Before you even think about filling out forms or making grand announcements, there are a few crucial bits of groundwork to cover when appointing a new director. Getting this part right is everything.

It all starts with a couple of straightforward legal checks and a look at your own company rulebook. Nail these early steps, and you’ll avoid a world of compliance headaches down the line.

Think of this initial phase as due diligence. It's about checking the foundations before you start building. Skip these checks, and you risk the entire appointment being invalid, which can cause serious legal problems for the company.

This isn't just about ticking boxes; it's a critical risk management exercise. You’re making sure the person you’re bringing into a position of trust and legal responsibility is actually eligible and suitable for the role.

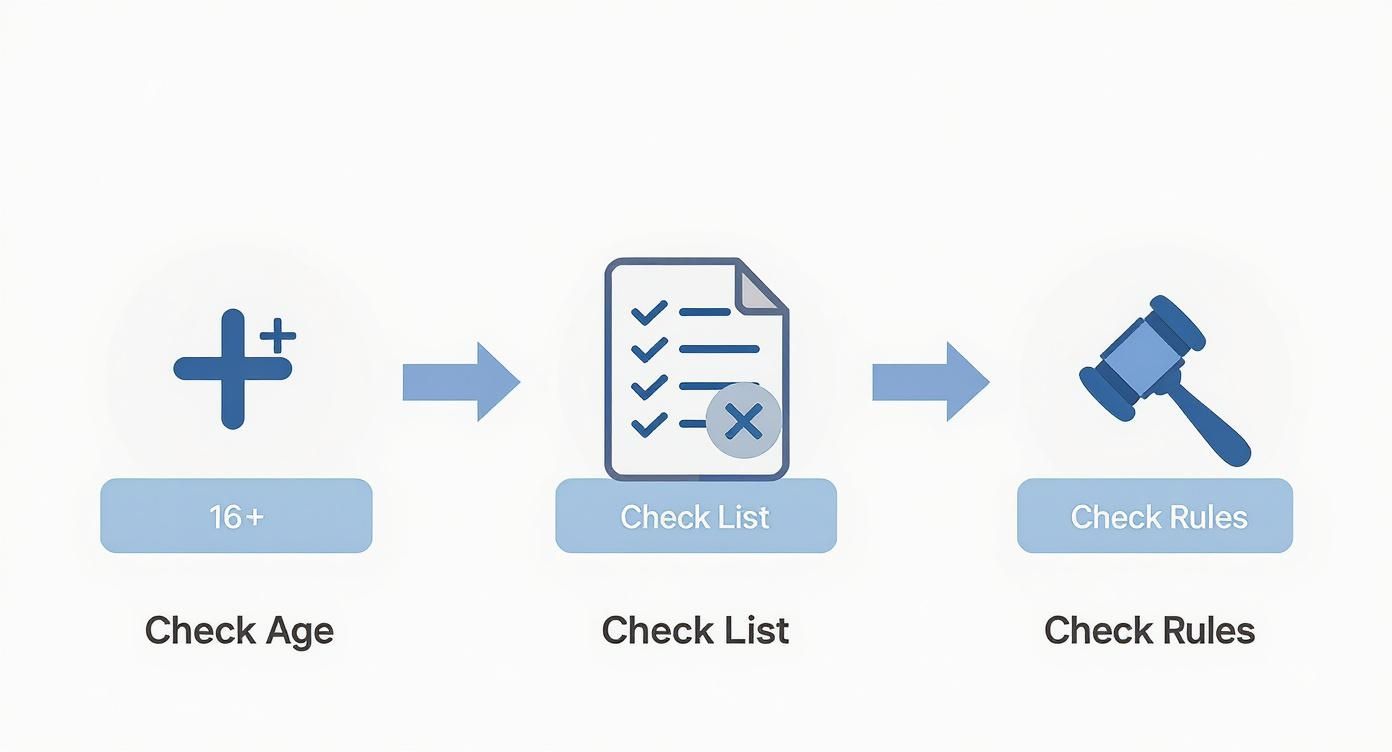

This quick diagram breaks down the essential early checks into a simple workflow.

As the visual shows, it’s a logical flow: start with the absolute legal must-haves, then move on to your company's internal rules. This way, you satisfy both UK law and your own governance procedures from the get-go.

First up, the non-negotiables. UK law is very clear on who can and can't be a company director. Getting this wrong can invalidate the appointment before it's even begun.

To help you get this right every time, here’s a quick checklist summarising the core requirements.

These criteria are absolute deal-breakers.

Thankfully, checking is easy. You can run a quick search on the official disqualified directors register on the Companies House website. It takes minutes and could save you from a major compliance nightmare. This isn’t just admin; it’s about protecting your business and existing directors from the fallout of an invalid appointment.

While the law sets the baseline, your company's own rulebook—the Articles of Association—often adds another layer of procedure. This document is the instruction manual for how your company is run, and it nearly always has specific clauses about appointing directors.

Dig out your articles and check for things like:

One of the most common mistakes I see is businesses ignoring their own articles. This can lead to messy internal disputes or even legal challenges that question the appointment's validity. Always treat your articles as the ultimate guide to your company's governance.

While you're laying the groundwork, it’s also the perfect time to establish clear ethical boundaries. A great way to do this is by reviewing a modern conflict of interest policy template to formalise expectations before the appointment is finalised. This proactive step helps clarify duties and prevents potential issues later on.

For businesses structured as limited companies, ensuring all governance procedures are followed to the letter is essential for maintaining your legal status. You can find out more about our accounting support for https://www.gentax.uk/who-we-help/limited-companies and how we help you stay compliant.

Right, so you’ve confirmed your candidate is eligible and that your company’s Articles of Association give you the green light. Now it’s time to make the appointment official on the inside. A quick chat and a handshake won't cut it here; you need a proper, documented paper trail to show everything was handled by the book.

This internal process boils down to two key pieces of paperwork: getting the director's formal consent and then securing the existing board's approval. This isn't just about ticking boxes. These documents are legally binding records that protect both the company and the incoming director, creating a clear line in the sand for when their duties officially begin. Get this wrong, and you're opening the door to some serious governance headaches down the line.

Before the board can even think about approving the appointment, the candidate first needs to formally agree to take on the role. This is handled with a simple but crucial document called a 'Consent to Act' letter. In it, the individual formally accepts the directorship and acknowledges the legal responsibilities that come with it.

Think of this letter as your proof. It provides undeniable evidence that the director was appointed with their full knowledge and consent, heading off any potential disputes where someone might later claim they were added to the register without their permission.

The letter itself needs to be clear and to the point. While there isn't a rigid legal template you must follow, it absolutely has to contain a few key details to be valid.

A solid Consent to Act letter should always include:

With the candidate's signed consent in hand, the final internal step is for the existing directors to approve the appointment. This decision has to be formally recorded in a board resolution – the official mechanism a board of directors uses to document its decisions.

How you go about passing this resolution really depends on your company's setup and articles. For many smaller businesses, getting everyone together for a physical board meeting is a bit impractical. The good news is that the Companies Act 2006 allows for decisions to be made via a written resolution, as long as your articles don't specifically forbid it. This is simply a document signed by all eligible directors, and it carries the same legal weight as a resolution passed in a formal meeting.

Whether it's passed in a meeting or in writing, the resolution itself needs to be precise.

Key Takeaway: The board resolution is the legal switch that officially flips the appointment to 'on'. The wording should be direct, stating the new director's full name and the exact date their appointment takes effect. This leaves no room for doubt about the board's collective decision.

For instance, the wording can be as simple as this:

"IT WAS RESOLVED that [New Director's Full Name] be and is hereby appointed as a director of the company with effect from [Date of Appointment]."

This resolution, along with the meeting minutes (or the signed written resolution), becomes a permanent part of your company's statutory books. For senior roles with financial oversight, getting this documentation spot-on is critical. If your business needs that kind of strategic financial leadership but isn't ready for a full-time hire, bringing in a fractional finance director can provide high-level expertise from day one.

Either way, keeping these records immaculate isn’t just good practice—it's a legal requirement.

Once you've got the board resolution signed and filed away, the appointment is official within your company's four walls. But to make it legally binding in the eyes of the public, you have one more crucial step: notifying Companies House.

This isn't just a bit of admin; it's a legal requirement that puts the new director on the public record, cementing their role and responsibilities. The good news is that the process is fairly straightforward, so long as you get the details right.

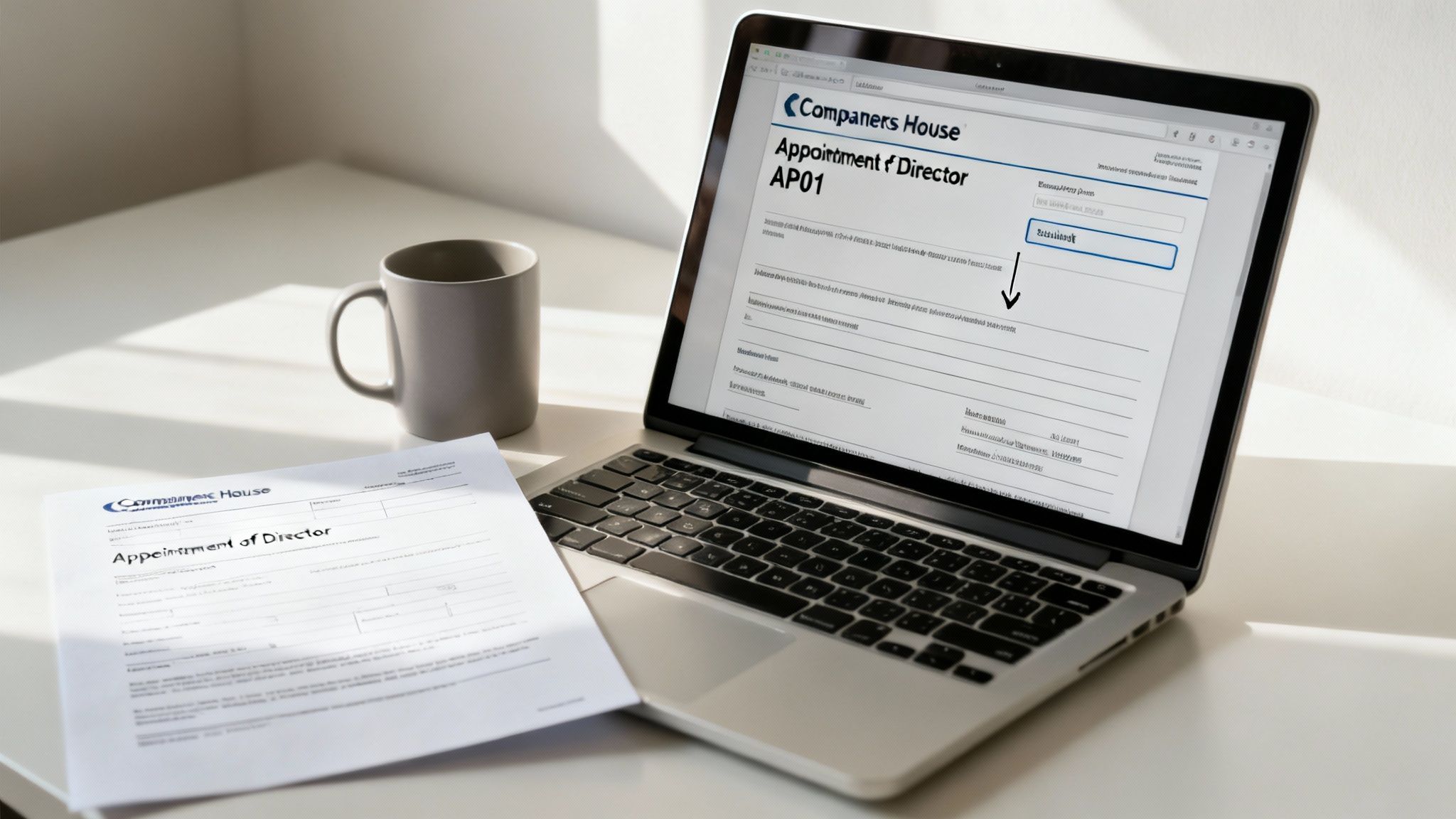

You'll do this by filing a Form AP01. Getting this spot on is key, as any mistakes can lead to rejections and delays.

You can choose to file this online or send it through the post, but as we'll see, one method is usually much better than the other.

Here’s the most important thing to remember: you have just 14 days from the director's official start date to get that AP01 form filed with Companies House.

This isn't a friendly suggestion – it's a hard deadline under the Companies Act 2006.

Missing it is technically a criminal offence for the company and its officers. While you're unlikely to face severe penalties for a first-time slip-up, a history of late filings can seriously damage your company's compliance record and attract unwanted attention. It’s simply not worth the risk.

Form AP01 is where you'll provide all the essential details about your new director for the public register. Accuracy is everything.

You’ll need to have the following information handy:

The service address is the official address for correspondence and will be publicly available. To protect their privacy, many directors use the company's registered office address. The residential address, on the other hand, must be their genuine home address and is kept private by Companies House.

Getting this distinction right is vital. A simple mistake here could accidentally publish your new director's home address for all to see.

You’ve got two routes for filing the AP01: the fast, modern online service or the traditional paper form sent by post. While they both get the job done, they're worlds apart in terms of speed and convenience.

For most businesses, filing online is the obvious choice. It's quicker, free, and the built-in checks help you catch common errors before you hit submit.

Comparing AP01 Filing Methods

Given the tight 14-day deadline, the speed and peace of mind from online filing make it a no-brainer. It's also worth noting that Companies House has recently introduced new ID verification rules for directors and anyone filing forms. You can get the full rundown in our guide on Companies House ID verification.

Once Companies House has processed and accepted your AP01, that’s it. The appointment is fully official, the new director will appear on the public record, and their journey with your company can truly begin.

Getting the AP01 form filed with Companies House is a big tick on the public-facing side of things, but your job isn't quite done yet. Appointing a director also means you need to turn your attention inwards and update your own company books, often called the statutory registers.

It's a step that gets missed more often than you'd think, but skipping it puts you in direct breach of the Companies Act 2006. Think of these registers as the ultimate source of truth for your company's structure – they have to be spot-on.

First up, and the most obvious change, is adding the new director to your Register of Directors. This is a legally required log of every person who has ever served as a director for your company. You’ll need to add the new director’s details as soon as their appointment is official.

The key here is consistency. Everything you record should be an exact match for the information you submitted on the AP01 form.

Make sure you've got the following details down for the new director:

This register needs to be kept at your company's registered office (or a Single Alternative Inspection Location, known as a SAIL address) and must be available for inspection if requested.

You’re also required to maintain a separate, private Register of Directors' Residential Addresses. This document is where the sensitive stuff goes, and it isn't available for public viewing—only specific bodies like credit agencies and the police can access it.

When you bring a new director on board, their usual residential address must be added to this register. It's a vital part of your compliance duties, but it also protects your director’s privacy. Getting this right is just as important as keeping the public records accurate.

Crucial Tip: Never mix up the service address and the residential address. The service address is public, but the residential one is strictly private. A simple mistake here can cause a serious privacy headache for your new director.

Keeping these registers in order isn't just about ticking boxes; it's a sign of good corporate governance. For businesses juggling several directorships or complex records, looking into professional enterprise document management solutions can be a smart move to keep these crucial documents secure and organised.

Finally, you need to take a look at your Register of People with Significant Control (PSC). A PSC is anyone who holds more than 25% of the company's shares or voting rights, has the power to appoint or remove most of the board, or otherwise has significant influence over the company.

A new director isn’t automatically a PSC, but their appointment could shake up the control structure. For instance, if the director is also buying a large chunk of shares as part of their package, they could easily cross that 25% threshold.

It's your responsibility to figure out if this new appointment creates a new PSC or changes an existing one's status. If it does, you're legally obliged to update your PSC register and let Companies House know. This check is fundamental to keeping your company's ownership and control structure transparent and compliant.

Juggling these internal books is a core part of your company's administration. Many businesses find that professional bookkeeping services are invaluable for ensuring these records, and others, are always accurate and up-to-date, heading off any compliance issues before they even start.

Once a director is appointed, the administrative tasks split into two main streams: internal updates to your own statutory books and external notifications to official bodies. Here's a quick checklist to make sure you've covered all the bases.

Following this checklist ensures nothing slips through the cracks, keeping your company fully compliant and demonstrating professional management from day one.

Bringing a new director on board is a big move, but it’s about more than just updating your leadership team. It immediately triggers a whole new set of financial and legal duties with HM Revenue & Customs (HMRC). Getting the payroll and tax side of things right from day one is absolutely crucial if you want to steer clear of penalties and keep your compliance record spotless.

This isn't as simple as just paying someone. You've got to think about their entire remuneration package, how you'll process it, and what it all means for the director's personal tax situation and the company's bottom line. Get this wrong, and you could find yourself in a real tangle with HMRC down the line.

First things first: if your new director is drawing a salary, they must be added to your company’s Pay As You Earn (PAYE) payroll system. This is non-negotiable. The process involves formally registering them as an employee with HMRC, which is what ensures their Income Tax and National Insurance Contributions (NICs) are calculated and deducted correctly every time they're paid.

To get them set up, you'll need their personal details, including their National Insurance number. If they have a P45 from their last job, that's ideal. If not, you’ll need to fill out a starter checklist to help determine their correct tax code. This code is what tells your payroll software how much tax-free income they can receive, directly impacting the deductions from their pay.

A common pitfall I see is businesses assuming a director who only takes dividends doesn't need to be on the payroll. Even if they don't draw a regular salary, any payment for their services—no matter how small—usually requires PAYE registration. Always double-check the rules to stay compliant.

Getting this initial setup spot-on saves a world of headaches later. Think of accurate, timely payroll as the bedrock of good financial management.

Once the director is on the payroll, you'll be dealing with two distinct types of National Insurance Contributions: the employee's and the employer's.

For directors, NICs can be calculated a bit differently than for regular employees. You have the option to work them out on an annual basis at the end of the tax year or cumulatively each time they get paid. The annual method is often the go-to choice as it smooths out contributions, which is especially useful if their pay varies throughout the year.

It's a tricky area, so getting expert advice is always a good move. Our dedicated payroll services can make sure these calculations are handled perfectly, saving you time and preventing costly errors.

The financial ripple effect of a new director goes beyond just their salary. Their remuneration package can influence your company’s Corporation Tax bill, as director salaries are typically a tax-deductible expense. In simple terms, a higher salary can help reduce your company's taxable profits.

However, be aware that HMRC has its eye on director compliance more than ever. Their compliance checks can be incredibly thorough, looking at everything from PAYE and VAT filings to Corporation Tax returns, and they often dig into a director's personal tax history too. With the introduction of changes to UK company law for directors, the level of scrutiny is only increasing.

This makes it absolutely vital to keep meticulous records of every payment, benefit, and expense linked to the director. Your company has to submit Real Time Information (RTI) reports to HMRC every single time you run payroll. At the end of each tax year, you must also provide the director with a P60 form, which summarises their total pay and deductions. Nailing these details isn't just good practice; it's essential for smooth and compliant financial governance.

Getting a new director on board involves more than just filling in a form. In my experience, it’s the little details that often trip people up. While the main steps are straightforward, certain scenarios pop up time and again, causing confusion and sometimes, a bit of a panic.

Let's walk through some of the most frequent queries we hear from businesses. Getting these details right is just as crucial as the main filing – a small misunderstanding can lead to compliance headaches or even accidental privacy breaches for your new director.

Yes, absolutely. And frankly, they should. A director is legally required to provide Companies House with two addresses: a service address and their usual residential address. It’s vital to understand the difference.

The service address is the one that goes on the public record. Anyone can look it up online. For this very reason, most directors wisely choose to use the company's registered office address. It keeps their home life private and separate from the business.

Their residential address, on the other hand, must be their actual home address. This information is kept private by Companies House and isn't visible to the public, protecting the director's personal information.

This one is serious. You have 14 days from the date of appointment to notify Companies House. Missing this deadline isn't just a bit of admin sloppiness; it's a criminal offence committed by the company and every director who is in default.

Now, will a minor, first-time delay of a day or two bring the wrath of regulators down on you? Probably not. But it does leave a black mark on your company's compliance history. If it becomes a pattern, or the delay is significant, you can expect financial penalties and unwanted attention. It’s always best to treat that 14-day window as a hard, non-negotiable deadline.

A strong compliance record is a sign of a well-run business. Missing statutory deadlines, even for something as routine as appointing a director, can signal poor governance to potential investors, lenders, and partners. Filing on time is non-negotiable.

Not at all. This is a common misconception. Appointing a director and issuing shares are two completely separate legal procedures. A person can be a director without owning a single share, and a shareholder has no automatic right to a seat on the board.

The roles are fundamentally different:

If the intention is for the new director to also become a shareholder, that requires a separate process. You'll need to follow the correct procedure for either allotting new shares or transferring existing ones, which involves its own paperwork and resolutions, completely distinct from the AP01 director appointment form.

Yes, you can. There are no restrictions on nationality or country of residence for a director of a UK limited company.

However, there are a couple of practical points to consider. First, every UK company must have at least one director who is a "natural person" (i.e., an individual, not another company).

Second, while they can live anywhere in the world, they must still be able to fulfil their legal duties effectively. This means being available for board meetings (even if virtual) and staying properly informed about the company's financial and operational health. You’ll also need to ensure you have all their required personal details for the Companies House filing, which can sometimes be trickier to gather from overseas.

Managing director appointments and the associated financial responsibilities is just one part of running a compliant and successful business. At GenTax Accountants, we handle the complexities of payroll, tax, and company secretarial duties so you can focus on growth. Discover how our expert accounting services can support your company's journey.