isn't just about good bookkeeping; it’s a legal minefield. Getting it wrong can trigger automatic penalties that stack up faster than you’d think. In truth, solid accounting for payroll is as much about nailing compliance as it is about getting the numbers right.

The whole system of modern UK payroll reporting is built around Real Time Information (RTI). Just like the name suggests, it means you have to report your payroll data to HMRC every single time you pay your team. No exceptions. This gives the taxman a live, up-to-the-minute view of employment and tax liabilities across the country.

Your main tool for this is the Full Payment Submission (FPS). This is a digital report your payroll software spits out, detailing every employee's pay and deductions for that specific pay period. Think of it as the official summary of your payroll run that goes straight to HMRC.

Legally, you must send your FPS to HMRC on or before your employees' payday. Submitting it late is a red flag and can lead to penalties, so this step needs to be baked into your core payroll process. Honestly, missing these deadlines is one of the most common—and completely avoidable—payroll mistakes a business can make.

HMRC's RTI system is designed to stop tax and National Insurance errors from snowballing over the tax year. By making businesses report in real-time, any discrepancies can be flagged and sorted out much faster, making sure both you and your employees are paying the right amount.

This strict schedule means your internal accounting has to be watertight. Any slip-ups in your payroll calculations will show up directly in your FPS, potentially creating compliance headaches down the road.

Staying on HMRC’s good side is about more than just sending the FPS on time. There are several other critical deadlines and duties you need to juggle throughout the tax year.

Here are the non-negotiables every UK employer has to get right:

For some businesses, compliance goes beyond the standard payroll run. If you engage contractors, for example, you need to get your head around tricky regulations like the updated HMRC Off-Payroll Rules (IR35) to make sure you're not misclassifying people and landing yourself in hot water.

Likewise, managing auto-enrolment pensions adds another layer of responsibility. If you need a hand with the specifics, our guide on how to calculate employer pension contributions breaks it down. Getting these complex rules right is a vital part of building a payroll system that truly works.

Think of payroll reconciliation as the final quality check for your accounts. It’s where you meticulously confirm that the numbers in your payroll software perfectly match what’s in your general ledger and, most importantly, the actual cash that left your bank account.

Without this crucial step, your accounting for payroll is basically flying blind, leaving you open to all sorts of hidden errors. It's not just some optional admin task; it’s a fundamental control that protects the financial integrity of your business. Regular reconciliation acts as a safety net, catching common but costly mistakes before they spiral into bigger headaches.

A small discrepancy might seem harmless, but over time, these little errors can snowball. They can lead to inaccurate financial statements, incorrect payments to HMRC, and frustrated employees—all of which can damage your business’s credibility and financial health. The goal is to verify every single pound.

The process helps you answer three critical questions with confidence:

Mistakes can and do happen. A key part of this process is understanding and addressing payroll overpayments, which is essential for keeping your finances in order.

Payroll reconciliation is your monthly financial health check. It proves that what you thought you paid matches what you actually paid, ensuring your books are a true and accurate reflection of reality.

Doing this check monthly is absolutely best practice. It keeps the task manageable and ensures errors are caught almost as soon as they happen.

Here’s a straightforward checklist to guide you through it each month:

This systematic approach turns what could be a daunting task into a routine check, giving you real confidence in your financial data. As your company grows, mastering this is key, though many businesses find that dedicated payroll services for small businesses in the UK offer expert support and complete peace of mind.

Once you’ve got a compliant payroll accounting system up and running, the next step is to make it faster, smarter, and more secure. This is about moving beyond simple data entry and actively managing the process. When you get it right, payroll stops being a repetitive chore and becomes a strategic asset that minimises risk, saves huge amounts of time, and makes sure your team is always paid correctly.

Think of these strategies as building a robust process that grows with your business. The goal is a system that’s not just accurate, but also resilient and efficient, freeing you up to focus on running the business instead of getting tangled up in admin.

One of the single most effective changes you can make is to use payroll and accounting software that are integrated. When your payroll system can speak directly to your general ledger, the whole journal entry process happens automatically. This simple connection wipes out the risk of manual data entry errors – a classic culprit behind accounting headaches.

This integration also gives you a live, real-time picture of your labour costs and tax liabilities. Instead of waiting until the end of the month to see the financial impact of your payroll run, you know exactly where you stand, right now. It allows for much sharper cash flow planning and more agile financial decisions, with the software handling all the tricky calculations instantly.

Consistency is the absolute bedrock of efficient accounting for payroll. A documented payroll calendar, shared with all your managers and employees, is a surprisingly powerful tool for setting clear expectations and deadlines for everyone.

Your calendar should lock in the key dates for:

Having this structure prevents those last-minute scrambles and ensures you have enough breathing room to sort out any issues without sacrificing accuracy.

A payroll calendar isn’t just about scheduling; it's a commitment to a predictable and reliable process. It builds trust with your team and ensures compliance deadlines are never an afterthought.

Payroll data is some of the most sensitive information your company holds. Looking after it isn’t just good practice; it's a legal obligation under GDPR. You need to have strict access controls in place so that only authorised people can view or change payroll details.

Criminals are increasingly targeting HR and payroll systems to try and divert salary payments, which makes ongoing training for your staff absolutely essential. Regular updates on security best practices, how to spot phishing attempts, and the correct way to handle employee data can dramatically lower the risk of a costly and damaging data breach. Investing in your team’s knowledge is a direct investment in your company’s security.

When you're running a business, payroll accounting can throw up some tricky questions. Getting your head around the specifics is non-negotiable for staying compliant and keeping your books in good nick. Think of this section as a quick-fire Q&A, tackling the common hurdles business owners face every day.

Getting these things right from the start means small queries won’t spiral into major compliance headaches or messy accounting errors down the line. Let’s clear up a few of the big ones.

The short answer? Every single month. No exceptions. This is one of the most critical habits you can build in your business. Think of it like balancing your personal bank account – you wouldn't just leave it for a year and hope for the best, would you? A monthly reconciliation ensures that what your payroll software says, what your general ledger shows, and what’s actually happened in your bank account all line up perfectly.

Sticking to a monthly routine is vital because it stops tiny errors from snowballing. A simple typo in February's payroll run could morph into a massive headache by December if it’s left to fester. Regular checks keep your financial reports clean and give you peace of mind that your numbers are spot on.

This is the absolute bedrock of accounting for payroll, and mixing them up is a fast track to incorrect bookkeeping. It's simple when you break it down:

Gross Pay: This is the full whack. It's an employee's total earnings before a single penny has been taken off. It includes their basic salary, of course, but also any extras like overtime, bonuses, or commissions. For your accounts, gross pay is the total cost of that employee's labour, and it’s the figure you’ll record as a business expense.

Net Pay: This is the "take-home" pay. It’s the amount that actually lands in your employee's bank account after all the deductions have been made. We're talking about things like PAYE tax, National Insurance, student loan repayments, and pension contributions.

Your accounting system has to track both figures meticulously. The gross amount hits your profit and loss as an expense, while all those deductions become liabilities on your balance sheet – money you owe to HMRC and others.

At its heart, payroll is simply the journey from gross to net pay. Your journal entries need to tell that story perfectly, booking the full expense first, and then showing how it was split between what the employee received and what you owe to the authorities.

Don't panic. Realising you've sent a Full Payment Submission (FPS) to HMRC with an error on it can be a stressful moment, but it’s almost always fixable if you act fast. The worst thing you can do is ignore it.

For most errors you spot within the current tax year, the standard fix is to correct the details in your payroll software. Then, in your very next payroll run, you simply send an updated FPS with the correct year-to-date figures. For bigger mistakes or anything from a previous tax year, you might need to use a specific correction form. The key is to act quickly to stay on the right side of HMRC and avoid any potential penalties.

At GenTax Accountants, we turn complex payroll and accounting challenges into clear, manageable processes. If you're ready to ensure your payroll is always accurate, compliant, and efficient, explore our expert services at https://www.gentax.uk.