If you’ve ever tried to reconcile a payout from Amazon or Shopify, you’ll know it’s rarely a straightforward job. Instead of a simple sales figure, you get a tangled mess of transactions, deductions, and fees. LinkMyBooks is the automation tool designed to fix this headache for good.

Think of it as a translator. It sits between your sales channels (like Shopify or Amazon) and your accounting software (like Xero or QuickBooks), turning complex sales data into perfectly organised accounting entries. For busy UK sellers, it’s a game-changer, wiping out hours of tedious manual bookkeeping every month.

Imagine your eCommerce bookkeeping running on autopilot. No more spending hours digging through spreadsheets, trying to match sales reports with bank deposits. That’s the reality LinkMyBooks delivers. It’s less of a software tool and more of an automated bookkeeper working silently in the background. It connects directly to your sales platforms, pulls all the data, and posts clean, summarised invoices right into your accounting system.

This isn't just a nice-to-have; for UK sellers, it's pretty much essential. Running an online store here comes with its own unique set of financial hurdles. You have to wrestle with:

LinkMyBooks was built from the ground up to solve these exact problems. It untangles messy sales data, neatly separates out all the different fees, and correctly applies VAT rates before sending anything to Xero or QuickBooks. The result? Your financial records are always accurate and compliant.

For any UK business, accurate bookkeeping isn't just about being organised—it's a legal requirement for your VAT returns and tax reporting. Automation tools like LinkMyBooks take human error out of the equation, ensuring your figures are consistently reliable and ready for HMRC.

By creating this smooth flow of information, LinkMyBooks gives you a crystal-clear picture of your financial health. That accuracy is the bedrock of any serious business, and for those who want expert guidance, having clean numbers is the first step. You can learn more about how specialised accounting supports eCommerce businesses on our services page.

To get your head around what LinkMyBooks actually does, think of it as an expert financial translator. When a customer buys something from your Shopify store, that single sale leaves behind a messy trail of data. You’ve got the sales revenue, shipping fees, charges from payment processors like Stripe or PayPal, and of course, VAT. Trying to unpick this puzzle for every single sale isn't just painfully slow; it's practically an open invitation for costly mistakes.

This is where LinkMyBooks steps in. It takes that entire translation job off your plate. It cleverly groups all your sales for a set period—let's say, a day—into one clean, simple summary invoice. But this isn't just a grand total. The real magic is how it intelligently separates every single component.

The platform automatically figures out what's what in each transaction. It identifies the gross sale amount, deducts the Shopify transaction fee, accounts for the shipping income, and correctly calculates the UK VAT you owe on that sale. This detailed, broken-down summary is then posted straight into your Xero or QuickBooks account. No manual data entry needed.

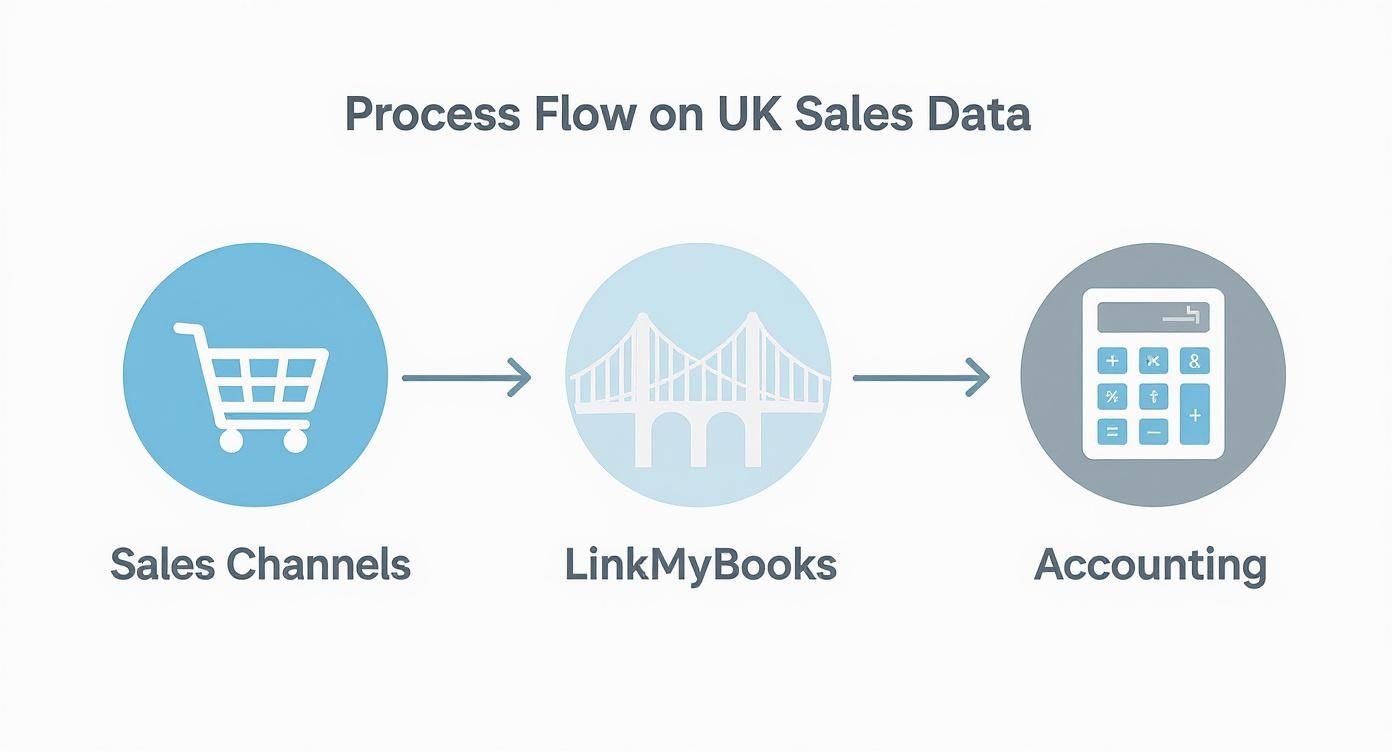

This simple diagram shows you exactly how the data flows from your sales channels, through LinkMyBooks, and into your accounting software.

As you can see, LinkMyBooks acts as that critical bridge, making sure all that complex sales information is organised and simplified before it ever touches your financial records.

This level of automation brings more than just a tidy set of books; it delivers rock-solid accuracy. With the e-commerce world booming—we're talking over 28 million active online stores globally—the need for efficient back-office tools has never been greater. LinkMyBooks rises to this challenge by ensuring the figures in your accounting software perfectly match the deposits hitting your bank account from your sales channels. This turns bank reconciliation from a week-long headache into a simple, one-click task.

Let's compare the old way with the new way.

For many eCommerce businesses, the jump from manual data entry to automation is a game-changer. The table below lays out the stark difference in effort and accuracy when you compare doing things by hand versus letting a tool like LinkMyBooks handle the heavy lifting.

The takeaway is clear: automation doesn't just save you a few minutes here and there. It reclaims hours, even days, of your time each month while virtually eliminating the human error that creeps into manual bookkeeping.

This clean, reliable data flow is the bedrock of accurate financial reporting. By handling the nitty-gritty transaction details, LinkMyBooks provides the trustworthy data you need for understanding your Shopify Profit & Loss statement. With precise numbers at your fingertips, you can finally make smart, confident decisions about your business's future. For businesses that want to maintain flawless records without the daily grind, pairing this automation with professional bookkeeping services creates an unbeatable foundation for growth.

Any eCommerce business is only as strong as the tools it uses, and more importantly, how well they talk to each other. This is where LinkMyBooks really shines. Think of it as the central translator between the platforms where you make your money and the software you use to track it. It creates an automated connection that gets rid of tedious manual data entry and makes sure your numbers are spot on across the board.

For UK businesses, this usually means linking up the big sales channels with the most popular accounting software. LinkMyBooks was built to work flawlessly with the giants of eCommerce, grabbing the exact data you need for perfect bookkeeping.

LinkMyBooks connects directly with the platforms most UK sellers use every day:

Once it has all that clean sales data, LinkMyBooks sends it over to the UK's leading cloud accounting platforms:

At its heart, the main benefit of these integrations is data integrity. By creating a direct, automated link, LinkMyBooks guarantees the numbers from your sales channels always match the numbers in your financial reports, completely removing the risk of human error.

Getting these systems connected properly is fundamental to scaling your business without creating an administrative nightmare. Getting expert help with your financial technology can make sure every tool works in perfect harmony right from the start. To see how we approach this, take a look at our technology transformation services, where we focus on building efficient, interconnected systems for growing businesses.

For any UK eCommerce seller, getting to grips with Value Added Tax isn't just a chore; it’s a serious legal responsibility. Get it wrong, and you could be facing hefty penalties from HMRC, which makes accuracy an absolute must. This is one of those areas where LinkMyBooks really shines, turning what can be a complex headache into a smooth, automated process. The platform is built from the ground up to handle the fiddly details of UK VAT.

It automatically figures out the correct VAT treatment for every single sale, whether your customer is based in the UK, somewhere else in the EU, or on the other side of the world. This means the right tax rates are applied to each transaction without you having to manually check or calculate anything, which dramatically cuts down the risk of human error. To get your head around your obligations as a UK seller, it's worth having a solid understanding the specifics of Value Added Tax (VAT).

Think about how you reconcile your personal bank account. You check your shopping receipts against your bank statement to make sure it all adds up. Bank reconciliation for an eCommerce business follows the same logic, but it’s on a completely different scale. You’re trying to match lump-sum payouts from platforms like Shopify against potentially hundreds or even thousands of individual orders.

The core challenge of eCommerce reconciliation is that the payout you receive rarely matches the total sales for that period due to fees, refunds, and taxes being deducted.

This is the exact problem LinkMyBooks was designed to solve. For each payout you receive, it creates a single, perfectly balanced summary invoice. This invoice breaks down everything—all the sales, fees, and taxes—so the final total is the precise amount that hits your bank account.

This clever but simple feature makes reconciling in Xero or QuickBooks incredibly straightforward. What used to be a painstaking manual matching job becomes a quick one-click approval. This level of accuracy is essential for keeping compliant records and gives you a rock-solid foundation for filing your VAT returns with total confidence.

Getting started with new software can feel like a chore, but thankfully the LinkMyBooks onboarding is refreshingly straightforward. It’s been designed from the ground up to be intuitive and guided, meaning you don’t need to be an accountant to get everything connected and running smoothly.

It’s clearly built for busy business owners who just want to get it done with minimal fuss. The whole thing only takes a few minutes.

You kick things off by creating your account, a standard first step that takes you straight into the main setup area. From there, you'll be prompted to connect your sales channels and accounting software one by one.

Connecting your platforms is as simple as logging into your existing accounts and giving permission. This secure handshake lets LinkMyBooks pull the data it needs without you ever having to share your passwords directly. It's safe and quick.

The typical flow looks a bit like this:

One of the most common worries I see is getting the tax mappings right. The good news is that LinkMyBooks provides really clear guidance and sensible default settings, especially for UK businesses, which makes this step far less scary than it sounds.

Once these connections are locked in, the system starts pulling in your historical data, ready to generate your first summary invoice. With great support and a logical flow, LinkMyBooks is designed to get you automated and back to running your business as quickly as possible.

While LinkMyBooks is a brilliant piece of automation, getting its full potential unlocked often needs an expert eye. Think of the software as a high-performance engine; to get the best out of it, you still need a skilled driver at the wheel. That’s where an experienced accounting firm like GenTax comes in. We make sure your investment in this tool delivers from day one.

Our partnership starts right at the beginning, with implementation. We'll handle the initial setup to guarantee every single setting is perfectly configured for your specific business structure and UK VAT scheme. Getting this right from the start prevents those common, niggly errors that can lead to inaccurate financial data down the line.

Once you're up and running, our role changes. We shift from setup to providing ongoing services that are all about supporting your growth:

The UK’s eCommerce market is incredibly dynamic, with over 65 million online shoppers. In this buzzing environment, our job is to turn the clean data from LinkMyBooks into actionable financial intelligence that actually fuels your growth. You can read more about the UK's bustling online shopping landscape and its key trends to get a sense of the opportunity.

This approach turns our relationship into a proper long-term financial partnership. By combining a best-in-class tool with expert guidance, we help you build a resilient and profitable business. You can learn more about our dedicated approach and meet the team by finding out more about us at GenTax. We’re committed to using technology to make your financial management clearer and more effective.

Even when you get the general idea, it’s natural to have a few specific questions before you trust a new tool with your finances. Let's tackle some of the most common queries we hear about LinkMyBooks.

No, and honestly, that’s one of its best features. Instead of flooding your accounting software with thousands of separate transactions, LinkMyBooks is much smarter. It groups all your sales together into clean daily or monthly summary invoices.

This approach keeps your financial records tidy and organised. More importantly, it makes bank reconciliation a breeze. The total on the summary invoice perfectly matches the payout you receive from Shopify or Amazon, so you can reconcile with a single click. It also stops you from maxing out transaction limits in Xero or QuickBooks.

LinkMyBooks was built from the ground up for global eCommerce. It automatically handles sales made in different currencies, like those from Amazon's US or EU marketplaces.

The tool converts all your foreign sales data into your home currency (GBP for UK businesses) before it ever hits your accounts. It uses the exact exchange rates provided by the sales platform for that specific day, ensuring the numbers in your books match the deposits landing in your bank. No more reconciliation headaches.

One of the biggest pitfalls in eCommerce accounting is getting currency conversions wrong. By using the sales channel's own exchange rate, LinkMyBooks takes all the guesswork out of the equation, guaranteeing your reconciled figures are spot-on every time.

Absolutely. LinkMyBooks uses a tiered pricing model based on your monthly order volume, which makes it incredibly accessible and affordable for businesses at any stage.

For new sellers, getting a tool like this set up from day one is a brilliant move. It helps you build solid, scalable accounting habits right from the start and prevents bookkeeping backlogs from ever piling up. You can be confident your financial data is accurate and reliable, freeing you up to focus on what really matters: growing your brand.

At GenTax Accountants, we help eCommerce businesses implement powerful tools like LinkMyBooks to build a rock-solid financial foundation for growth. Get in touch with our team today to see how we can sort out your accounting for good.