When you’re self-employed, ‘accounting services’ can sound a bit formal, maybe even a little intimidating or expensive. But what are they, really?

Let's cut through the jargon. For a sole trader, accounting services are less about corporate finance and more about having a financial co-pilot for your business.

Think of it like the dashboard in your car. Without it, you’re basically driving blind. You wouldn’t know your speed, how much fuel you have left, or if an engine warning light is about to flash. A good accountant provides that same clarity, showing you exactly where your money is going so you can make smart, confident decisions to keep your business moving forward.

It’s easy to feel like you’re on your own when running a business, but you're part of a huge community. In the UK, there are roughly 3.0–3.2 million sole proprietorships, making up about 57% of the entire private-sector business population. That’s a massive number of people who need straightforward, no-nonsense accounting support. If you're interested, the government publishes business population estimates for 2025 with all the details.

At its heart, sole trader accounting boils down to a few essential jobs designed to keep your business financially healthy and on the right side of HMRC. These aren’t complex theories; they're the practical tasks every business owner needs to get right.

The main components usually include:

One of the biggest myths is that you only need an accountant at tax time. The reality? A great accountant is a year-round advisor. They help you plan for big expenses, understand your profit margins, and spot potential financial issues long before they become serious problems.

Modern, tech-focused accounting isn’t a chore; it’s a tool. It takes the tedious, manual tasks off your plate and gives you a real-time view of your finances, freeing you up to focus on what you actually enjoy—running your business.

When you start looking for sole trader accounting services, you’re really searching for a specific set of skills to keep the financial engine of your business running smoothly. These aren’t just dull admin tasks; they are the pillars that keep you compliant, profitable, and ready for whatever comes next.

Trying to run a business without getting these right is like building a house without a blueprint. Sure, you might get the walls up, but the structure will be shaky, and you’ll inevitably hit serious snags down the line. A good accountant provides that essential blueprint, making sure every part of your financial structure is solid.

To give you a clearer picture, here’s a quick rundown of the essential services every sole trader needs.

This table breaks down the essential accounting tasks for a UK sole trader, explaining what each one involves and its primary purpose for your business.

Now you've seen the overview, let's dive into what each of these really means for your business.

Bookkeeping is the absolute foundation of your business finances. It’s the simple act of recording every single financial transaction—every sale you make, every supplier invoice you pay, and every receipt for a pack of pens.

Think of it like a fitness tracker for your business. It provides live data on your financial health, showing you exactly where your money is coming from and where it's going. Without it, you’re just guessing. Good bookkeeping gives you the clarity to spot problems early and truly understand how your business is performing day-to-day. If you'd like to see how we turn this daily data into powerful insights, check out our professional sole trader bookkeeping services.

Your Self Assessment tax return is your annual report card to HMRC. It’s a legal must-do where you declare your income and work out the tax you owe. For most sole traders, this is easily the most stressful financial job of the year.

An accountant turns this task from a frantic hunt for crumpled receipts into a calm, organised process. They make sure your return is accurate, filed on time, and—most importantly—that you claim every single expense you're entitled to. This isn't just about ticking a box for HMRC; it’s about making sure you don't pay a penny more in tax than you legally have to.

Key Takeaway: A great accountant doesn’t just fill in the boxes. They actively hunt for ways to lower your tax bill by ensuring no legitimate expense is missed.

A huge part of this is identifying key tax deductions for freelancers, which is where professional expertise can save you a serious amount of money.

Value Added Tax (VAT) is something you need to get to grips with once your business's taxable turnover hits the government's threshold. Once you cross that line, you have to register for VAT, start charging it on your sales, and file regular VAT returns with HMRC.

This adds a whole new layer of complexity to your finances. An accountant will tell you exactly when you need to register, handle the paperwork for you, and manage your ongoing VAT filings. They'll help you navigate the tricky VAT rules and avoid the very steep penalties that come with getting it wrong.

While year-end accounts aren't a strict legal requirement for sole traders like they are for limited companies, preparing them is an incredibly smart move. These accounts pull together all your bookkeeping records into a clear profit and loss statement, giving you a comprehensive summary of your financial performance for the entire year.

It’s the ultimate "big picture" view, showing you exactly how successful you’ve been and where your business stands financially.

Forget the dusty old image of accountants buried under mountains of paper and shoeboxes stuffed with receipts. Modern sole trader accounting has had a serious upgrade, powered by clever, easy-to-use tech that saves you time, slashes errors, and gives you a crystal-clear picture of your finances.

Think of it this way. Old-school accounting was like developing film from a camera—a slow, manual slog where you only saw the results long after the moment had passed. Today’s approach is like your smartphone camera: the picture is instant, sharp, and ready to go.

This isn't just about convenience; it's a complete overhaul of how you manage your business's money. It’s a big reason why the UK's £6.8 billion accounting market is seeing a huge demand for tech-savvy providers, especially from sole traders who need every bit of efficiency they can get.

The real game-changer here is automation. Modern accounting software plugs directly into your business bank account, automatically pulling in every transaction through a secure bank feed. This one feature alone pretty much wipes out the soul-destroying task of manually typing in every single sale and expense.

That means you can wave goodbye to hours spent hunched over a spreadsheet. Instead of drowning in data entry, your time is freed up for what actually matters—growing your business.

Key bits of automation you'll love:

The whole point of modern accounting tech isn't to replace your accountant. It's to take care of the boring, repetitive jobs so your accountant can focus on giving you smart, strategic advice that helps you make more money.

Because all your financial data is captured automatically and instantly, you get a live, up-to-the-minute view of your business's health. You no longer have to wait weeks or even months for your accounts to be updated just to find out if you're making a profit.

With just a few clicks, you can see your cash flow, check your profitability, and see exactly who owes you money. This lets you make quick, confident decisions based on actual data, not just guesswork. Getting your head around the options is the first step, and our guide on the best cloud accounting software for startups is a great place to see what tools are out there.

This kind of real-time insight is the power that modern sole trader accounting services put right at your fingertips.

One of the first, and biggest, questions sole traders ask when they think about getting professional help is simple: "What's this actually going to cost me?"

Getting your head around how accountants charge for their time is crucial. It helps you budget properly and find someone who’s a good fit for your business. Generally, you’ll come across two main ways they price their services.

The old-school method is the hourly rate. You pay for every single minute an accountant spends on your work – from doing your tax return to firing off a quick email. While it sounds fair on the surface, this model can lead to some seriously unpredictable costs. One complicated question or an unexpected problem from HMRC can send the billable hours soaring, leaving you with a nasty surprise in your inbox.

That uncertainty can also make you hesitant to ask for help in the first place. When you know the meter is running every time you pick up the phone, you might put off asking those small but important questions. That completely defeats the point of having an expert in your corner.

Because of these issues, most modern firms have moved over to fixed-fee pricing. It’s a much clearer, more predictable way of working. You pay a single, agreed-upon monthly fee that covers a specific list of sole trader accounting services – things like bookkeeping, VAT returns, and your annual Self Assessment.

Think of it like the difference between a pay-as-you-go mobile plan and an all-inclusive monthly contract.

A fixed-fee model isn’t just about predictable costs; it’s about building a better relationship. When you’re not worried about billable hours, you’re more likely to treat your accountant as a true partner, asking for the advice that can actually help your business grow.

This approach means communication stays open. It allows your accountant to be proactive and offer support throughout the year, not just when your tax deadline is looming. For a sole trader, having that financial clarity and expert guidance on tap – without the fear of a spiralling bill – is invaluable.

Picking the right accountant is one of the most important calls you’ll make for your business. This isn’t just about finding someone to tick the boxes on your tax return; it’s about bringing a financial co-pilot on board who genuinely gets your journey as a sole trader and wants to see you succeed.

Get it wrong, and you could be looking at missed deadlines, overpaid tax, and a whole lot of unnecessary stress. But get it right? That means peace of mind, freeing you up to focus on what you actually love doing. To help you make a confident decision, let’s look at the green flags to watch for and the red flags to avoid.

Your search for the perfect sole trader accounting services should start with a few non-negotiables. First off, find an accountant with real, provable experience working with businesses like yours. A specialist who knows the common headaches faced by contractors, freelancers, and other sole traders is worth their weight in gold. If you want to see what that kind of tailored support looks like, you can learn more about our dedicated accounting services for sole traders.

Next, always insist on transparent, fixed-fee pricing. You should never feel anxious about picking up the phone or sending an email because you’re worried about a surprise bill. A clear monthly fee means you can budget properly and build a strong, open relationship with your advisor. Lastly, make sure they’re fluent in modern cloud accounting software like Xero or FreeAgent. A tech-savvy accountant will save you countless hours of admin.

A great accountant won't just report on what happened last year; they'll use real-time financial data to help you plan for the year ahead. They should feel like a proactive member of your team, not just a once-a-year compliance checker.

Knowing what to look for is only half the battle; you also need to know what to run away from. Be very wary of any accountant who is vague about their pricing. If they can’t give you a clear, upfront cost, it's a massive red flag that probably means unexpected bills are heading your way.

Slow or patchy communication is another big one. Your accountant should be a responsive partner you can count on. If they take days to reply to a simple email when you're just enquiring, imagine how it will feel when you have an urgent question from HMRC.

Finally, a resistance to technology should set alarm bells ringing. An accountant still clinging to paper ledgers or complicated spreadsheets just isn't equipped to give your business the efficient, real-time service it needs to thrive. When you're making your choice, understanding the basics of their profession, like those covered in a guide on how to start an accounting firm, can offer clues about their operational structure and whether their approach is actually fit for a modern business.

To make it even clearer, we’ve put together a quick checklist to help you weigh up your options.

Choosing an accountant is about finding a long-term partner for your business journey. Use this checklist to filter out the noise and find someone who will genuinely help you grow.

Missing an HMRC deadline is one of the most stressful—and easily avoidable—mistakes a sole trader can make. It’s not just the immediate financial penalty; it’s the worry and administrative headache that follows. Think of your compliance calendar as a simple roadmap for the year. Knowing the key stops prevents you from taking a wrong turn and getting lost in paperwork.

This is where having a professional in your corner really pays off. An accountant providing sole trader accounting services doesn’t just file your taxes; they manage this entire timeline for you. They give you advance notice, help get all your information ready, and make sure submissions are made well ahead of time. It transforms compliance from a source of anxiety into a background task that just gets done.

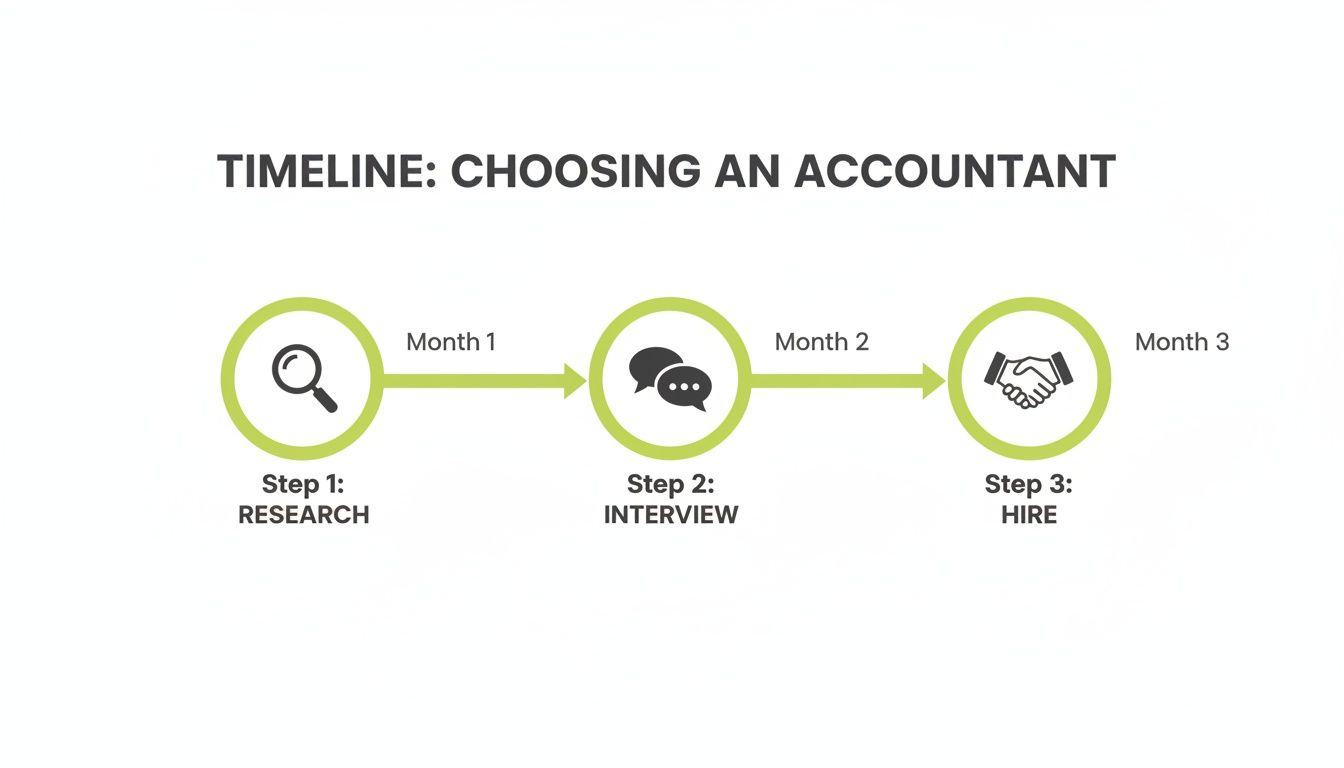

This timeline shows that finding the right accountant is a structured process, not a rushed decision, giving you time to research, interview, and onboard a partner who truly understands your business.

It’s about taking a measured approach to find someone who fits, so you can hand over the financial admin with complete confidence.

Forgetting a key date can be costly. HMRC issues automatic penalties for late filing and charges interest on overdue tax. While your accountant will keep you on the straight and narrow, it’s vital to have a grip on the core deadlines that affect your business.

Here are the key dates every sole trader must know:

It's important to remember that these dates are the absolute final cut-off points. A good accountant works months ahead to prevent any last-minute rush, ensuring your records are organised and your tax liabilities are clear well in advance.

As regulations evolve, staying compliant is only becoming more complex. Our guide to Making Tax Digital for Self Assessment explains the upcoming changes you need to be aware of.

Jumping into the world of self-employment always brings up a few practical questions, especially around the money side of things. Here are some of the most common queries we hear from sole traders who are thinking about getting professional help for the first time.

While there's no law forcing you to have a separate bank account as a sole trader, it's one of the best things you can do for your business—and your sanity.

Mixing your business and personal spending creates a massive bookkeeping headache. It makes it incredibly difficult to accurately track what you've spent on the business and, crucially, calculate your taxable profit. A separate account provides a clean financial trail, which makes filling out your Self Assessment a whole lot simpler. It’s a small step that makes a huge difference.

Of course. Many sole traders handle their own books when they're just starting out. But as your business grows, you'll quickly find that the hours spent hunched over spreadsheets start to really eat into your productive time.

An accountant doesn't just save you time; they bring expertise to the table. They know exactly which expenses you can claim and how to keep you compliant with HMRC. Their advice often ends up saving you more money in tax than their fee costs, especially when it's time to prepare your annual self-assessment tax returns.

Think of it this way: You're the expert at what you do. An accountant is an expert at managing finances and tax. Using their skills frees you up to focus on yours.

There isn't a magic number, but a common trigger is when the admin just starts to feel like too much. Another is when you're approaching a key milestone, like hitting the VAT registration threshold.

If you find yourself spending more time wrestling with receipts and spreadsheets than you do on your actual work, that's a pretty strong sign. It's the point where getting professional help stops being a cost and becomes an investment in your business's growth.

Ready to get clarity on your finances and win back your time? At GenTax Accountants, we offer fixed-fee accounting packages designed specifically for sole traders. Get your instant quote today.