Working as a contractor means your financial world is completely different from someone in a typical nine-to-five job. You're dealing with project-based work, income that can swing wildly from one month to the next, and a minefield of tax rules that demand specialist know-how.

Standard, off-the-shelf accounting just doesn't cut it.

Relying on a standard accountant for your contracting business is like asking a GP to perform heart surgery. Sure, they understand the basics of health, but they lack the razor-sharp expertise needed for something so complex and high-stakes. This is precisely why generic accounting so often fails UK contractors.

A one-size-fits-all approach is doomed from the start because your financial reality is built differently. It isn’t predictable, and it certainly isn't simple.

The heart of the problem is that generic accounting systems are designed for stability—things like consistent monthly salaries and predictable overheads. A contractor's world is the polar opposite.

You’re constantly juggling:

A specialist contractor accountant doesn't just record your financial history; they help you write your financial future. They get that for a contractor, compliance isn't just about avoiding penalties—it's about building the financial stability you need to chase that next big project with confidence.

This need for focused expertise is playing out across the wider industry. The UK's accounting sector is on track to hit £39.8 billion by 2026, largely driven by increasingly complex regulations. Contractors are a huge part of this shift, demanding more than just someone to file their accounts once a year.

Ultimately, proper accounting services for contractors are about moving from simply ticking boxes to actively managing your finances. A specialist understands the ins and outs of claiming every allowable expense, structuring your salary and dividends for maximum tax efficiency, and making sure you're always prepared for what's around the corner.

It’s about giving you peace of mind so you can focus on what you do best—delivering brilliant work for your clients. We explain exactly how our specialised approach helps contractors succeed on our dedicated service page.

Trying to manage your finances as a UK contractor without a clear plan is like sailing without a map. It's easy to get lost, miss crucial HMRC deadlines, and end up with some pretty stiff penalties for your trouble. This checklist cuts through the noise and lays out the non-negotiables—the core accounting services every contractor needs to stay compliant, profitable, and successful.

Don't think of these as chores. These services are the very pillars holding up your business. Getting them right from day one brings clarity, keeps you on the right side of the law, and paves the way for real financial growth.

Let's walk through the four services that form the bedrock of your financial responsibilities.

At its heart, bookkeeping is the daily diary of your business's financial life. It’s the simple act of recording every single penny that comes in and goes out, from client payments and software subscriptions to travel expenses and that essential coffee you bought for a meeting.

This isn’t about stuffing receipts into a shoebox anymore. Modern bookkeeping uses cloud software to create a real-time, organised record of your financial health. This data is the single source of truth for everything that follows, from your tax returns to your year-end accounts. You can learn more about how our effective bookkeeping services can build a solid foundation for your business.

Without it, you’re flying blind. You won’t know if you’re actually making a profit, where your money is going, or how much to stash away for the taxman. It’s the first, most critical piece of the puzzle.

If bookkeeping is your daily diary, your Annual Accounts are the official, end-of-year report card. This is the formal summary of your company's financial performance and position over the last 12 months. For any limited company, filing this with Companies House isn't optional—it's a legal requirement.

These accounts summarise your income, expenses, assets, and liabilities. They're also a public record, meaning lenders, investors, or even potential clients can look them up to see if your business is in good shape. Miss the filing deadline, and you're looking at automatic penalties starting from £150 that climb quickly.

Think of your Annual Accounts as your company's official financial story for the year. They prove to the government and the public that your business is a legitimate, well-managed entity.

While your Annual Accounts report your performance to Companies House, your Corporation Tax return is all about reporting your profit to HMRC. This is how the government works out how much tax your limited company owes.

The process involves taking the profit figure from your accounts and making a few specific adjustments for tax purposes. The deadline for paying your Corporation Tax is nine months and one day after your company's year-end, while the return itself is due 12 months after.

Getting this wrong can be costly. HMRC isn't forgiving when it comes to errors, and the penalties for late or incorrect returns can be severe. This is where specialist accounting services for contractors really prove their worth, ensuring you claim every allowable expense to legally and accurately reduce your profit—and your final tax bill.

As the director of your own limited company, you're also technically an employee. You’ll probably pay yourself a mix of a small salary and dividends. While the company pays Corporation Tax on its profits, you have to personally declare your income to HMRC.

This is done through a Self-Assessment tax return. It’s where you list all your personal income for the tax year (which runs from 6 April to 5 April), including salary, dividends, and any money you earned outside your company. The deadline to file online and pay what you owe is 31 January every year.

To get your invoicing and project records spot-on, which feeds directly into your bookkeeping, it’s worth looking into the best time tracking apps for contractors. These tools help make sure your financial records are accurate right from the start.

To bring it all together, here’s a simple breakdown of these essential services and what they really mean for you as a contractor.

Getting a handle on these four areas is the key to running a financially sound and stress-free contracting business. They work together to give you a complete picture of your finances, keeping both you and the authorities happy.

Once your core legal obligations are sorted, this is where specialist accounting services for contractors really start to pay for themselves. We move beyond just keeping you compliant and shift into a proactive strategy to optimise your finances and legally boost what you keep. This is the point your accountant stops being a historian, just recording what's already happened, and becomes a strategist for your financial future.

It’s all about looking at your business from every angle—from tax status to spending habits—and making smart choices that directly fatten your bottom line. Let's dig into the key services that help you hold onto more of your hard-earned cash.

For a lot of contractors, Value Added Tax (VAT) just sounds like a massive administrative headache. But once your turnover starts creeping up to the £90,000 threshold (for the 2024/25 tax year), registration is no longer optional. The interesting part? For many, voluntarily registering for VAT before you hit that number can be a seriously clever financial move.

This is especially true if your clients are large, VAT-registered businesses. They simply reclaim the VAT you charge them, so it’s no extra cost to them. But for you, it opens up tools like the Flat Rate Scheme. This scheme is a huge timesaver, letting you pay a fixed percentage of your turnover to HMRC instead of sweating over the VAT on every single purchase.

For contractors in certain fields with low day-to-day expenses, this can lead to a surprising financial gain. It turns a compliance chore into a genuine revenue-booster. A good accountant will run the numbers on your specific situation to pinpoint the exact moment VAT registration flips from being a cost to a profitable strategy.

"Why on earth do I need payroll? It’s just me!" It’s one of the most common questions we hear, and the answer is simple: tax efficiency. Running a director's payroll, even for a one-person company, is the single best way to take a salary from your limited company.

Here’s a quick rundown of why this simple service is so powerful:

This salary-and-dividend mix is the absolute cornerstone of tax planning for contractors. Getting that balance right is crucial, and it’s a calculation a specialist accountant can nail every time. You can see how we manage payroll services for contractors to get the most out of your earnings.

If bookkeeping is your financial diary and annual accounts are your year-end report card, then Management Accounts are your business's live dashboard. Think of them as your sat-nav. These are internal financial reports, usually put together monthly or quarterly, giving you a real-time snapshot of your company's health.

They go way beyond basic compliance, arming you with the critical data needed for smart, forward-thinking decisions.

Think of it this way: Annual accounts tell you where you've been. Management accounts tell you where you are right now and help you chart the best course forward.

With up-to-date management accounts, you can confidently:

This kind of insight is no longer a 'nice-to-have'. In fact, 75% of firms are seeing a higher demand for strategic advice based on this kind of real-time data. It shows how modern accountants use these tools to actively guide your financial planning.

This is where a specialist accountant really proves their worth—spotting deductions you might have missed. For example, many contractors don't realise they can maximize your take-home pay by understanding the self-employed health insurance deduction. By combining a smart VAT strategy, efficient payroll, and insightful management accounts, you build a financial engine that doesn't just run smoothly—it actively works to make you more profitable.

Choosing the right accountant is easily one of the most critical business decisions you'll make as a contractor. This isn't just about handing over a shoebox of receipts once a year; it's about finding a strategic partner who genuinely gets your world and can actively help you build your wealth.

Making the wrong call—often by going for the cheapest, most general accountant you can find—can cost you a fortune in missed tax efficiencies, compliance headaches, and sleepless nights. To get it right, you need to look way beyond the price tag. You need a specialist.

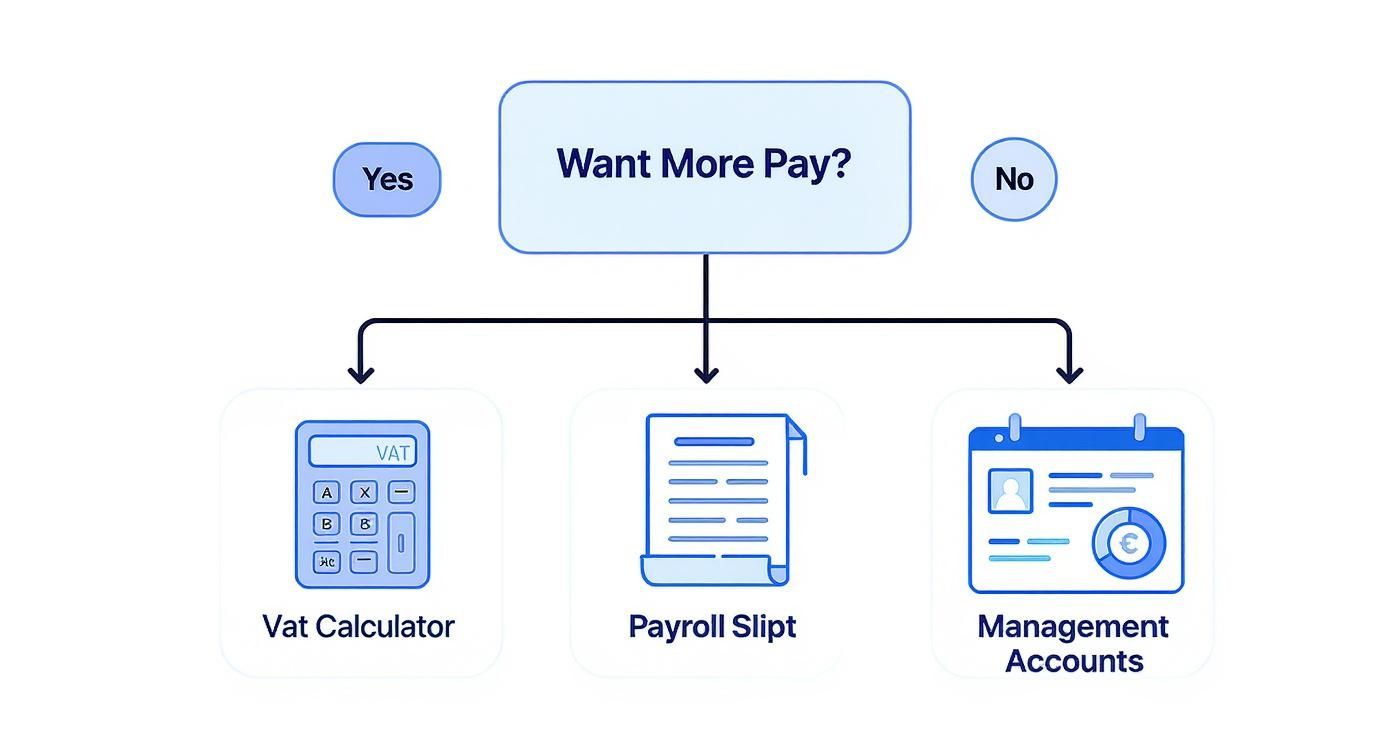

The infographic below shows how the right services, managed by the right expert, can directly boost your take-home pay.

As you can see, things like VAT and payroll aren't just admin chores. When managed properly, they become powerful tools for financial growth.

Your first and most important filter should be finding a true specialist. Plenty of general high-street accountants will say they can "do" contractor accounts, but that's a world away from actually understanding the unique challenges and opportunities of the sector. A specialist lives and breathes this stuff every single day.

A genuine contractor accountant will have deep, hands-on knowledge of:

Choosing a specialist is like hiring a guide who has climbed the same mountain a hundred times. A generalist has only read the map. The specialist knows every shortcut, every hidden hazard, and the most reliable path to the summit.

In today's world, your accountant should be a tech-savvy partner, not a bottleneck. Clinging to spreadsheets and boxes full of receipts is just inefficient and puts you at a serious disadvantage. Ask any potential accountant what software they use.

They should be fluent in modern cloud accounting platforms like FreeAgent, Xero, or QuickBooks. This technology gives you a real-time, up-to-the-minute view of your financial health, makes bookkeeping a breeze, and allows for seamless collaboration with your accountant. It transforms your accounting from a frantic once-a-year scramble into a calm, organised, ongoing process.

There are few things worse than an unexpected bill from your accountant. A confident, experienced contractor accountant will offer a clear, fixed-fee monthly package. This gives you absolute certainty over your costs and, just as importantly, encourages you to pick up the phone for advice without worrying about a ticking meter.

Before you sign anything, make sure you know exactly what's included. Does the fee cover your annual Self-Assessment return? What about VAT returns or running payroll? A clear, all-inclusive package is the hallmark of a well-run firm that values transparent client relationships. You can learn more about our commitment to transparent client partnerships and see how we build trust from day one.

When you're vetting potential accountants, you need to dig deeper than just asking about their price. The goal is to understand their process, their level of expertise, and the proactive value they bring to the table. A great accountant should be able to answer these questions with confidence.

Here’s a quick checklist of smart questions to ask:

Finding the right accountant is a direct investment in your financial future. By focusing on specialism, technology, and transparency, you can find a partner who will not only keep you compliant but will actively contribute to your success as a contractor.

As a contractor, you quickly learn that small financial oversights can snowball into massive headaches. The smartest way to protect your business is to understand the common pitfalls before you fall into them.

Spotting these issues early can literally save you thousands in penalties and spare you a world of cash-flow pain down the line. Let’s walk through the big ones.

This is one of the easiest traps to fall into, but it’s also one of the most damaging. Treating your business bank account like a personal piggy bank is a sure-fire way to create chaos.

When personal and business spending gets tangled up, it blurs the lines for HMRC and turns your bookkeeping into an absolute nightmare. Without that clean separation, you can kiss accurate profit calculations and predictable tax bills goodbye.

Keeping your accounts separate from day one forces a level of discipline that pays for itself. It gives you a crystal-clear view of your real profit margins and stops you from guessing what you owe. A dedicated bookkeeping service makes this second nature, creating a clean audit trail and saving you from hours of manual sorting.

When your business account is looking healthy, it’s all too tempting to think that money is yours to spend. Big mistake. Failing to squirrel away enough for your tax bill is a recipe for disaster.

A good rule of thumb is to set aside 25–30% of your income specifically for tax. An unexpected demand from HMRC can cripple your cash flow, putting your projects and your entire business at risk.

Having a dedicated tax reserve stops that last-minute scramble for cash when the payment deadline hits. Proper tax planning isn't just about filing a return; it's about forecasting accurately throughout the year, adjusting for the natural peaks and troughs in a contractor's income.

IR35 can feel like navigating a minefield blindfolded. But getting it wrong comes with some seriously steep penalties, including backdated tax, National Insurance bills, and hefty interest charges.

This is where a specialist accountant really earns their keep. They can decode the complex IR35 criteria and give you an honest, realistic assessment of your status for each contract.

"Ensuring IR35 compliance is critical to avoiding a surprise bill that can cost tens of thousands."

Getting your contracts reviewed before you sign is the best way to nip potential IR35 risks in the bud. Think of your accountant as a second pair of expert eyes, flagging any roles or clauses that might push you inside IR35 before it’s too late.

When you're juggling projects and chasing invoices, saving for a retirement that feels decades away often falls to the bottom of the to-do list. But ignoring your pension is a short-sighted move that robs you of both long-term security and immediate tax relief.

Even a small monthly contribution might feel like a pinch now, but it delivers significant tax benefits and grows over time.

Consistent contributions also benefit from the power of compounding, meaning the small amounts you save today can grow into something substantial by the time you need them. A contractor-focused accountant can help you choose a scheme that fits your business, like a SIPP, and integrate contributions into your monthly financial workflow so it all happens automatically.

Learning from these common mistakes is the key to building a resilient business. The right advice on bookkeeping, tax, IR35, and pensions creates a financial safety net, giving you the peace of mind to focus on what you do best.

And as tax rules continue to evolve, staying ahead is crucial. Be sure to check out our guide on Making Tax Digital for Self Assessment to see how new digital tools are simplifying compliance.

Turning these insights into action is what shields you from costly surprises. It’s time to protect your finances, both for today and for the long haul.

When you're running your own contracting business, you're bound to have questions about the financial side of things. It’s completely normal. We've pulled together some of the most common queries we get from contractors to give you clear, practical answers.

Trying to figure out the cost of accounting services for contractors can feel a bit like guesswork, but it doesn't have to be. As a general rule of thumb in the UK, you can expect to pay a monthly fee somewhere in the region of £75 to £150 + VAT for a decent package from a specialist accountant.

Of course, that's just a ballpark figure. The final price tag will shift based on a few key things:

But remember, the cheapest option is almost never the best value. Think of it less as a cost and more as an investment. A sharp specialist accountant should save you far more in tax than their fee, turning an expense into a profitable part of your business toolkit.

Switching accountants is one of those things that sounds way more awkward and complicated than it actually is. In reality, the process is incredibly straightforward, and any professional firm will have it down to a fine art. The best part? You don't even need to have that dreaded "break-up" call with your old accountant – your new one handles pretty much everything for you.

Here’s how it typically works:

A good accountant makes the entire switch feel effortless. Their job is to lift the admin burden from your shoulders, ensuring a smooth transition with zero disruption to your business. The whole process is designed to be professional, efficient, and completely painless for you.

This is a big one. With fantastic cloud accounting software like Xero or FreeAgent at our fingertips, it's tempting to think the tech can do it all. And while these tools are brilliant for keeping your day-to-day finances organised, they are just that—tools. They simply can't replace the strategic mind of a human expert.

Think of it this way: buying a top-of-the-line Snap-on toolkit doesn't suddenly make you a master mechanic. The tools are essential, for sure, but you still need the mechanic’s experience to diagnose a tricky engine problem, carry out a proper service, and make sure the car is running at peak performance.

Your accounting software can track your mileage, but it can’t advise you on the most tax-efficient way to buy a new van. It can categorise your expenses, but it can't spot that you're missing out on claiming a whole category of allowable costs you never even knew existed.

An accountant provides that critical layer of strategy, foresight, and interpretation that software alone can't deliver. They analyse the numbers, offer proactive advice on tax planning, make sure you're navigating ever-changing rules like IR35 correctly, and help you build a solid long-term financial plan. The software is the calculator; the accountant is the financial strategist.

At GenTax Accountants, we pair powerful, modern technology with expert, personal advice to give you the best of both worlds. We get stuck into the complexities so you can stay focused on what you do best.

See how our dedicated accounting services can support your contracting business by visiting https://www.gentax.uk.