Let's be blunt: small business cash flow management is all about tracking, analysing, and fine-tuning the money moving into and out of your company. This isn't about profit. It’s about having the actual cash on hand to pay your bills.

Getting this right is the single most critical factor for survival and growth.

Think of cash as the oxygen for your business. Profit is a brilliant long-term goal, but you can’t get there if you can’t breathe. A business can look fantastic on paper—plenty of signed contracts and a stack of unpaid invoices—but still go under because it lacks the physical cash to keep the lights on.

That’s the fundamental challenge of small business cash flow management. It’s about making sure there's always enough money in the bank to handle today's needs and to plan for what's coming next.

When your cash flow is healthy, your business doesn't just survive; it thrives. You can confidently:

This isn’t just an accounting chore; it's the very pulse of your company. A recent QuickBooks survey highlighted that almost half (47%) of UK small and medium-sized businesses are grappling with significant cash flow issues, and 57% expect their operational costs to keep rising. As you can imagine, this puts a serious brake on their growth potential. You can dig into the full survey findings on rising SME costs over at Accountancy Age.

Cash flow management gives you financial clarity. It turns that vague, nagging financial stress into a clear, actionable roadmap. You can see exactly where your money is going and spot potential shortfalls long before they become emergencies.

Ignoring your cash flow is like setting sail without a navigator. You might have a powerful engine (your product or service) and a great destination in mind (profitability), but you'll almost certainly run aground on completely predictable obstacles.

Proactive management is your best defence against economic bumps in the road. It lets you anticipate challenges like late-paying clients or seasonal lulls and prepare for them. For many businesses, using the best cloud accounting software for startups is the key to gaining the visibility they need to stay ahead of the curve.

This guide is designed to move beyond theory. We’re going to give you a clear plan to monitor, analyse, and improve your cash position, turning it from a source of anxiety into a powerful tool for strategic growth. Let’s get started.

Your cash flow statement tells a story, but it can feel like it’s written in another language. The trick is to stop thinking of it as a spreadsheet and see it more like a special kind of bank statement. It has three distinct chapters that spell out exactly where your money came from and where it went. Getting to grips with small business cash flow management starts with learning how to read this story.

Let's break it down. Your cash flow statement is neatly organised into three core activities. Understanding what each one represents is the key to seeing the full financial picture.

This is the main plot of your business's story. Operating activities cover all the cash that flows in and out from your primary business operations—the day-to-day stuff you do to make money. If you run a coffee shop, this is the cash from selling lattes and pastries, minus what you paid for milk, beans, rent, and your team's wages.

A positive number here is a brilliant sign. It means your core business model is working, bringing in more cash than it's spending. If this figure is consistently negative, it’s a red flag that your fundamental operations are costing you more than they bring in.

This chapter is all about the big-ticket items. Investing activities track the buying and selling of long-term assets—things that will help your business run for years. We’re not talking about your daily stock; we’re talking about the foundational pieces.

Don't panic if you see a negative number here. It often just means you're reinvesting in the business by purchasing equipment or property to fuel future growth. On the flip side, a large positive number might mean you’re selling off assets to raise cash, which could signal trouble.

Think of it like this: Operating cash flow is your monthly salary. Investing cash flow is when you sell your old car or buy a new one. Both are crucial parts of your financial story, but they tell you very different things about your financial health.

The final chapter deals with how you fund the business outside of its own sales. Financing activities include any cash transactions with owners and lenders. This is where you’ll see the movement of money from taking out loans, repaying debt, or an owner putting their own funds into the business.

For instance, if you get a business loan to expand your coffee shop, that injection of cash shows up here. Likewise, when you make your monthly loan repayments, the money leaving your account is recorded as a financing activity. This section reveals how you're using external money to support the business, which is a vital piece of your overall cash flow management puzzle.

Getting your head around a cash flow statement is a great start, but the real test comes when you face the challenges that mess it all up. Even the most solid business plan can get knocked sideways by a few common, yet powerful, financial hurdles. Good small business cash flow management is all about spotting these tripwires before they send you sprawling.

For countless small businesses, the single biggest cash flow killer is late payments from customers. When an invoice goes unpaid, it’s not just an admin headache; it’s a bottleneck that can set off a seriously damaging chain reaction.

Think of it like a line of dominoes. The first domino is your client's unpaid invoice. When it doesn't fall on time, it stops you from knocking over the next one – paying your own suppliers. That delay then stops you from paying your team, which is the next domino down the line. All of a sudden, one late payment has created a cascade of financial trouble and damaged your reputation.

This isn't just a hypothetical problem. Research from Intuit QuickBooks revealed that in the UK, one in seven small business owners has been forced to pay their own employees late because of cash flow problems. This staggering figure affects as many as 2.2 million workers and causes business owners to lose an average of £26,000 in potential earnings while they're busy chasing money instead of growing their business.

Being unable to meet payroll is one of the most severe consequences imaginable. It's a critical responsibility you can't afford to get wrong, which is why exploring dedicated payroll services for small businesses in the UK can provide the stability needed to ensure that particular domino never even wobbles.

Of course, it’s not just about late payments. There are plenty of other obstacles that can crop up. Recognising them is the first step toward building your defences.

Several other factors consistently put a strain on cash flow for small businesses. Each one needs its own strategy to keep it under control.

Identifying these common pressure points is more than half the battle. When you know what to look for—a slow-paying client, a predictable quiet season, or an overstuffed stockroom—you can stop reacting to crises and start preventing them.

It's easy to feel like you're the only one dealing with these issues, but they are incredibly common across every industry. When things go wrong, the consequences can be more than just a temporary headache. The real costs, both direct and hidden, can be substantial.

The table below breaks down just how damaging these common challenges can be, highlighting the immediate financial hit and the longer-term, less obvious consequences for a UK small business.

Acknowledging these challenges is the first step. It shows you're not alone and, more importantly, it sets the stage for building the robust strategies and systems you need to navigate them successfully. Mastering these obstacles is what effective small business cash flow management is all about.

Alright, you've got a handle on what cash flow is and what trips most businesses up. Now for the practical part: taking back control. Real small business cash flow management comes down to simple, proactive tactics that have a direct impact on the money flowing in and out of your bank account.

Let's walk through some concrete strategies that target the biggest pressure points. These aren't complicated financial theories, but straightforward changes you can make today to boost your financial stability and get a better night's sleep.

Want to know the single fastest way to get more cash in the bank? Get paid quicker. It sounds obvious, but every unpaid invoice is basically an interest-free loan you're giving your client. It’s time to stop funding their business and get that money working for yours.

A few small tweaks here can make a world of difference.

A small creative agency in Manchester swapped from monthly batch invoicing to sending them out immediately after project sign-off. Combined with an automated reminder system, their average payment time plummeted from 42 days to just 19 days. That freed up thousands in cash every single month.

Getting your money in quickly is one side of the coin; managing when your money goes out is the other. This isn't about dodging your bills. It's about clever timing that keeps cash in your account for longer, without upsetting your suppliers.

The goal is simple: line up your outgoings with your incomings.

Have a chat with your suppliers. If you've got a good track record, there's no harm in asking to extend your payment terms from Net 30 to Net 45 or even Net 60. That simple conversation could give you an extra month to hold onto your cash.

Also, don't pay bills the moment they land on your desk. Schedule them to go out just before they're due and make full use of the credit period you’ve been given. For businesses juggling lots of invoices, professional bookkeeping services can be a massive help in keeping everything organised and timed perfectly.

If you sell physical products—whether you're a baker or an e-commerce giant—your inventory is a huge cash trap. Every single item sitting on a shelf is cash you can't use for wages, rent, or marketing. Getting smarter with stock is a direct path to better cash flow.

You need to find that sweet spot: enough stock to keep customers happy, but not so much that it bleeds your bank account dry.

One of the best things you can do for your long-term financial health is to build a cash reserve. Think of it as your business's emergency fund. It’s a pot of money set aside specifically to handle unexpected costs or to ride out a slow month without needing a loan or hitting the panic button.

A healthy cash reserve completely changes how you deal with problems. A key piece of equipment breaking down or a major client leaving doesn't have to be a full-blown crisis when you have a buffer.

Aim to save enough to cover three months of your essential running costs. This means things like rent, payroll, utilities, and crucial software subscriptions. Work out that number and make it your target. Even setting aside a little each week builds the right habit.

Open a separate business savings account to keep this fund away from your day-to-day working capital. It makes it much less tempting to dip into for non-emergencies and builds the financial discipline that is the foundation of solid cash flow management.

Managing your cash flow by only looking at past statements is a bit like driving while staring in the rearview mirror. It’s useful, sure, but it only tells you where you’ve been, not where you’re heading.

To really get ahead of the curve, you need to stop reacting to financial surprises and start anticipating them. This is where cash flow forecasting comes in. It’s your business’s financial weather report, giving you a reliable prediction of what’s on the horizon so you can decide whether to pack an umbrella or plan for a sunny day. This forward-looking approach is the heart of effective small business cash flow management.

When it comes to creating this financial weather report, you have two main options: the direct method and the indirect method. Each has its place, and the right one for you really depends on what you need the forecast for.

The direct method is the most straightforward and practical approach for most small businesses. You simply list all the actual cash you expect to come in (from client payments, sales, etc.) and all the cash you expect to go out (rent, payroll, supplier bills) over a specific period. It's concrete, tangible, and based on real-world numbers.

The indirect method, on the other hand, starts with your net profit and then makes adjustments for non-cash items like depreciation. It’s more of an accountant's tool for high-level analysis and is less useful for the nitty-gritty of day-to-day cash planning.

For a small business owner, the direct method is your best friend. It’s a ground-level view that answers the most important question you have: "Will I have enough cash in the bank to pay my bills next month?"

To make the difference crystal clear, let's break down how these two methods stack up against each other.

This table gives a quick comparison to help you choose the right approach for your business needs.

For most small business owners, getting to grips with the direct method is the key to unlocking powerful financial insight and staying in control.

One of the most powerful tools in your forecasting arsenal is the 13-week cash flow forecast. Why 13 weeks? It perfectly covers one business quarter, giving you a clear window to spot trends and prepare for upcoming challenges without getting lost in long-term guesswork.

Think of it as your early-warning system. It can flag a potential cash shortfall weeks or even months in advance, giving you plenty of time to act. Seeing that you might be short on cash in Week 8 gives you the power to chase an overdue invoice, delay a non-essential purchase, or explore funding options without panic. This foresight is invaluable, and for more detailed guidance, you can explore professional tax advice for small businesses.

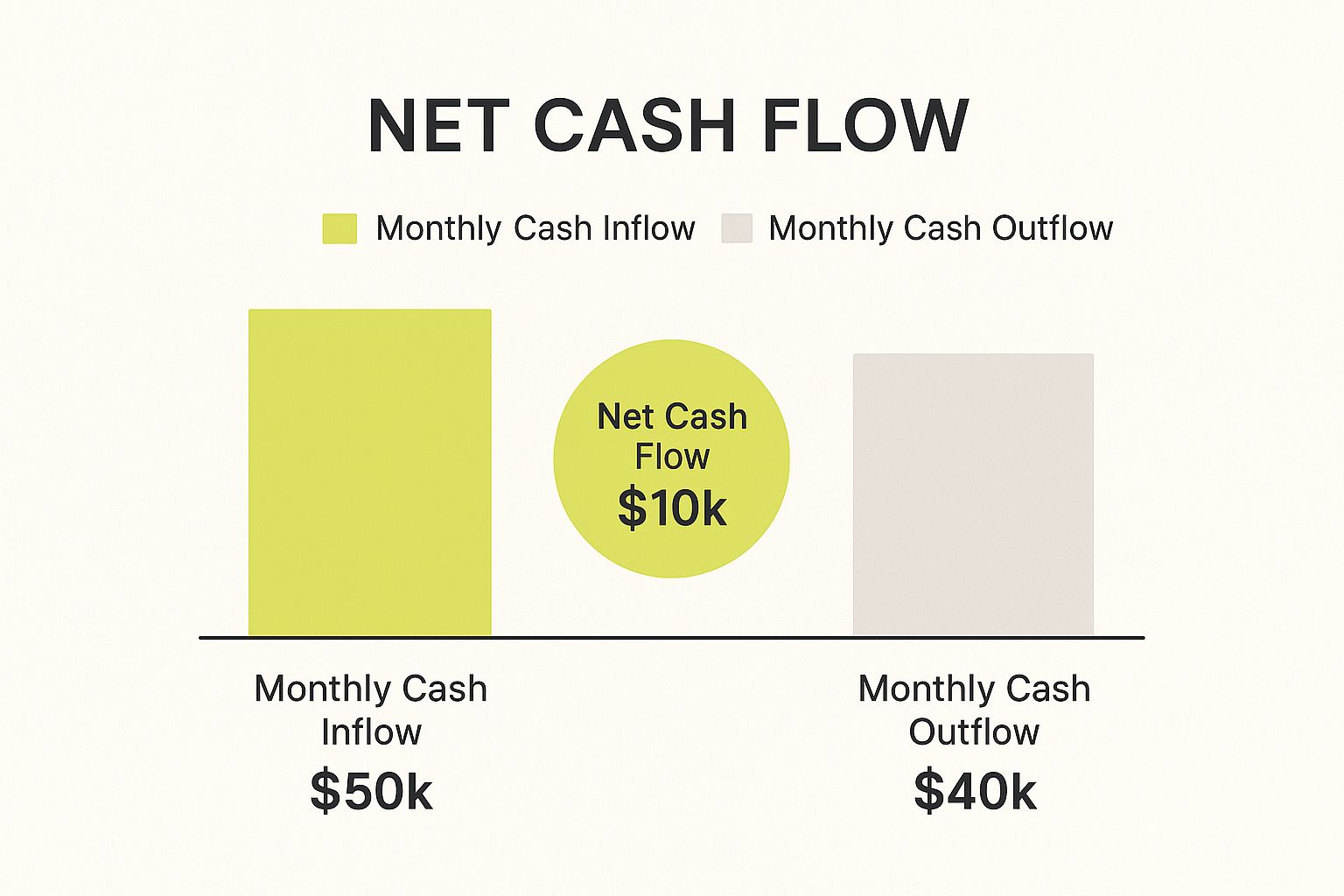

This infographic shows a simplified snapshot of what this looks like for a single month, highlighting the relationship between cash coming in and going out.

As you can see, with £50k in inflows and £40k in outflows, the business generated a positive net cash flow of £10k for the month. A 13-week forecast simply applies this same logic across a full quarter, mapping out these balances week by week. It's the ultimate tool for making informed decisions about hiring, spending, and growth before a problem ever becomes a crisis.

Sometimes, even with the best planning in the world, you’ll hit a cash shortfall. It happens to everyone. When you see a gap looming in your forecast, external funding can be the lifeline you need to navigate a quiet period or even pounce on a sudden growth opportunity. Knowing your funding options is a core part of effective small business cash flow management.

But let’s be honest, getting your hands on finance isn't always a walk in the park. For UK SMEs, it can be a real hurdle. In Q2 2024, around 39% of overdraft applications and a whopping 56% of traditional bank loan applications were rejected. According to some eye-opening business finance statistics from Merchant Savvy, this tough environment has pushed 30% of small business owners to dip into personal savings or credit cards just to keep things afloat.

Relying on your own money is a risky game. A much better approach is to get to grips with the different types of business finance out there. This way, you can find a solution that actually fits your business, without putting your personal assets on the line.

The funding world has more to offer now than ever before. While the old-school options are still very much in play, a new generation of financial products has popped up, built for the fast-paced reality of small business life. Before you do anything, though, it’s crucial to have your financial house in order; our guide on how to set up a business bank account is a great place to start.

Let's break down some of the most common options:

Bank Loans and Overdrafts: These are the classics. A loan gives you a lump sum for a big purchase, like new equipment, while an overdraft is more of a flexible safety net for day-to-day costs. The downside? They often involve a mountain of paperwork and, as we've seen, high rejection rates.

Invoice Financing: This is a game-changer for businesses constantly chasing late-paying clients. A provider will advance you most of the value of an unpaid invoice right away. You get the cash you need to operate, and the provider simply takes their fee when your customer finally settles up.

Merchant Cash Advance (MCA): If your business sees a high volume of card sales, an MCA could be a good fit. A lender gives you a lump sum upfront, and in return, they take a small percentage of your future card sales until it's all paid back. It's incredibly fast and flexible, but it can work out to be more expensive than a traditional loan.

The secret is to match the funding to the problem. Don't take out a five-year loan to solve a 30-day cash gap caused by one late invoice. It’s all about using the right tool for the job.

Choosing the right funding isn't just about getting the money; it's about getting the right kind of money. A smart choice can plug a hole and fuel your next stage of growth. The wrong one can saddle you with long-term financial strain. By understanding the pros and cons of each, you can pick your path with confidence.

Even when you think you've got a handle on things, questions about cash flow management always seem to pop up. Let's tackle some of the most common ones with clear, straightforward answers to help you feel confident and ready to act.

For most small businesses, a weekly review is the sweet spot. It's often enough to catch little problems – like a client paying late or a supplier's price creeping up – before they snowball into a proper crisis. Think of it as a quick, regular health check for your finances.

Of course, if your business is growing rapidly or you're operating on razor-thin margins, you might want to glance at it daily. It all comes down to keeping a firm grip on the money moving through your business.

This is a big one, and it trips up even seasoned entrepreneurs. Profit is what's left on paper after you subtract all your expenses from your revenue. Crucially, this often includes sales you've made but haven't actually been paid for yet.

Cash flow, on the other hand, is the real, physical money flowing in and out of your bank account. You can be wildly profitable but still go under if your customers don't pay their invoices on time.

As the old saying goes, "Revenue is vanity, profit is sanity, but cash is reality." You can't pay your rent with profit; you pay it with cash.

The single most powerful first step is to create a simple 13-week cash flow forecast.

This doesn't need to be a complex masterpiece. Just open a spreadsheet and map out all the cash you genuinely expect to receive and all the payments you know you have to make, week by week. This simple exercise gives you instant clarity on your financial runway and acts like a torch, lighting up potential bumps in the road long before you hit them.

Feeling ready to turn financial data into confident decisions? The team at GenTax Accountants is here to help you master your cash flow and drive your business forward. Discover our dedicated accounting services at https://www.gentax.uk.